The widespread outbreak of coronavirus, which causes the disease COVID-19, is now a global pandemic. Here at Criteo, we’ve been analyzing our data from the past several weeks to understand how retail is affected as the virus spreads.

Our data includes insights drawn from across 80+ countries and two billion active monthly shoppers spending around $900 billion annually across approximately 20,000 ecommerce sites.1 From that massive data set, we’re able to see trends happening globally as well as across regions—Asia-Pacific, Europe, and the Americas.

Amid all the uncertainty and calls for social distancing, some industries will be affected more than others. Restaurants and bars are particularly vulnerable, as well as event spaces and retail stores. At the same time, consumers are shifting their spending habits and some companies and product categories are actually growing.

While circumstances continue to evolve each day, according to Criteo research, more than half (52%) of Americans say they will shop online more in the next two weeks as a result of COVID-19, and 51% say they’ll buy more groceries online.2

Here’s what our data is showing right now:

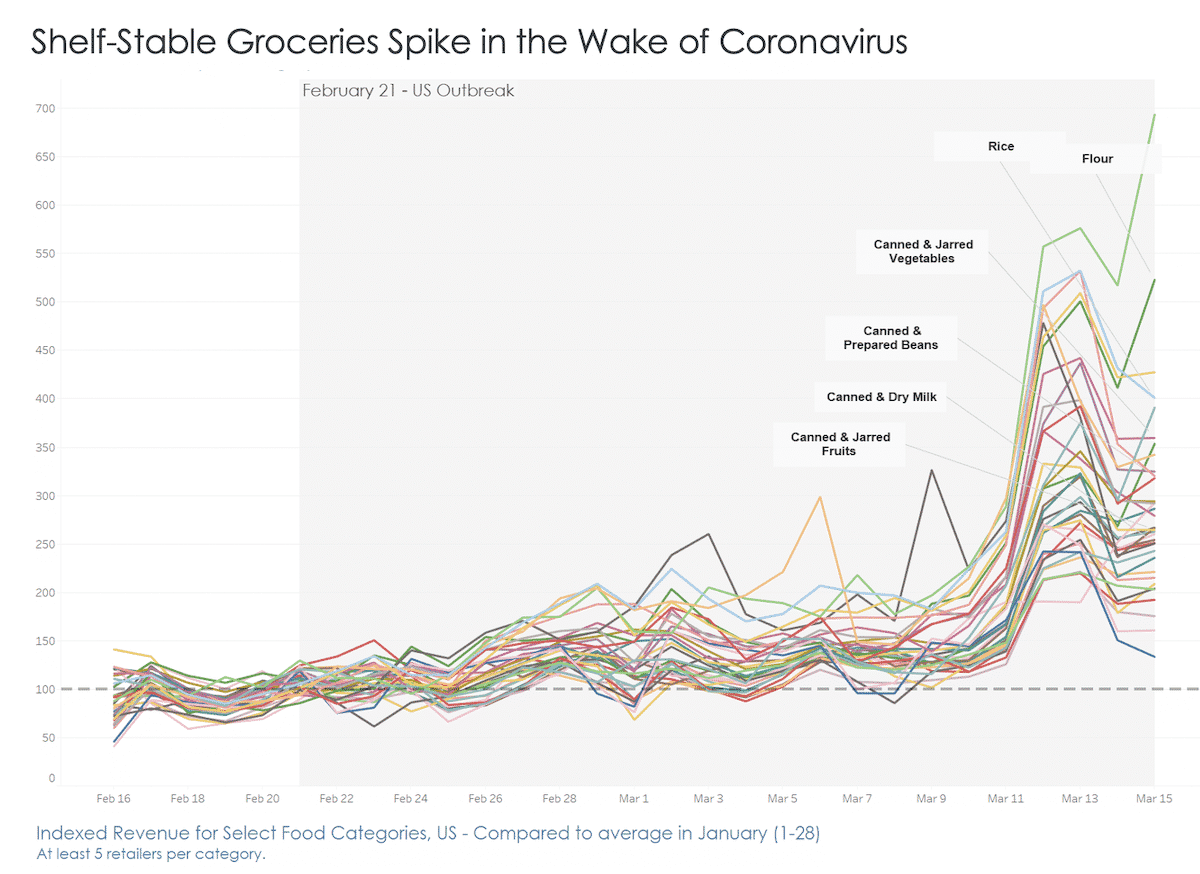

1. Grocery sales are going up.

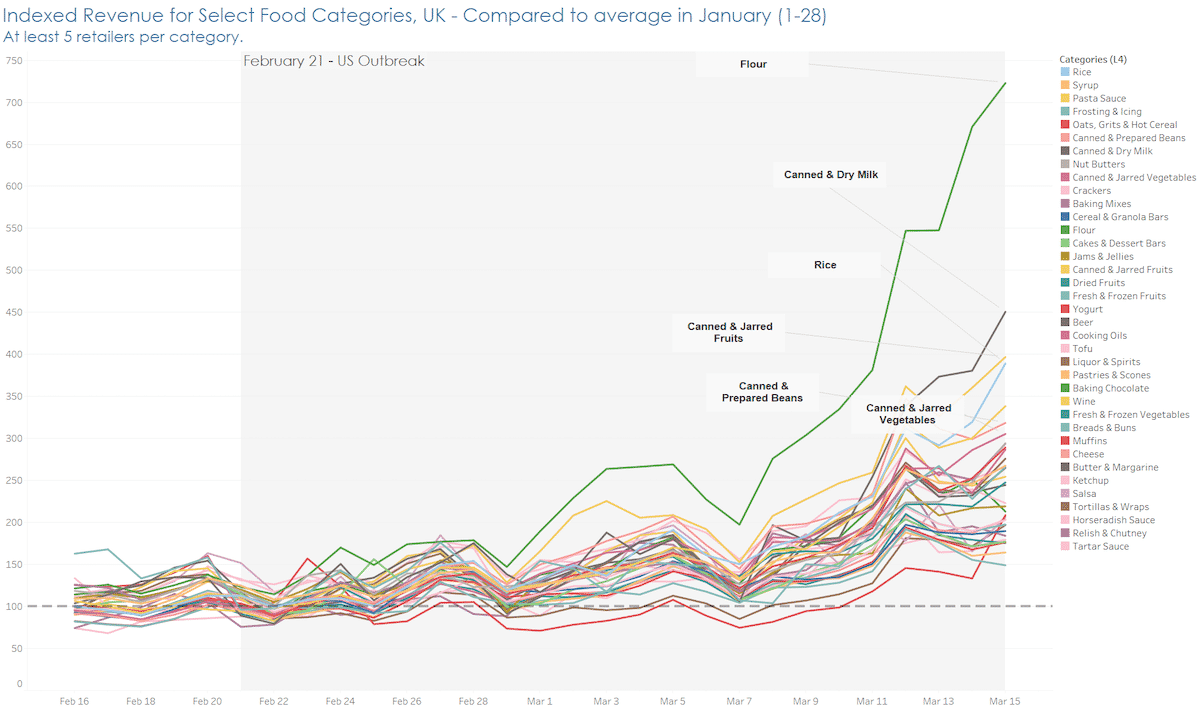

In the US online purchases of shelf-stable grocery items have grown substantially in the last few days, including Rice (+432%), Flour (+423%), Canned & Jarred Vegetables (+337%), Canned & Prepared Beans (+433%), and Canned & Dry Milk (+378%) compared to the first four weeks of January.

And it makes sense: These items are made for tough times when people may need to hunker down. They have a long shelf life, are versatile, and are frequently offered in large formats, making it easy to stock up on ingredients that last.

