Worldwide, it’s clear that there are new patterns and trends forming as a result of the coronavirus outbreak. At the end of March, more than 3.38 billion people, or roughly 43% of the world’s population, had been asked or ordered to follow social distancing measures.1

Social distancing has created a new normal. In New York City, the current epicenter of the COVID-19 pandemic, Times Square is empty and for a “city that never sleeps”, the streets are eerily quiet. In Barcelona, the once bustling Las Ramblas lies deserted. The same can be said for the Champs-Élysées in Paris, the Spanish Steps in Rome, and the Central Business District in Singapore.

With offices around the world, Criteo has seen the effects of social distancing firsthand. As we analyze coronavirus consumer trends, we’ve been working very closely with businesses from all industries that have been affected by these changes.

Last week, we reported on how the spread of coronavirus has changed the sales landscape of consumer electronics, pet supplies, and fresh groceries. This week, we did a deep dive into our data once again to see how the social distancing economy is influencing what and how people buy.

Social Distancing & the New Normal

Preventative strategies like restricting travel and cancelling mass gatherings—including weddings, sports events, and live concerts—have expanded in recent weeks. Social distancing, or more precisely, physical distancing, since socializing still happens online, is now the norm. It’s given rise to something we call the social distancing economy.

Here at Criteo, we analyze data from more than 80 countries and two billion active monthly shoppers across 20,000 retailers who work with Criteo.2 We provide data-backed insights to help companies lean into what’s working right now when it comes to reaching customers and build ad campaigns to show them what they really need at this time.

Ultimately, there is no business unaffected by coronavirus. Some industries have been totally disrupted, while others are experiencing significant ups and downs.

Let’s first take a step back to understand why.

COVID-19 Pushes Retail Sales From Offline to Online

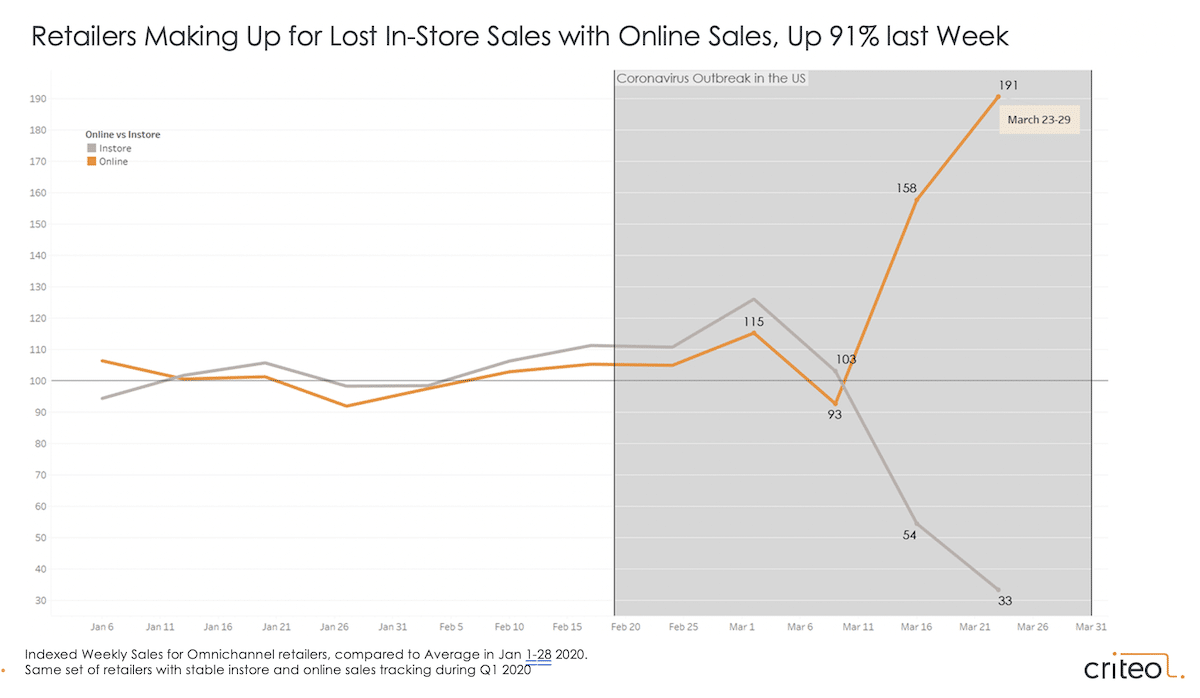

Akamai, a web services company, reported earlier this month that there has been a 50% increase in daily web traffic. A recent Criteo survey of more than 10,000 people showed that globally, half of consumers say they’ll purchase more online because of coronavirus.3

The chart above, which shows data from omnichannel retailers in Home Goods and Apparel, illustrates the widening gap between in-store and online sales. In the US last week, online sales were up by 91%—without even factoring in consumer packaged goods, like groceries—indicating that despite store closings, people are still buying stuff (and not just food and toilet paper).

