Amazon Prime Day will be here before the end of Q2, which means the massive deals day is happening earlier in the year than it ever has. After a postponed Prime Day in 2020, we expect the shopping “halo effect” to bounce back to 2019 levels and drive traffic and sales for retailers outside of Amazon.

Prime Day typically occurs in mid-July and has expanded from 24 hours to multiple days of deals just for Prime members. Over the years, a halo effect has also emerged. Many retailers promote their own deals at the same time as Prime Day to attract customers searching for deep discounts—including those who aren’t Prime members.

In 2020, the entire retail industry was paying attention to the later-in-the-year Prime Day on October 13 and 14. Would it cause a surge in holiday shopping well in advance of Black Friday and drive demand for discounts even earlier in the season?

Amazon did not announce its total sales figures for the 2020 event. However, Digital Commerce 360 estimates that the company generated more than $10 billion in gross merchandise sales in two days. This is an increase of 45% from over $7 billion in sales in July 2019.

What Will Happen on Prime Day 2021?

This year, Prime Day is back to its summer schedule (though rumor has it there could be a second Prime Day in the fall). Because of the June date and the recovering global economy, the potential halo effect on the retail industry is up in the air.

At Criteo, we looked at historical traffic and sales data from our retailer partners and our recent consumer survey data to understand Prime Day shopping trends.

There’s no question that Prime Day is popular in the US. In our May 2021 survey, two-thirds (66%) of US consumers said they’re familiar with Prime Day and among those, four out of five (81%) said it gets them in the mood to shop.1

Outside the US, Prime Day has gained momentum in some markets more than others. In the UK, six out of 10 (61%) consumers said they’re familiar with the event,2 while a third (34%) of consumers in Singapore3 and about a fourth (27%) of consumers in Australia4 said the same. However, the majority of consumers who are already aware of the event said it gets them in the mood to shop.

Here, we’re taking a closer look at three big Prime Day trends in the US to help retailers anticipate the halo effect and understand its potential around the world.

Trend #1: The Prime Day 2021 halo effect will more closely resemble 2019.

We define the Prime Day halo effect as the increase in traffic and sales that retailers outside of Amazon enjoy as a result of the event. In some cases, these are retailers that hold their own promotions at the same time (we call these “participating retailers,” defined as having a sales increase of 20% or more during Prime Day compared to the average on the same weekdays in the prior four weeks), but not in all cases (we refer to these as “all retailers”).

Our data from Prime Day 2019 and 2020 shows that there is a clear increase in traffic and sales for our retailer partners around the big sale days. However, in 2020, the halo effect began before the start of Prime Day and was more subdued than the year before.

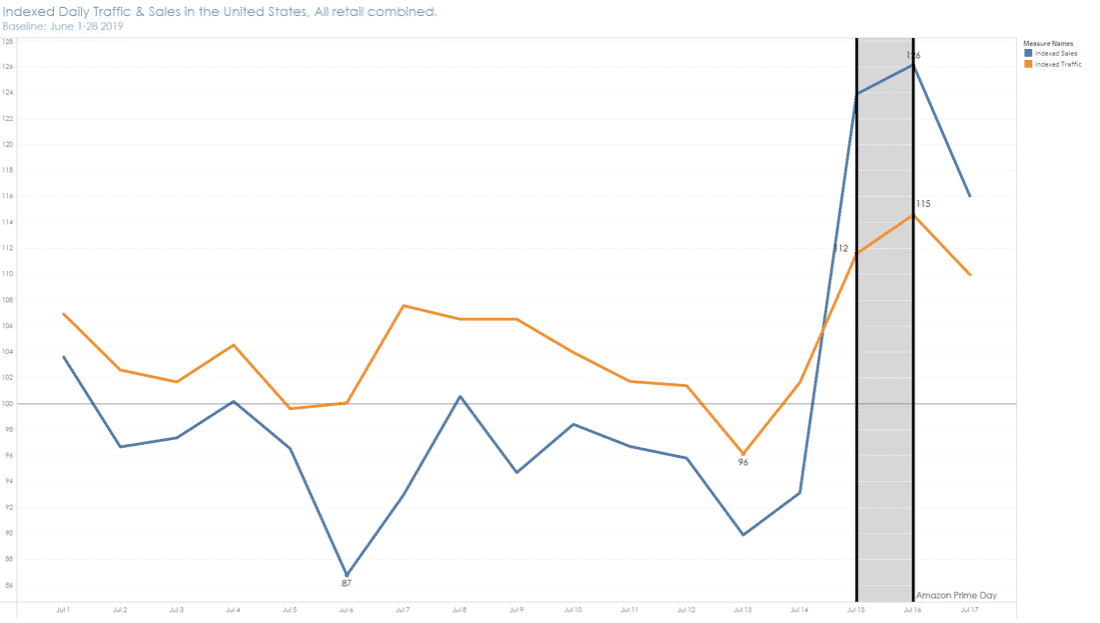

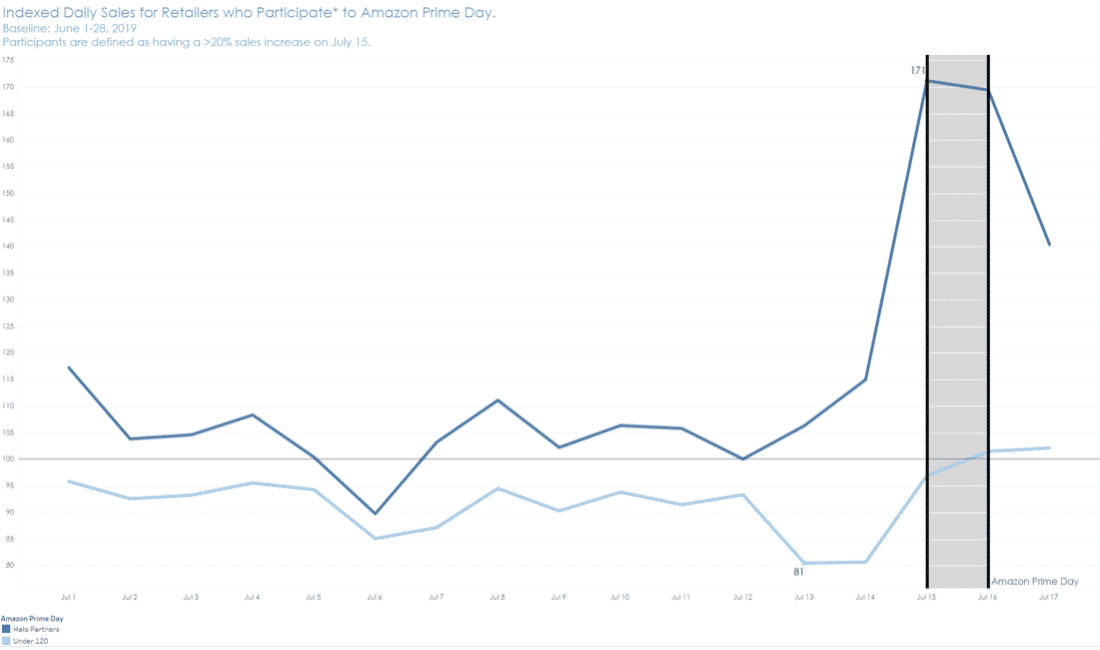

The chart below shows our retailer partners’ traffic and sales data during Prime Day 2019 on Monday, July 15 and Tuesday, July 16 compared to the averages from June 1-28. You can see that the halo effect began exactly on Prime Day.

Traffic increased 12% on Monday and 15% on Tuesday, while sales increased 24% on Monday and 26% on Tuesday. As you can see, both begin to drop immediately after the end of Prime Day.

The story changes for Prime Day 2020. The events of last year put a strain on the retail industry. Retail sales in the US plummeted from February to March but bounced back in April, according to the US Commerce Department. By mid-year, retailers were focused on strengthening their ecommerce operations to fully benefit from the surge in online sales.

This pushed many spring and summer promotions—including Prime Day—to later in the year when there was excitement for the holiday season and consumers wanted to start shopping early.

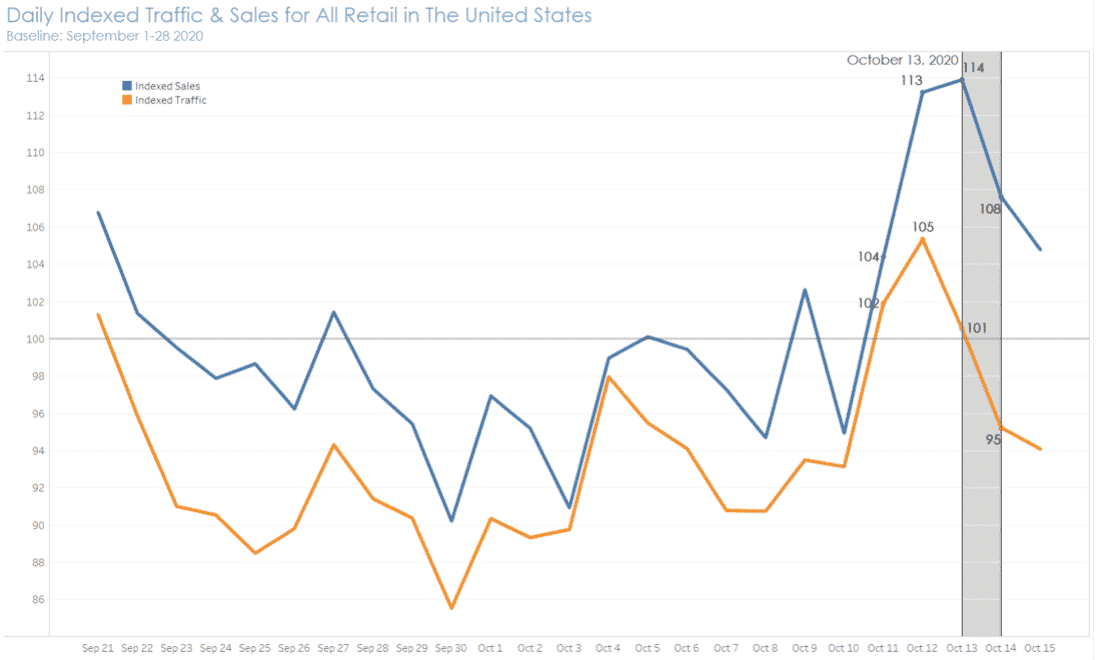

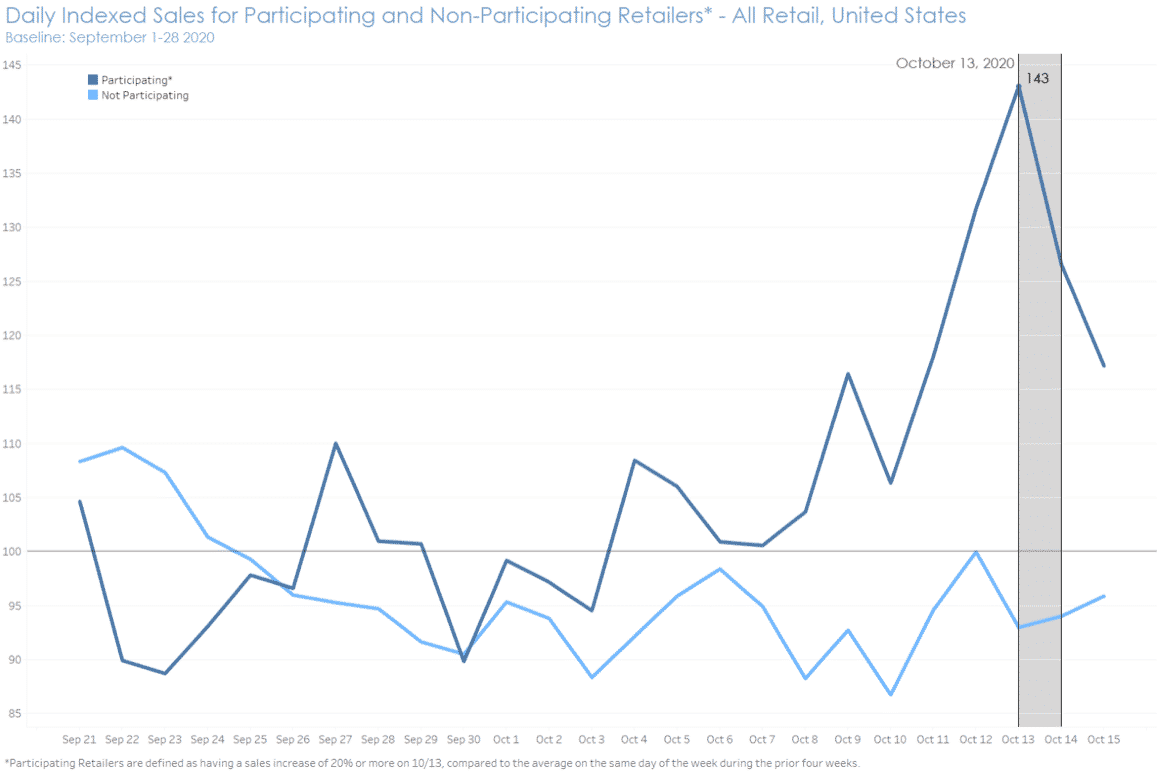

The chart below shows our retailer partners’ traffic and sales data during Prime Day on Tuesday, October 13 and Wednesday, October 15 compared to the averages from September 1-28. You can see that the halo effect starts early, but the traffic and sales spikes are lower than they were in 2019.

By October 12, traffic reaches its highest peak for the event—5% above average—and sales are 13% above average.

Sales peaked at 14% above average on Tuesday, have an increase of 8% on Wednesday, and continue to drop after Prime Day ends.

These early spikes could account for the smaller halo effect on the official sale days. However, factors like the delayed timing, proximity to Black Friday, and global uncertainty could have also dampened sales outside of Amazon.com.

As Prime Day returns to the summer and the US economy bounces back, it’s likely that the halo effect will be closer to 2019 levels.

Our recent survey results show that purchase intent for Prime Day is high and consumers plan to look for deals all over the internet. Close to half (45%) of US consumers familiar with Prime Day said they plan to purchase from websites other than Amazon during the event. This percentage is slightly higher (47%) among Prime members.

Trend #2: Prime Day promotions will become table stakes for retailers.

When we split up our data by participating retailers vs. retailers that did not have their own promotions timed with Prime Day, the discrepancy in sales generated is clear.

But, just like the overall halo effect, the sales boost for participating retailers was higher in 2019 than in 2020.

The chart below shows sales from our retailer partners during Prime Day 2019 compared to the averages from June 1-28. Participating retailers saw the highest average increase in sales on Monday, July 15, 2019 (the first day of Prime Day) at 71%. Sales for non-participating retailers stayed at average levels.

This next chart shows sales from our retailer partners around Prime Day 2020 compared to the averages from September 1-28. Participating retailers saw a 43% sales increase on the first day of Prime Day.

These sales figures show how much retailers can benefit from running their own deals timed with Prime Day.

Some big-box retailers have already adopted this strategy in a big way. Target, for example, has lined up its two-day Target Deals Day with Prime Day for the past two years (July 15-16, 2019 and October 13-14, 2020). Walmart’s 2020 Big Save event overlapped with Prime Day, but began on Sunday, October 11 to generate early excitement.

Neither retailer has announced the dates of its 2021 sale days yet, but they’ve set an expectation with consumers that there are deep Prime Day discounts to be found outside of Amazon.

Trend #3: Tech will be big this year, but sales in every category will spike.

Prime Day is a big day for tech deals. Amazon typically offers deep discounts on Alexa devices, which can inspire all types of tech purchases.

Our data uncovered that although tech sales spike around Prime Day, so do sales in other categories.

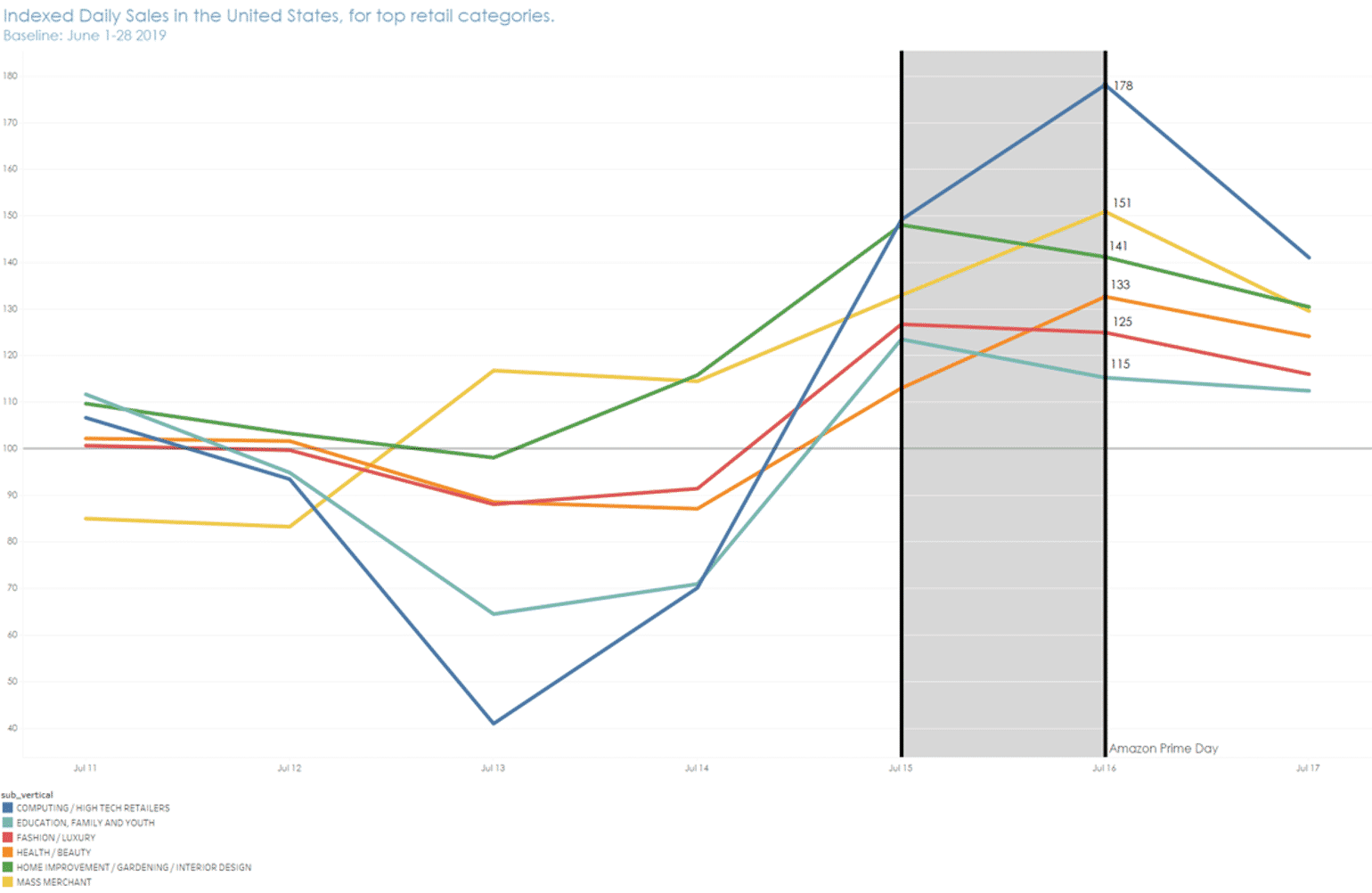

The chart below shows sales from our retailer partners across categories during Prime Day 2019. The biggest sales spikes happened on the second day of Prime Day, including:

- 78% for computing and high-tech retailers

- 51% for mass merchants

- 41% for home improvement, gardening, and interior design retailers

- 33% for health and beauty retailers

- 25% for fashion and luxury retailers

- 15% for education and family and youth retailers

Prime Day can also amplify seasonal sales patterns. The popularity of summertime home projects might explain the spike in home improvement, gardening, and interior design.

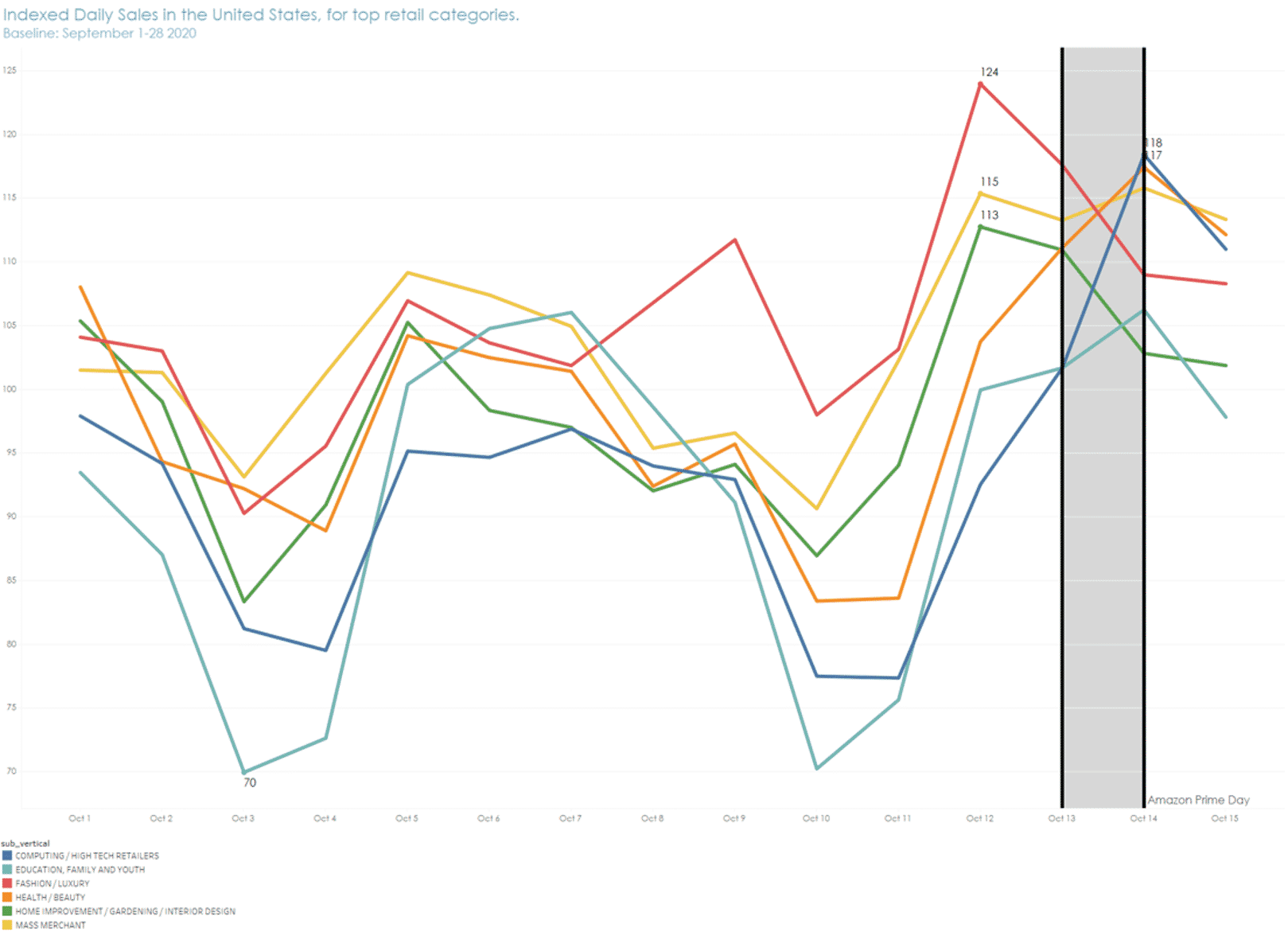

Like the year before, sales from computing and high-tech retailers showed the largest spike on the second day of Prime Day 2020. However, pre-Prime Day shopping drove significant sales in other product categories.

On October 12, the day before Prime Day, sales increased:

- 24% for fashion and luxury retailers

- 15% for mass merchants

- 13% for home improvement, gardening, and interior design retailers

By October 14, the biggest sales spikes shifted to:

- 18% for computing and high-tech retailers

- 17% for health and beauty retailers

In our recent survey, two-thirds (66%) of US consumers who plan to purchase on Prime Day said they already know what types of products they want to buy:

- 40% plan to purchase consumer electronics

- 40% plan to purchase video games

- 35% plan to purchase toys and games

- 35% plan to purchase cosmetics and perfume

- 32% plan to purchase apparel, sportswear, and accessories

Tech gear was the most popular category globally in our survey, with four in 10 prospective Prime Day shoppers (37%) in the US, UK, Australia, and Singapore saying they plan to buy consumer electronics during the event.

Though tech and electronics will no doubt be popular, every type of retailer has an opportunity to drive sales with discounts timed with Prime Day. Categories like beauty, fashion, and home decor can get a significant portion of consumer spend if there are discounts to drive interest leading up to Prime Day.

Because Prime Day is moving back to the summer, the top product categories this year are more likely to mirror those from 2019 to align with seasonal spending patterns.

How to Take Action Ahead of Prime Day

To benefit from the expected halo effect, run special discounts and put those deals in front of consumers who are most likely to buy from you with the right digital ad campaigns.

Once the exact dates of Prime Day are announced, be ready to launch campaigns that reach three types of audiences in the week surrounding the expected 48-hour event. This will account for potential sales spikes outside of Amazon ahead of Prime Day—as seen in 2020—and a halo effect that could linger after.

Audience #1: Retailer Website Audiences

If you’re a brand selling your products through retailer partners, run retail media campaigns to reach consumers who are actively browsing retailer websites when traffic is higher than usual.

Target your ads using retailers’ first-party intent and purchase data to drive interest and sales. As we saw from the charts above, traffic increases, but sales increase more, indicating that these shoppers are in purchase mode.

Audience #2: Commerce Audiences

Commerce audiences are built with commerce data that shows products people are interested in, brands they like, and meaningful demographics such as purchase power and gender. This allows you to drive interest and engagement from new customers that are most likely to take advantage of your promotions.

This audience option can also help you engage consumers that were exposed to your awareness campaigns at a time when they’re likely to shop.

Audience #3: Online & In-Store Shoppers

Engage audiences of recent website visitors, online buyers, and in-store shoppers to drive incremental sales and increase basket sizes. Build these audiences with your first-party customer and transaction data and promote your Prime Day deals to both recent and lapsed shoppers.

Though Prime Day is an online event, most retail sales still happen offline and in-store sales are climbing across several product categories as vaccine distribution widens. The Prime Day halo effect can get your in-store customers in the mood to shop and inspire offline outcomes like store visits and sales.

If you have access to offline data like store transactions and CRM or CDP data, combine it with your online data to build audiences that include valuable offline shoppers. In addition, work with a partner who can enhance your customer profiles with additional behavior and purchase intent data to get a full view of your customers.

Bonus: Contextual Targeting

Marketers know that third-party cookies won’t be here forever, and many are looking at contextual targeting as a sustainable advertising solution. However, they’re going beyond basic keyword targeting and using first-party data and commerce signals to drive results comparable to cookie-based advertising.

Prime Day is a great time to launch your first next-level contextual campaign and reach consumers that are likely to buy.

Ready to build a campaign? Contact your Criteo account strategist or click here to talk to an expert today.

Learn more about retail media, offline campaigns, and more in The 2021 Digital Advertising Manual:

1Criteo Consumer Sentiment Index, US, May 2021, n=483

2Criteo Consumer Sentiment Index, UK, May 2021, n=367

3Criteo Consumer Sentiment Index, Singapore, May 2021, n=132

4Criteo Consumer Sentiment Index, Australia, May 2021, n=128