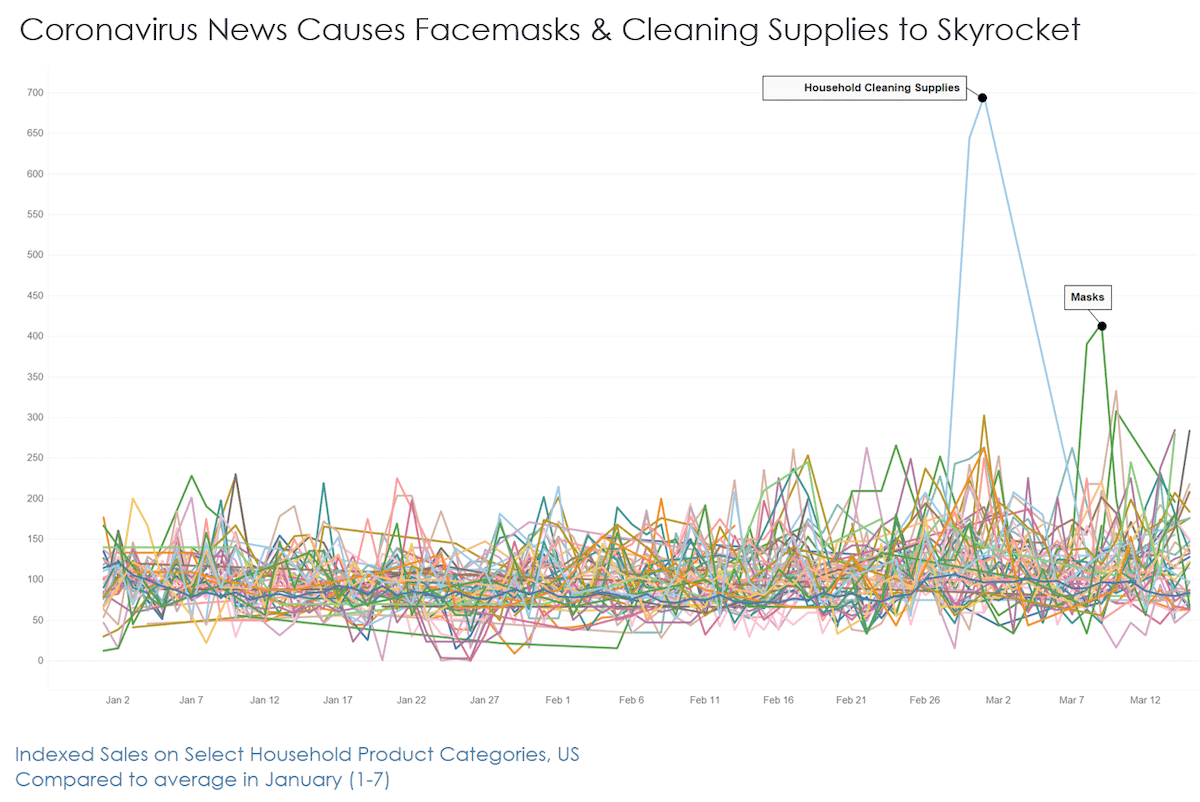

No surprise: Sales of facemasks and household cleaning supplies, which can be used to reduce the chance of contracting or spreading the virus, also shot up in early March compared to the first week in January—before running out of stock.