Here’s what we saw this past week:

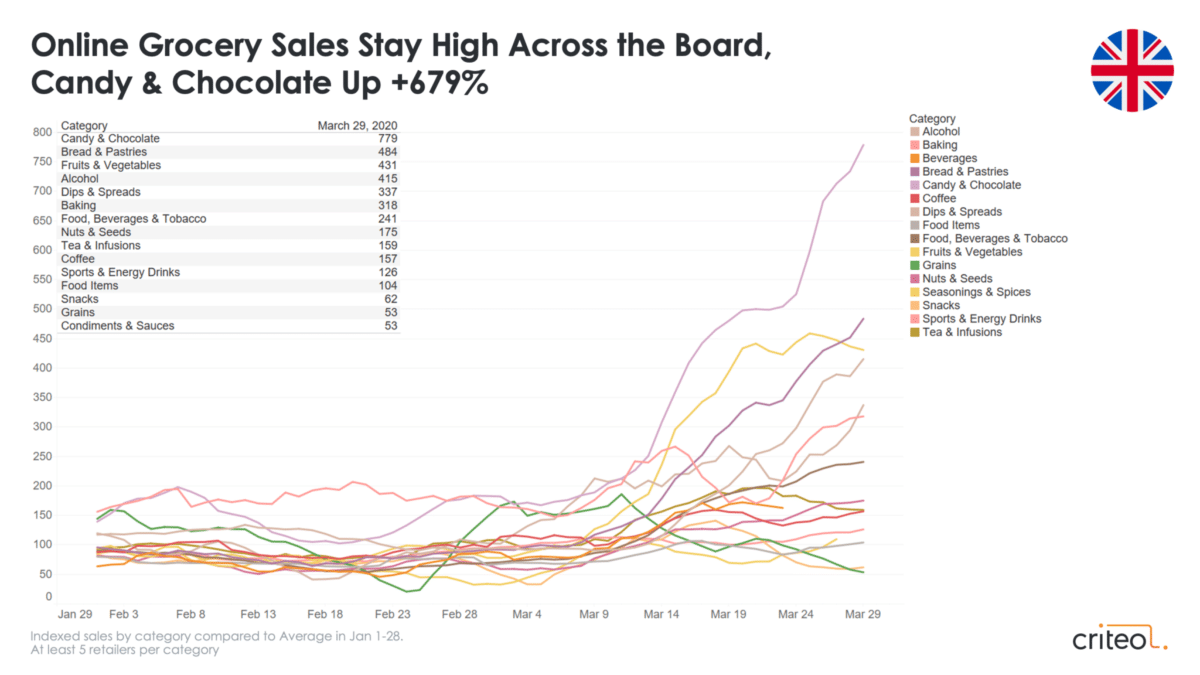

1. Sales of Sweets Are Up

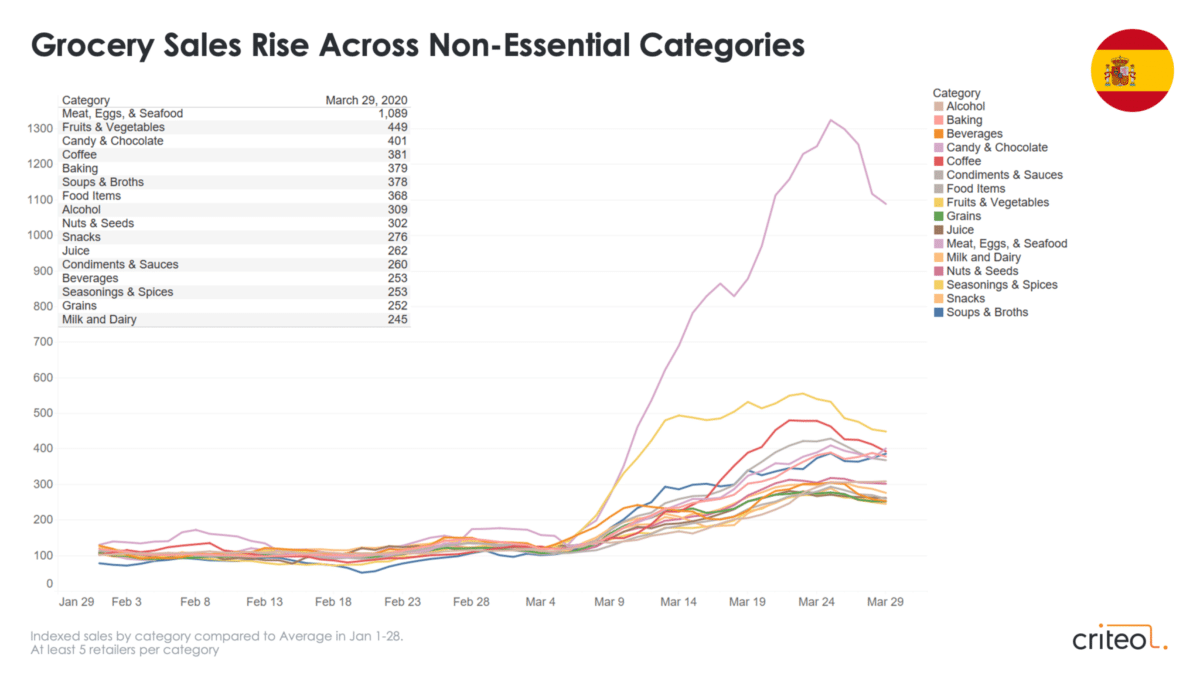

At the beginning of quarantines, people stocked up shelf-stable groceries like canned beans, rice and flour, as well as more fresh fruits and vegetables. This past week, more non-essential products made it into the mix.

Candy & Chocolate had a strong showing, with sales increasing more than 7x in the UK (+779%) and Italy (+736%), compared to the first four weeks of January. Sales in Brazil and France were both up by +146%.

In Spain, sales of Candy & Chocolate jumped by +301%, perhaps as the counterpoint to the spike we saw in savory Meat, Eggs, and Seafood (+989%).

2. Casual Clothing Purchases Increase

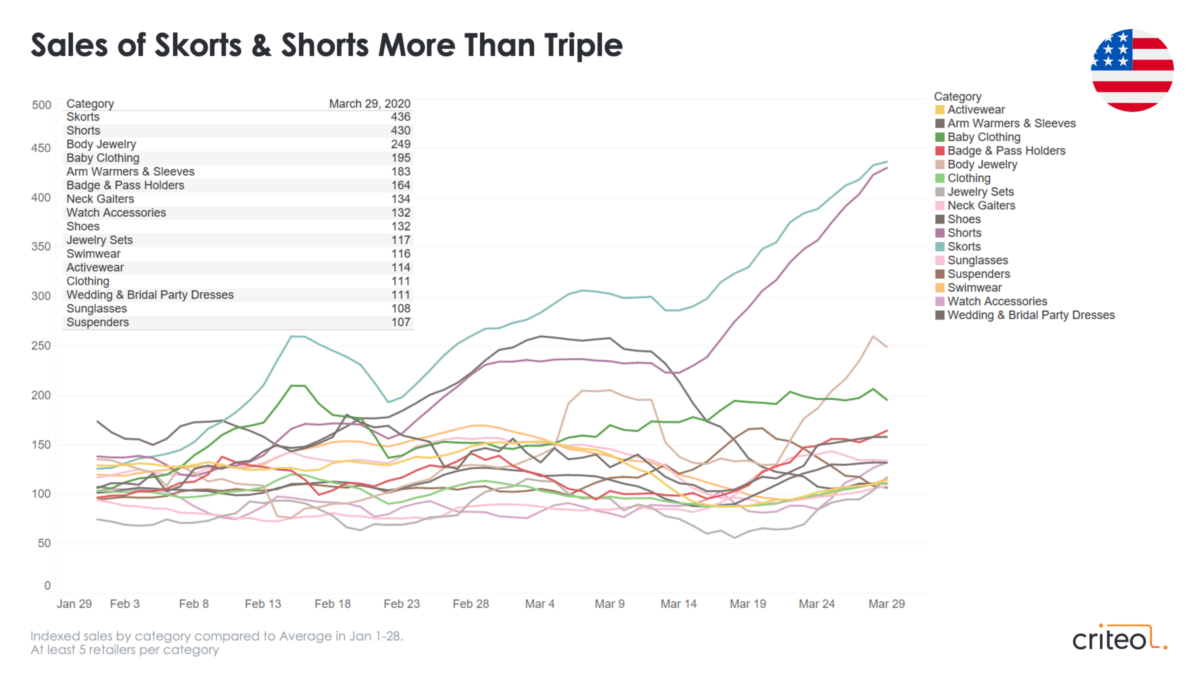

In Criteo’s recent survey, 60% of respondents said that because of coronavirus, they plan to do more work from home3 — and they’re reaching for comfortable clothes. With video conferencing software making it easy to be framed from the chest up, gone is the need to wear formal skirts, slacks, or even jeans to take business meetings.

In the US, skorts (+336%) and shorts (+330%) were tops as Americans look to keep things comfortable and ready for warmer weather. Shorts also spiked in the UK (+167%), Germany (+244%), and Italy (+77%).

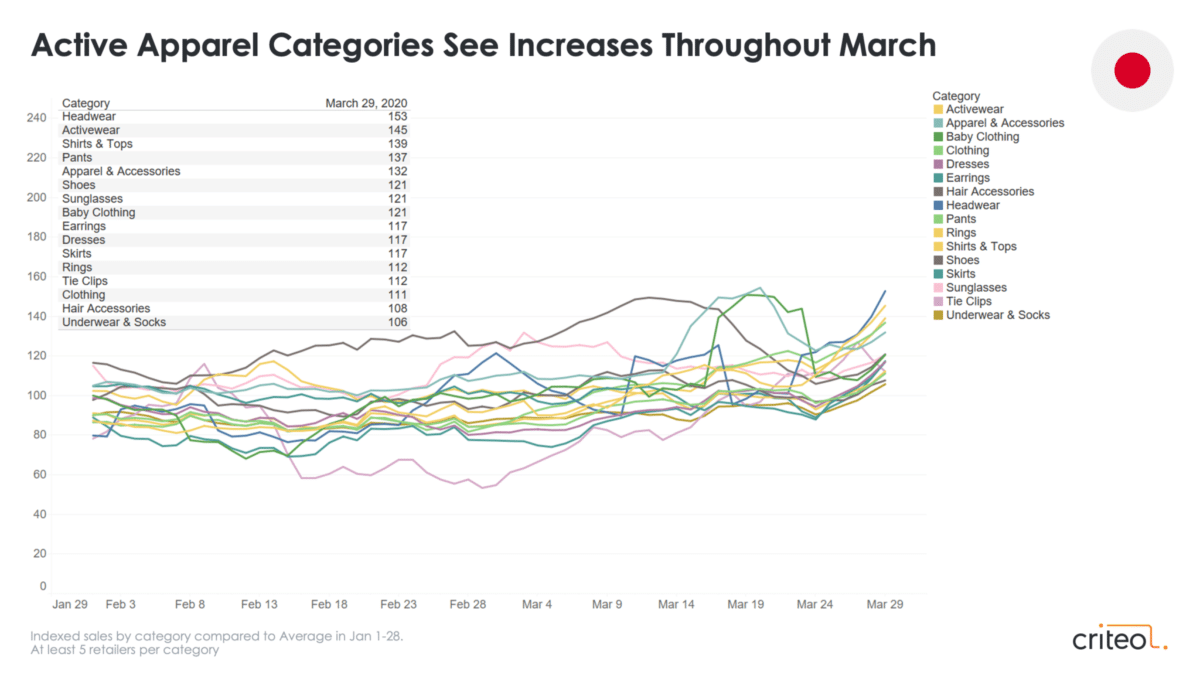

Activewear went up in Japan by +45%.

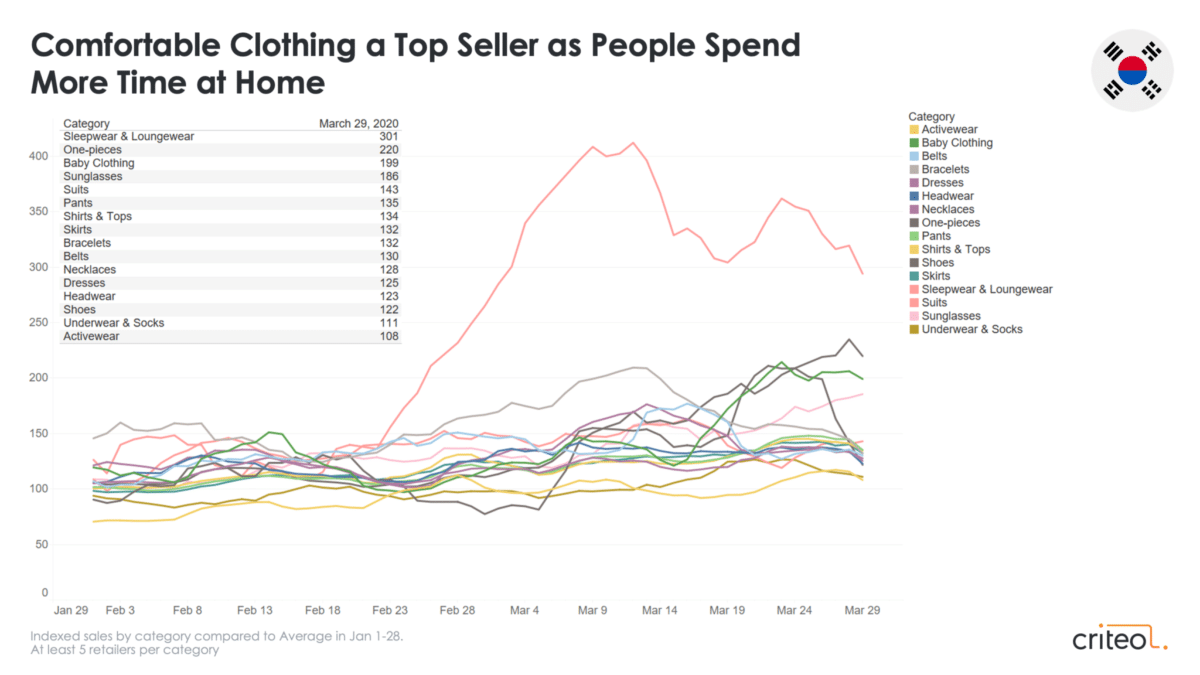

Sleepwear & loungewear grew in South Korea (+201%), the UK (+130%), Brazil (+85%), Italy (+55%), and Australia (+31%).

3. Sales of Sporting Goods Spike

A growing number of gyms are temporarily closed due to social distancing measures, and consumers are figuring out how to stay healthy and in shape without ever leaving the house…or going very far.

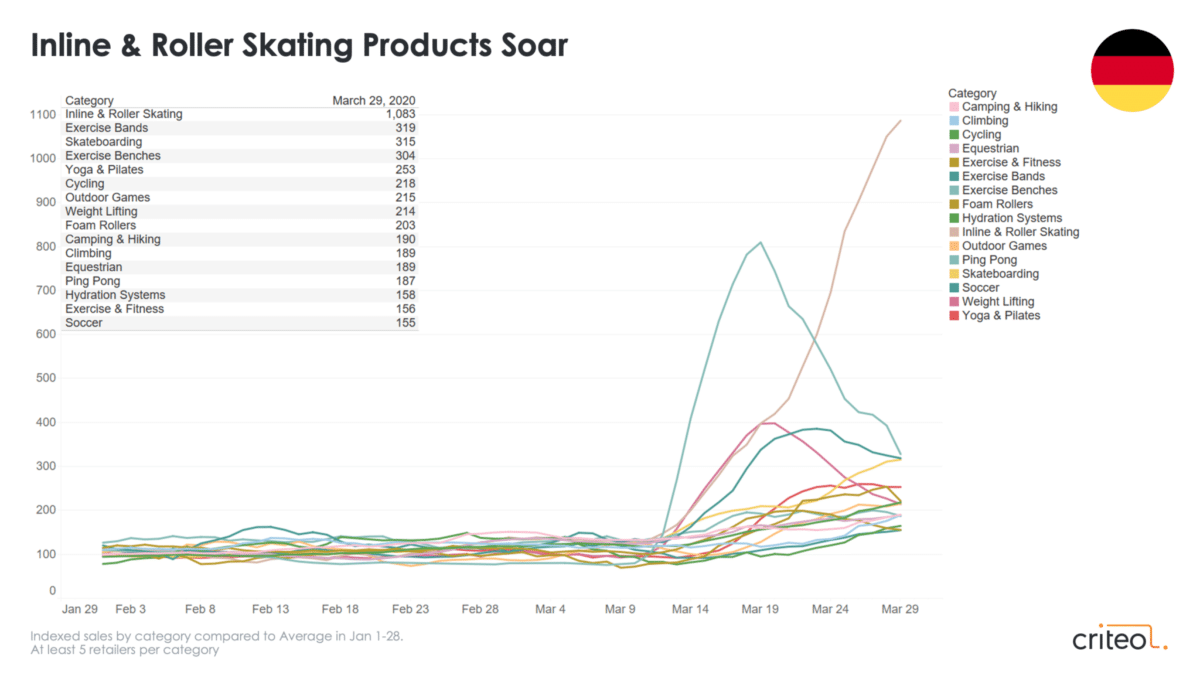

Inline and roller skating products surged in Germany (+983%) and in the US (+878%), where spending limited time in the open air is still allowed.

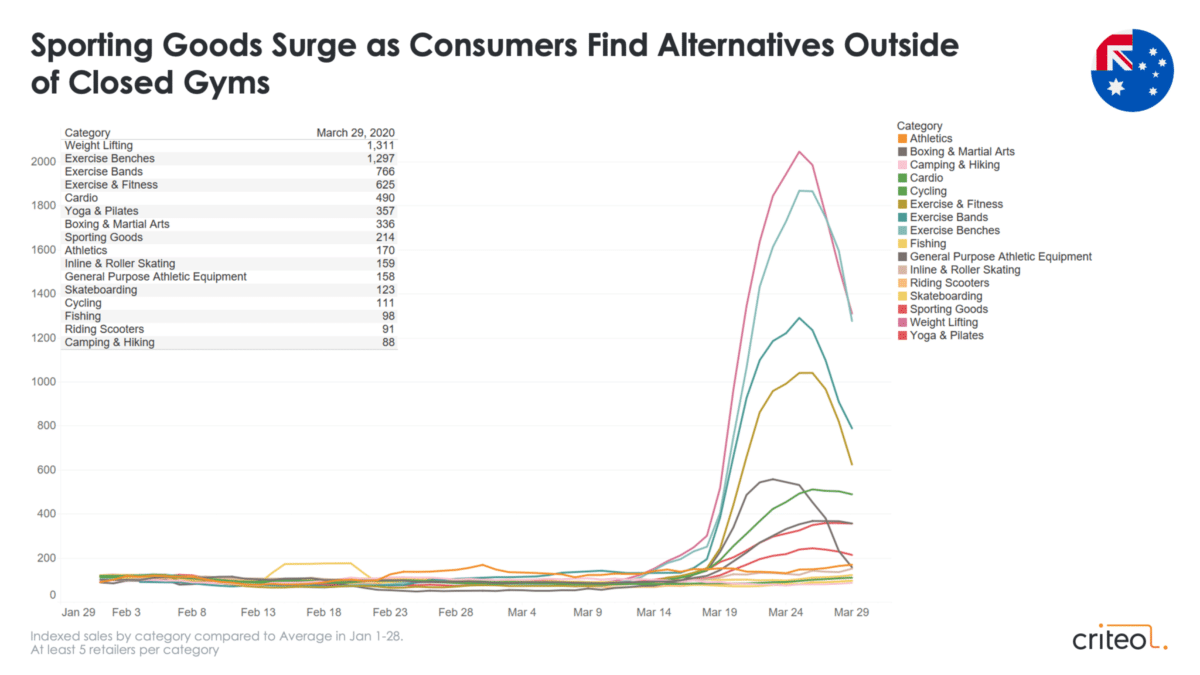

Weight lifting products shot up substantially in Australia (+1211%). Many Aussies also outfitted their home gym setup with Exercise Benches, up +1197%.

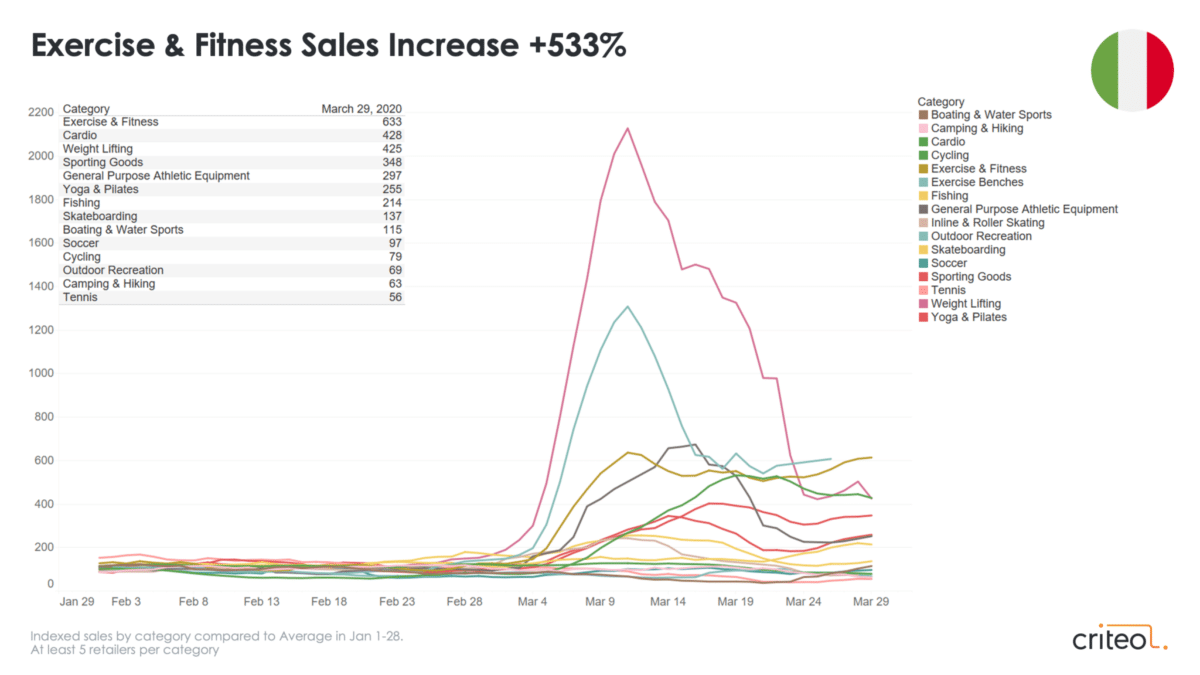

Italy saw “Exercise & Fitness” products jump +533%, while general “Athletics” sales increased +466% in the UK.

4. Webcams and Gaming Take Off

To combat feelings of isolation and boredom associated with social distancing, consumers are spending on products that help them stay connected and entertained.

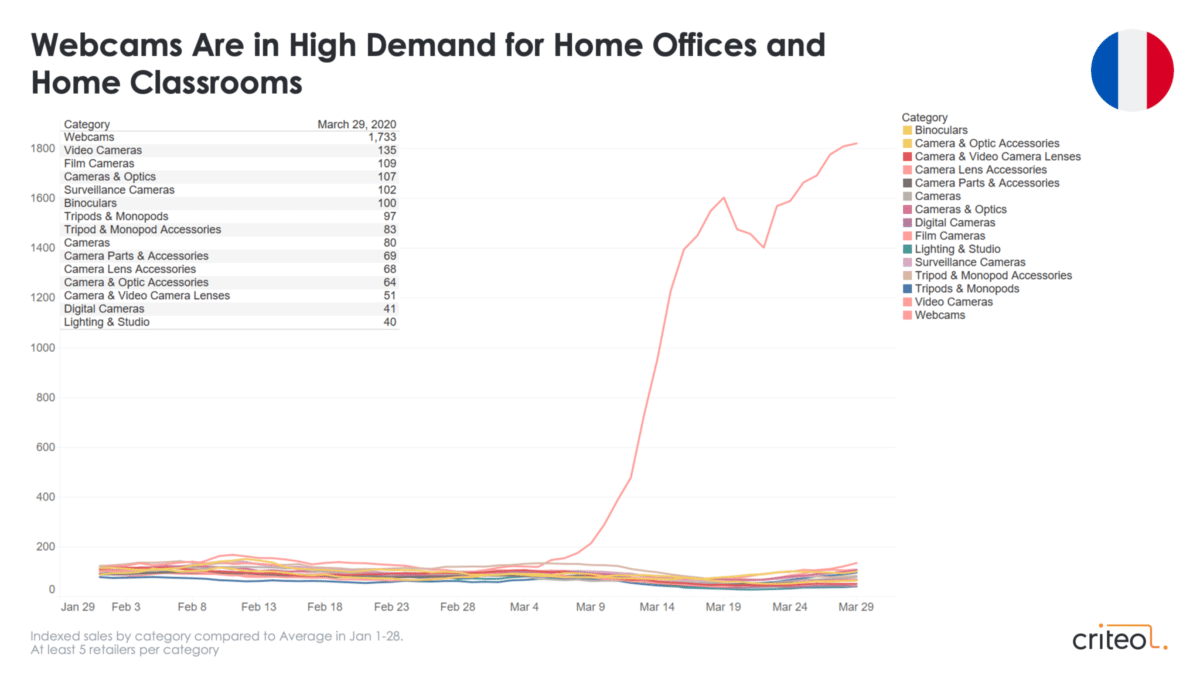

Sales of Webcams went up a resounding +1633% in France and +2418% in Germany. Sales also increased significantly in the US (+352%) and Australia (+544%).

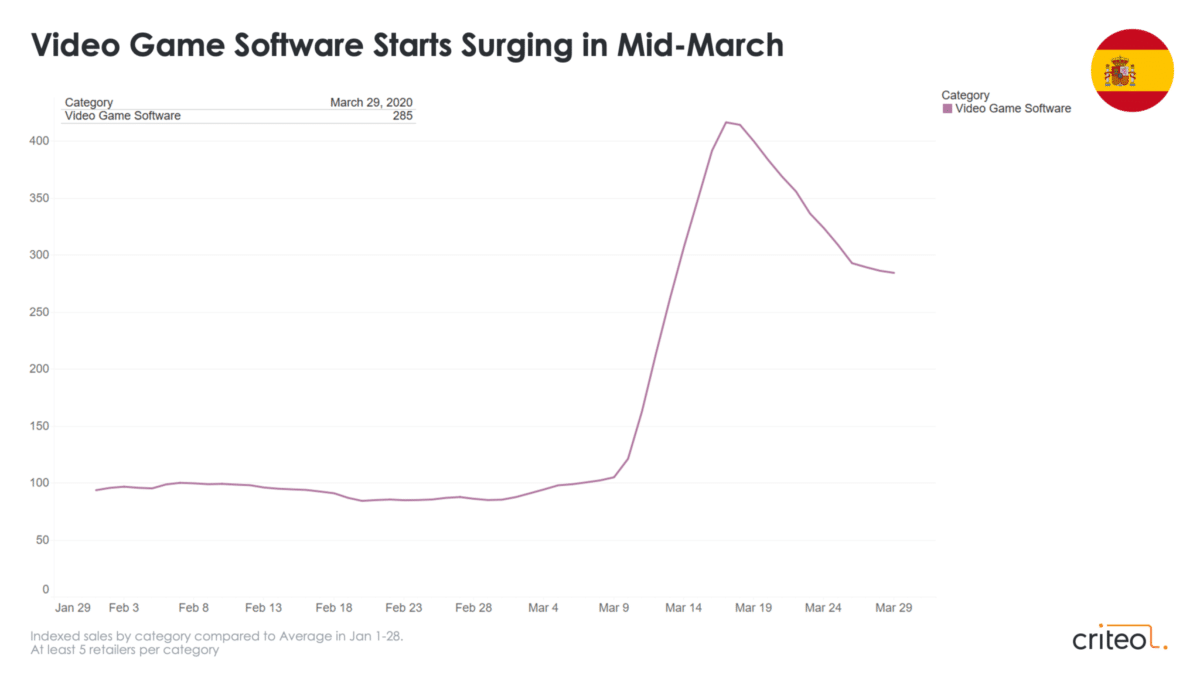

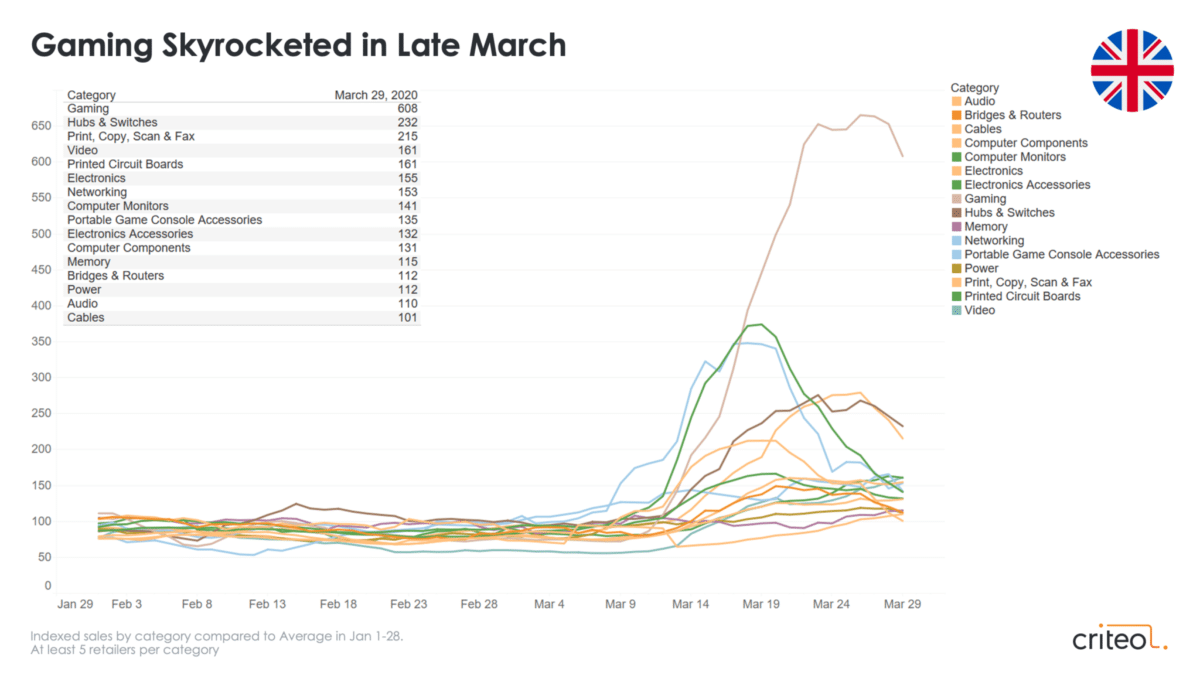

Video Game Software sales were elevated across Spain (+185%), the UK (+158%), Italy (+146%), the US (+131%), and Australia (+138%).

Last Sunday, Gaming sales, which includes hardware like consoles and other accessories, were up in the UK (+508%), Spain (+231%), and Australia (+230%).

How Brands Should Think About Social Distancing

The new social distancing economy sees people spending more on products that are less essential and more quality-of-life oriented. As our data shows, people are getting used to being at home more, and they’re adapting to living almost entirely indoors. Consumers are coming to terms with the knowledge that this state of being may last a while, and they’re turning toward products that help comfort and entertain.

Social distancing has changed how people interact with each other and with businesses. As marketers, it’s important to acknowledge these new realities and adjust ad campaigns accordingly.

1. Make relevant creative.

It’s important to stay present for your customers, and to think about how your offerings can be framed at this time. Ads that show crowds or outdoor activities should be shelved in favor of pictures and products that do best indoors.

2. Focus on social distancing products.

What products complement a social distancing routine? With consumers spending more time indoors and with family, think about which products can build an experience in a social distancing economy.

3. Get regular insights.

Make sure you have access to insights at least on a weekly basis. This can help you not only adapt to the situation as it evolves but also understand when things are getting back to normal.

4. Build relationships.

With the right messaging and branding, brands can build relationships with customers that lead to lasting loyalty. In a recent survey, 42% of consumers said that addressing coronavirus in ads is okay. Around half (44%) said that it depended on the message and/or the brands. Three-quarters of consumers said that brands have a responsibility to help out during the pandemic. The ads that resonated the most focused on resilience and unity.

Moving Forward

All marketers should consider the realities of the social distancing economy. As we continue to pull data on how consumers are changing purchasing habits, we are noticing some areas of growth that reflect that new normal. With personalized ad campaigns that help people find what they need during this time, marketers can connect with their audiences while building stronger relationships for the future.

1Source: AFP Database, March 29, 2020

2Source: Online sales and online bookings, Criteo data, Q1 2019 and Q1 2020. At least five retailers/travel players at the most granular level.

3Source: Criteo Coronavirus Survey, Global, March 2020, N=10,204.

Criteo Product Insights Finder

Take a closer look the data by utilizing our interactive Criteo Product Insights Finder. Choose a country and a product category to view the trends: