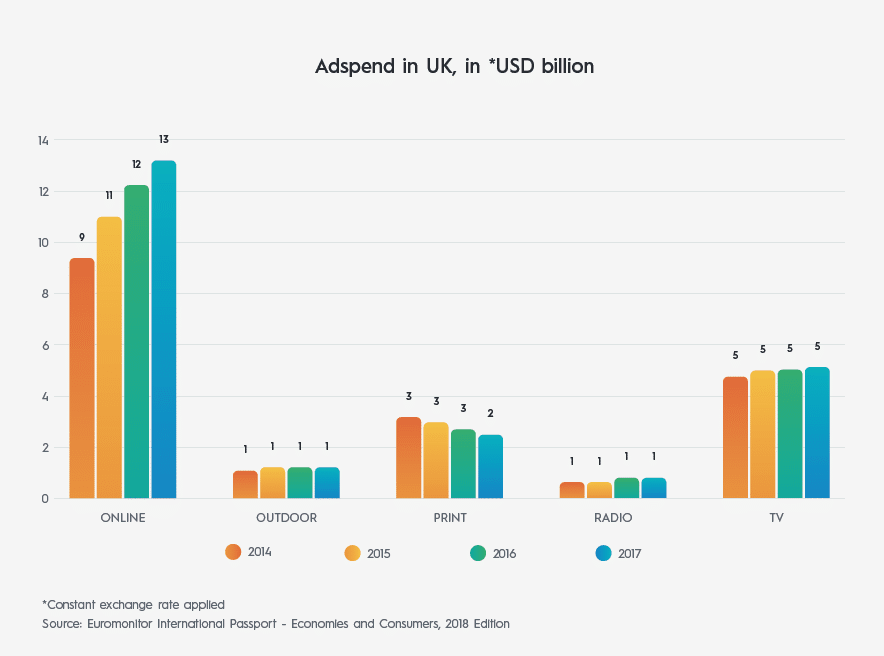

Online is the largest and fastest growing ad spend category in Europe. In the UK, online ad spend is the only category seeing double-digit growth. That’s a lot of brands and retailers putting a lot of money towards digital marketing.

Global digital ad spend is on the rise.

Today, more than 3.5 billion people are regular Internet users. So it makes sense that, on a global level, 40.2% of total ad spend is now going to digital. In Criteo’s recent State of Ad Tech EMEA report, we dive into exclusive findings from our work with Euromonitor on the survey, “Acquire, Convert, Re-engage.” We spoke with 150 marketers in Europe about how they convert customers today — and what works best.

The full report covers the top 2019 ad-tech trends, best strategies for re-engagement, most common metrics for measuring success, and more. In this post, we’ll unpack what makes the UK ad-tech market hum.

The UK Ad-Tech Opportunity

UK ecommerce is expected to sustain a two-digit growth in 2019 at +10.9%, and will reach one quarter (25.4%) of all retail sales by 2021, according to eMarketer.

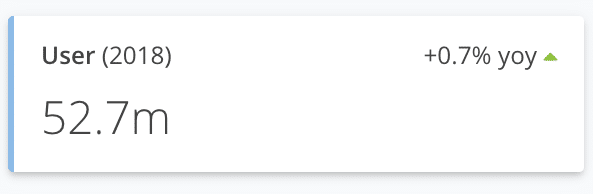

Statista research shows that about 79.5% of the UK population (or 52.7 million people) were ecommerce shoppers in 2018 (+0.7% YoY). User penetration is expected to hit 80.3% by 2023.

The United Kingdom’s largest ecommerce segment is Fashion, with a market volume of over 23 billion USD (about 20 billion euros, or 17 billion pounds) in 2018.

UK shoppers are omnishoppers.

The Ecommerce Foundation findings also revealed that that omnichannel is huge in the UK, with 93% of online shoppers also shopping in stores. This is likely due to the level of choice (over half of online consumers feel there is more choice online), the ability to compare prices, and the availability of lower-costing products.

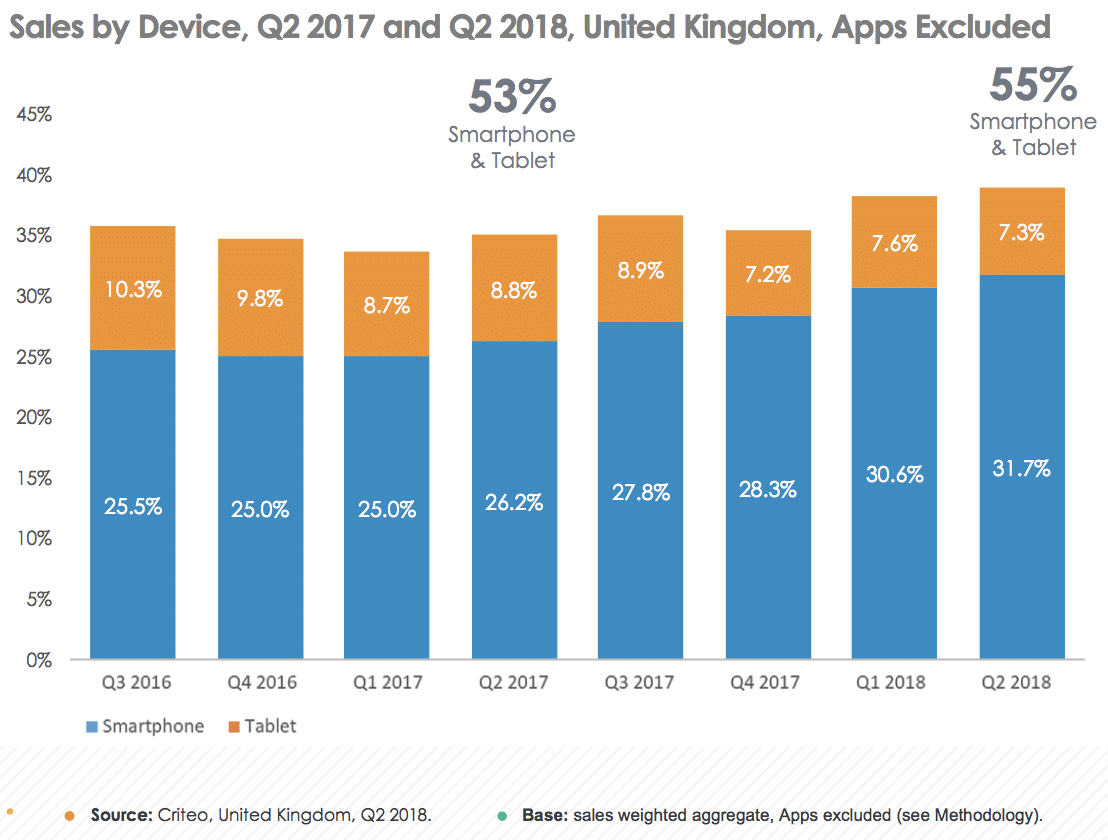

Mobile dominates online shopping in the UK.

Nearly half of online shoppers in the UK use a mobile device to search for products, then use their desktop to place the order. Criteo’s Global Commerce Review research supports the trend: In Q2 2018, over half (55%) of online retail sales in the UK happened on smartphones or tablets.

When it comes to demographics, internet usage in the UK is above 90% for almost all age groups, and 91% of those from 35-44 are shopping online.

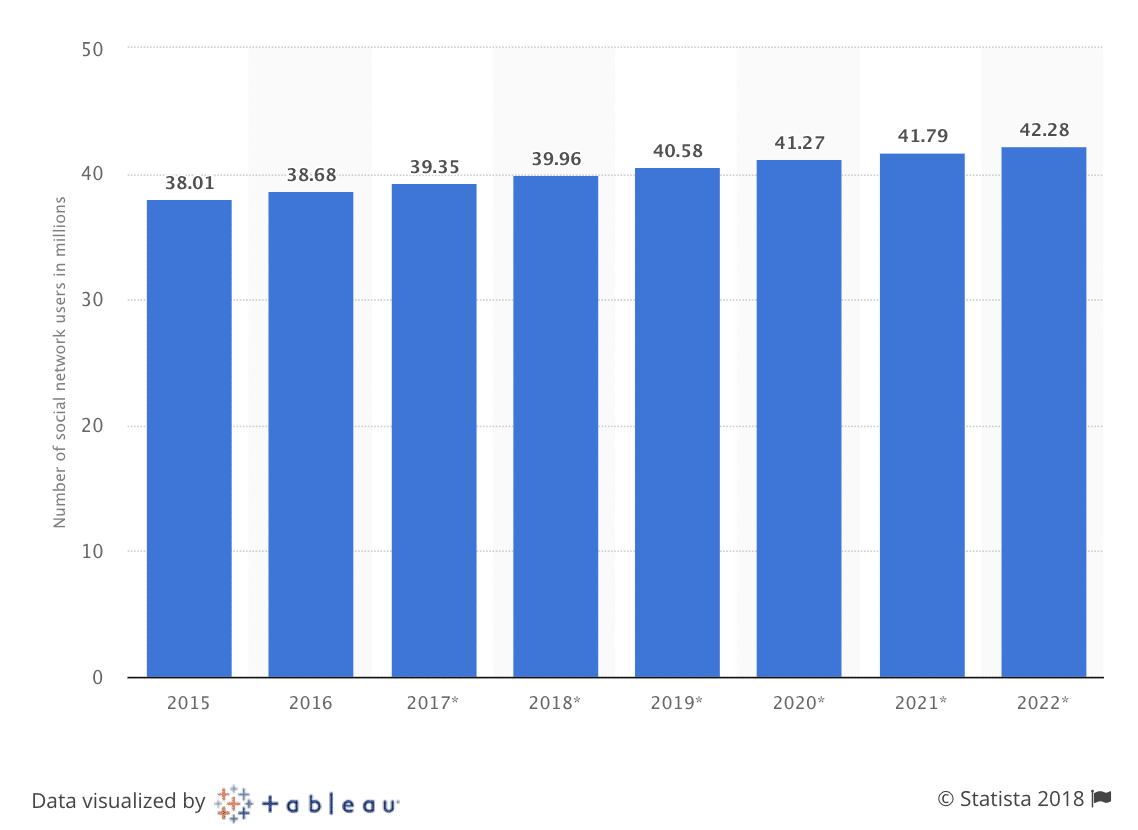

Social media is huge in the United Kingdom.

Social media is an integral part of daily life for many in the United Kingdom. Statista reports that the total number of social media users in the UK reached over 39 million in 2017, more than 58% of the population. Facebook is the most visited social network, followed by YouTube.

A study by Flint showed that younger generations (Gen Z and Millennials) embrace newer platforms like WhatsApp, Instagram, Snapchat, and Pinterest. Older generations (like Baby Boomers), prefer Facebook, with 70% of online adults aged 55-64 in the UK using the platform daily.

State of Ad-Tech Report: Ad Spend is Thriving in the UK

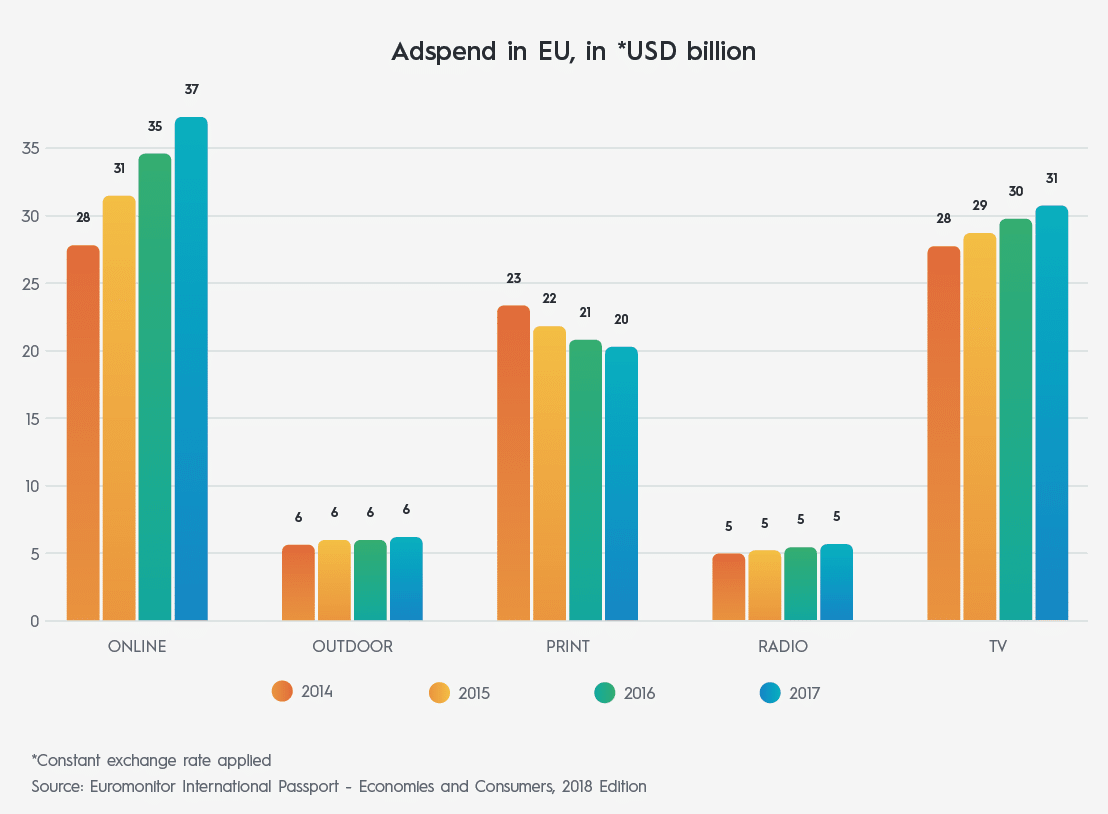

In step with the rise of ecommerce, overall ad spend in Europe is highest online, and has shown steady increases since 2014. TV holds strong, but print is declining and outdoor and radio spend has stagnated.

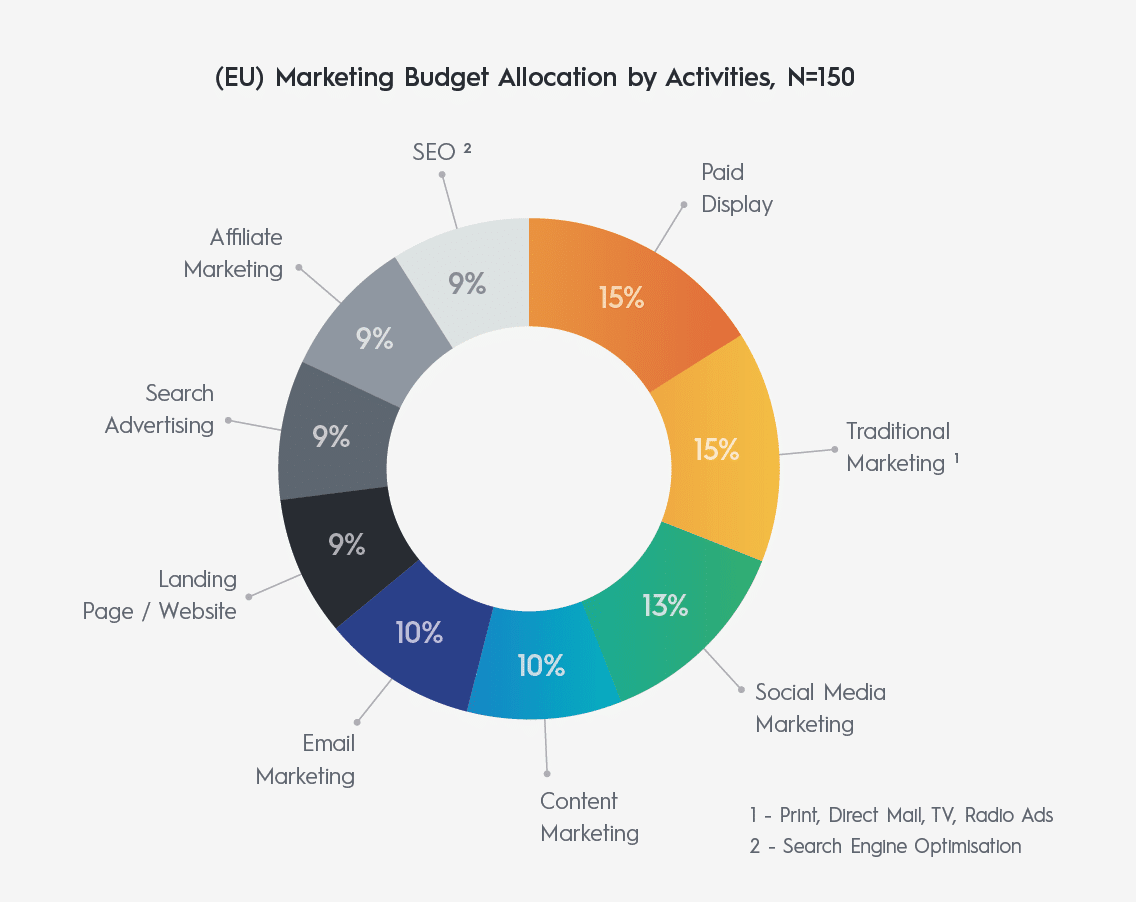

When it comes to tactics, EU marketers are spending heavily on paid display. Social media ad spend is increasing as well.

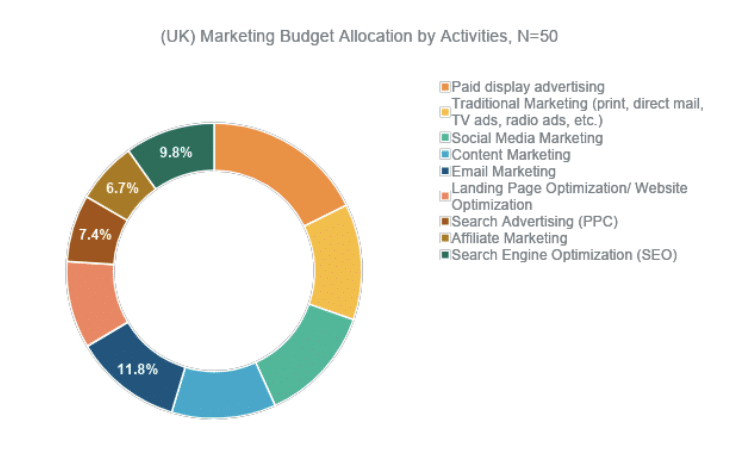

Paid Display ad spend is a key focus for marketers in the UK — 18% of marketing budgets went to paid display. The second highest share of ad spend went to social media.

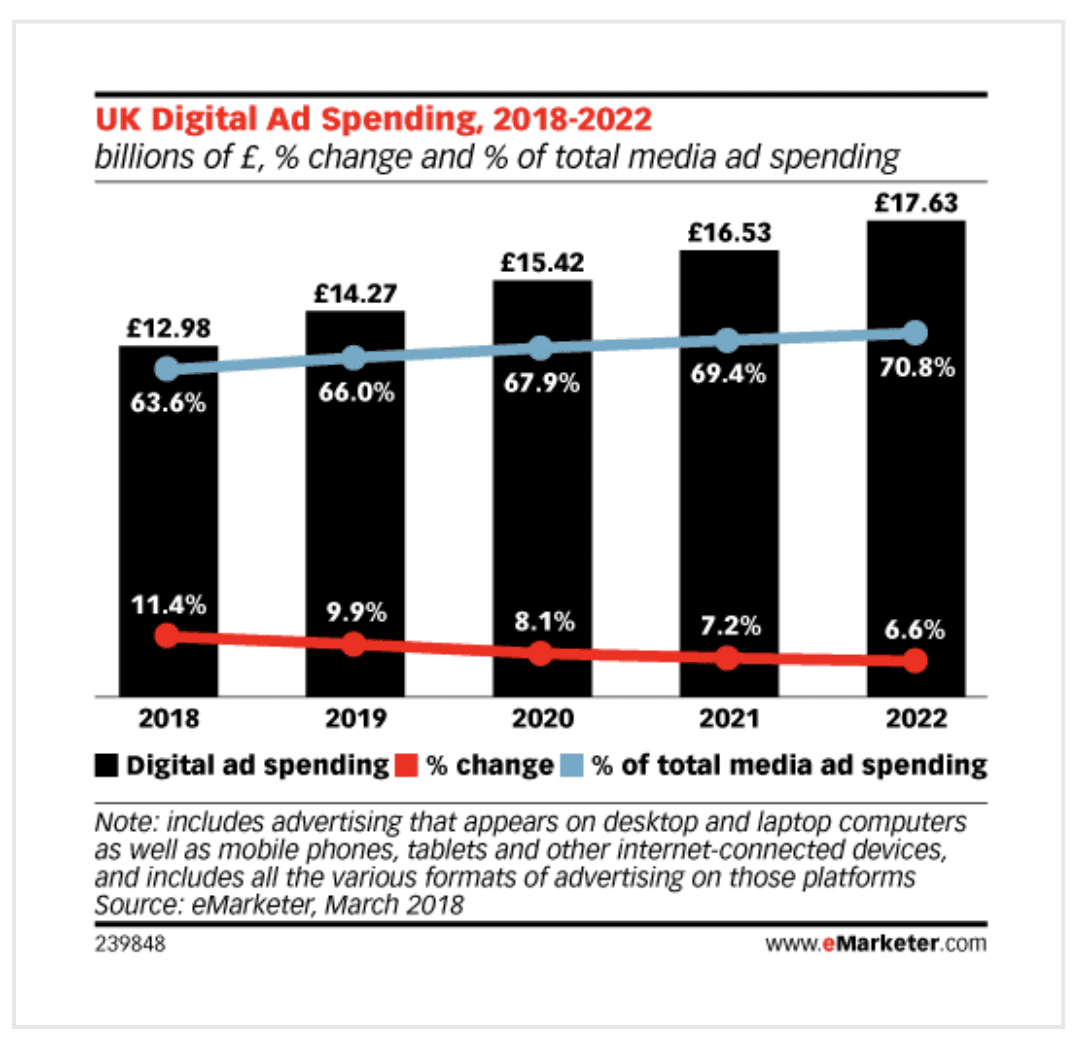

As the chart below shows, online ad spend in the UK far outpaces other channels like print, radio, and TV.

Forecasts from eMarketer show that total media ad spending and is projected to increase by over 9% in 2019.

Strategies for Ad-Tech Success in the United Kingdom

Leverage different channels with the right tactics.

Different channels and tactics move the needle in different ways. When you have the proper tools and partners in place to measure data-driven attribution, you can rest assured that your marketing dollars are being well-spent on the proper platforms.

Incentivize shoppers to buy more, more often.

EU marketers say offering discounts and making ads graphically engaging are keys to app re-activation. For repeat purchase campaigns, EU marketers agree that motivating with compelling discounts — which could be delivered through great emails, social media, or in-app — is the number one tactic.

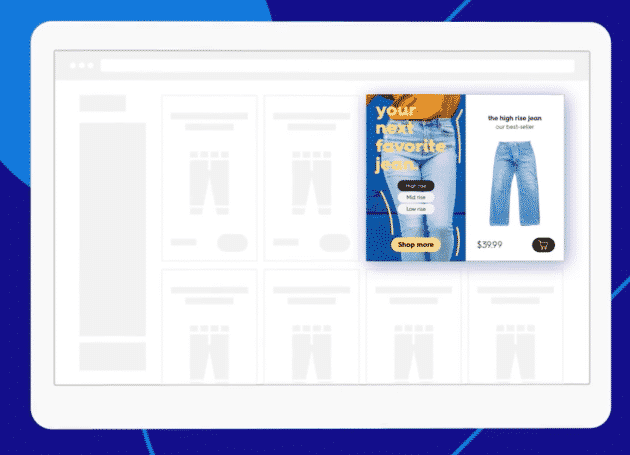

Get creative with your ad formats.

Interactive ads, videos, or unexpected ad placements and experiential marketing can help you target prospects at the right time and place, and help leave a lasting impression. Thinking outside the display-ad box will be key to winning more shoppers’ hearts and minds in 2019.

Final thoughts on the UK market: Ads need to do more than just push products.

With all the challenges brands and retailers have been facing in the UK recently, from a less-than-stellar Christmas 2018 to the decline of offline foot traffic, converting shoppers is more difficult than ever.

“The best ads in 2019 won’t sell. They will entertain, educate, and inspire.”

— Criteo’s State of Ad-Tech Report 2019

Companies that leverage technology and smart data activation to deliver hyper-relevant ads will be poised to win in today’s competitive retail market.

To learn more about how to deliver full-funnel ad experiences, ones that understand each customer’s needs and tell a great stories through product and content, download our State of Ad-Tech Report today!