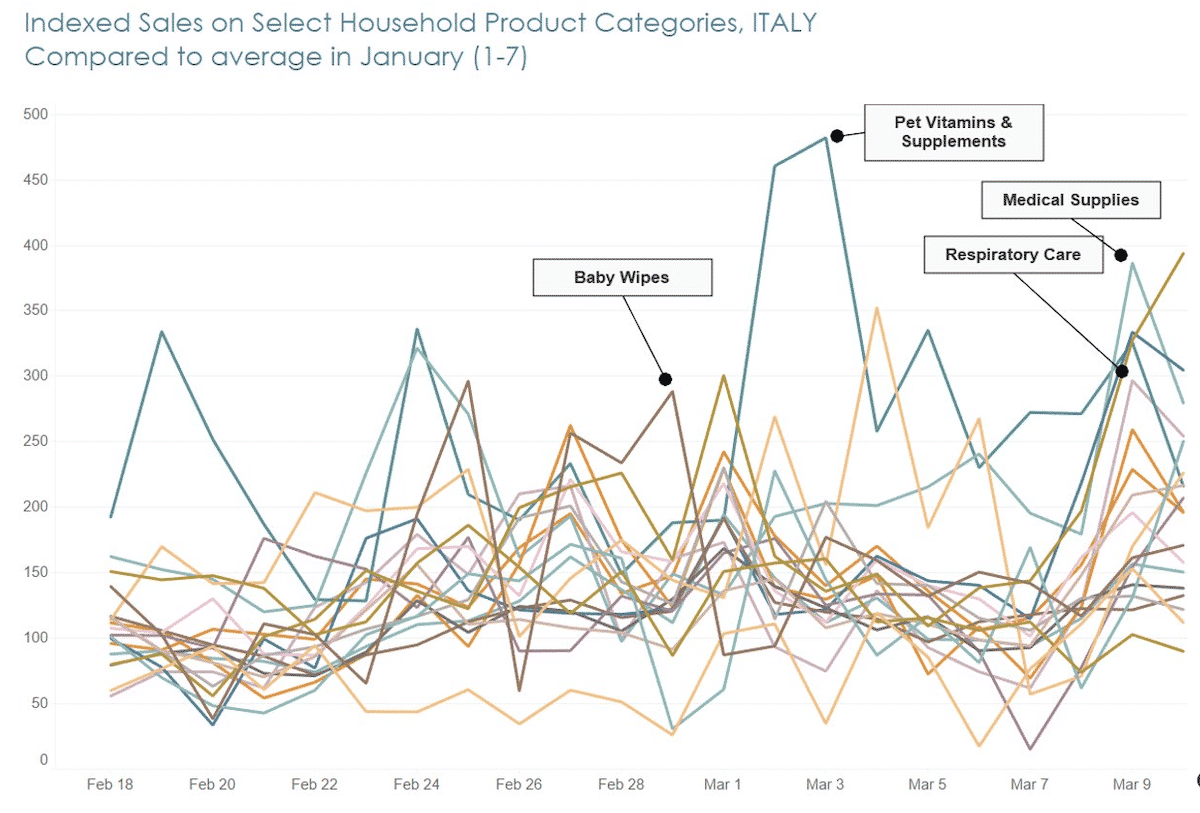

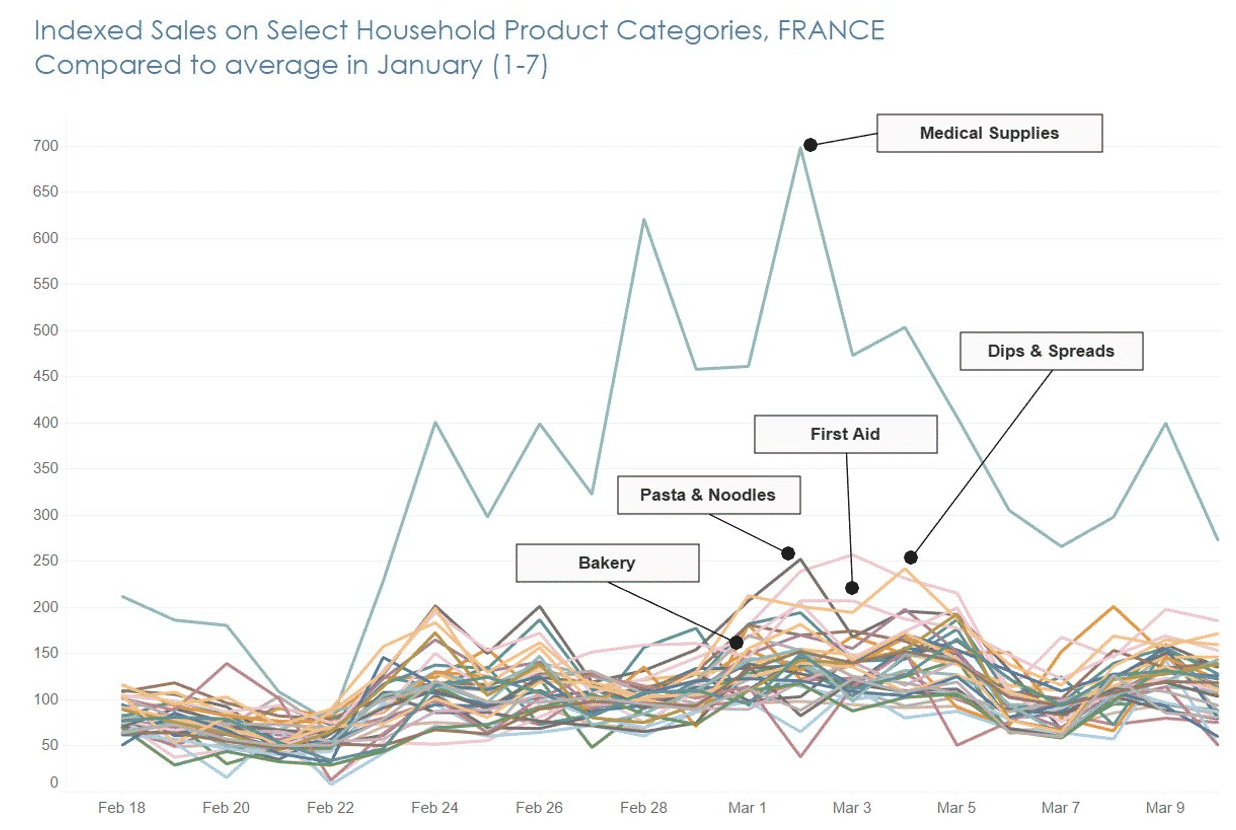

2. In Southern Europe, sales of medical supplies are soaring.

In Italy, people prepared to take good care of themselves at home after a partial lockdown on February 25th. Sales of Medical Supplies spiked by +286% in early March.

France, which has enacted a country-wide quarantine, saw sales of medical supplies outpace even food products in early March, rising by nearly +600%.

3. The United Kingdom favors non-perishable milk and fruit.

In the UK, sales of Canned & Dry Milk spiked by more than +350% last week, while Canned & Jarred Fruits were up by +297%. Flour sales skyrocketed to +623%.

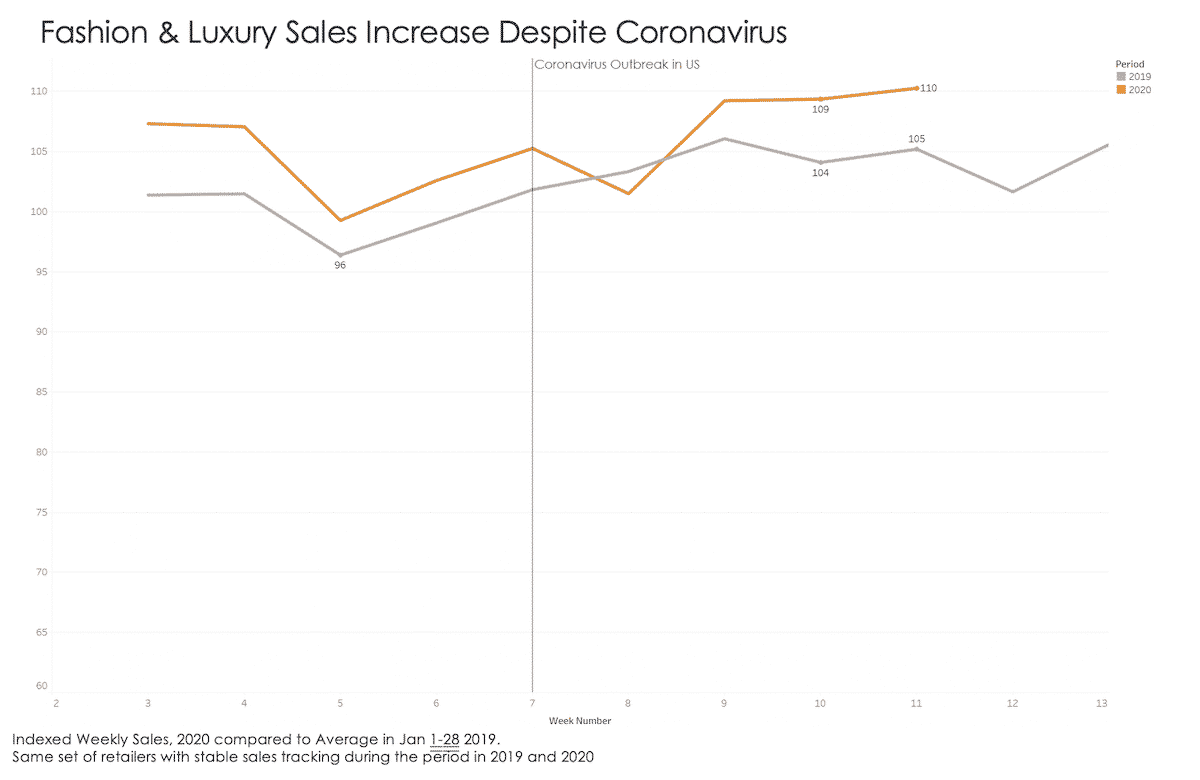

4. Online transactions in Fashion & Luxury remain above 2019.

Since the top of the year, online transactions in the Fashion & Luxury category—which includes items like designer clothes, watches, jewelry, and handbags—have largely stayed above their 2019 numbers. The growth trend that we saw in January 2020 continues unabated, even in the face of a worsening COVID-19 outbreak in the US.

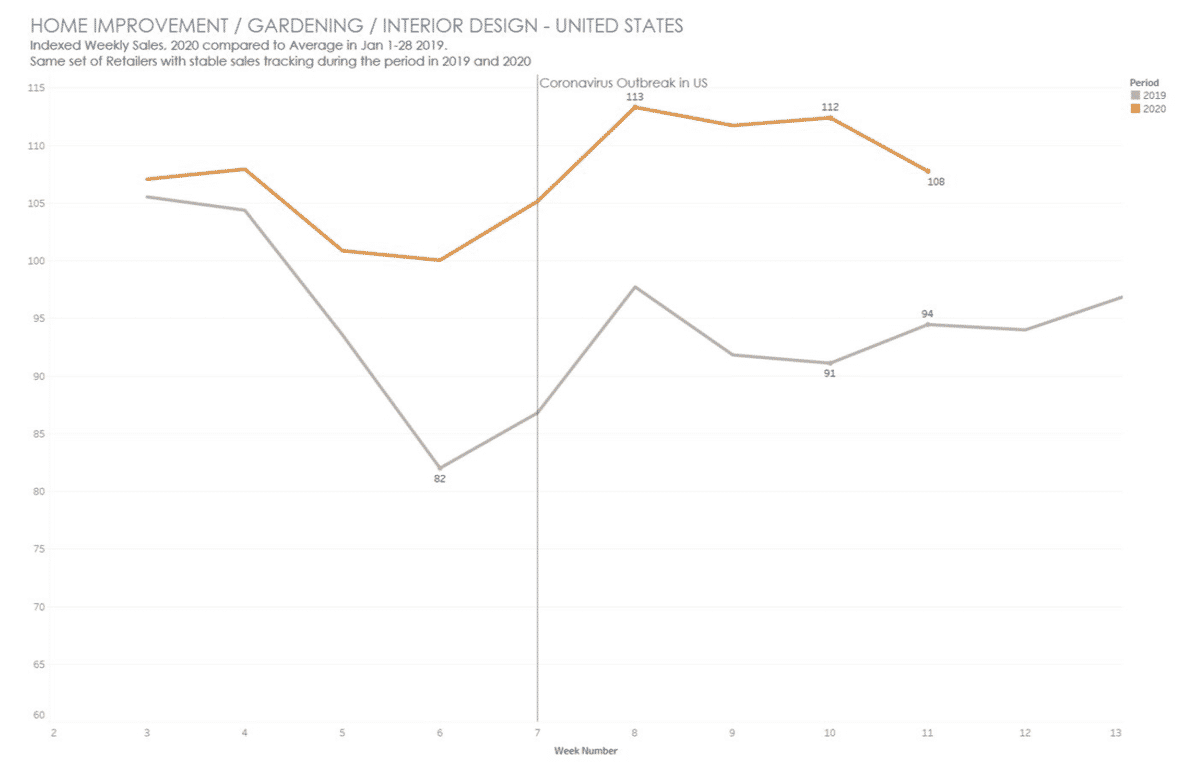

5. Home furnishing sales stay high.

As offices close and employees are encouraged to work from home, many may be outfitting their spaces with items that let them work comfortably and efficiently. In the US, sales of home improvement, gardening, and interior design products—which includes things like office furniture, lamps, and area rugs—were up +13% in early March and still up by +8% last week, compared to January 2019.

We’ll continue to monitor the effects that coronavirus is having on consumer behavior and report back. Stay tuned and stay safe.

To get the latest insights and strategies for marketers on a regular basis, sign up for our newsletter.

1Source: Online sales and online bookings, Criteo data, Q1 2019 and Q1 2020. At least 5 retailers/travel players at the most granular level.

2Source: Criteo Coronavirus Survey, US, March 2020, N=1,013.

Criteo Product Insights Finder

Dive into even more data through the interactive Criteo Product Insights Finder. Use the dropdown menus to pick a country and a product category to view the most recent figures: