Fresh and exclusive holiday shopping trends to inform your campaigns

Holiday and festive season shopping behaviors aren’t as predictable as they once were. The line between online and offline continues to blur, and macro trends like inflation and climate change are constantly changing the game.

To help marketers prepare, we asked thousands of US and UK consumers about their plans for the upcoming holiday and festive season and analyzed data from thousands of retailers to identify ten key insights. You’ll get the scoop on:

- Where shoppers discover products, and how long the average journey lasts

- What encourages them to try a new online store

- How they feel about AI as a shopping tool

- How much online touchpoints impact in-store purchases

- And more!

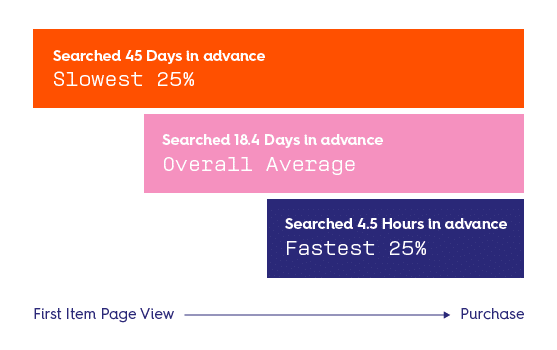

Holiday shopping journeys can be as long as 45 days

The longest holiday season path to purchase is about 45 days (44 in the UK). Our data also shows that the path to purchase for $500+ items is 48% longer than for items less than $100. In the UK, the path to purchase for $500+ baskets took 23% longer than baskets less than $100, and 54% longer than baskets between $300-$500.

Holiday campaigns should plan for touchpoints throughout the duration of the longer window to ensure that all journeys are facilitated. That means an even earlier start to campaigns for luxury brands and/or higher price point items.

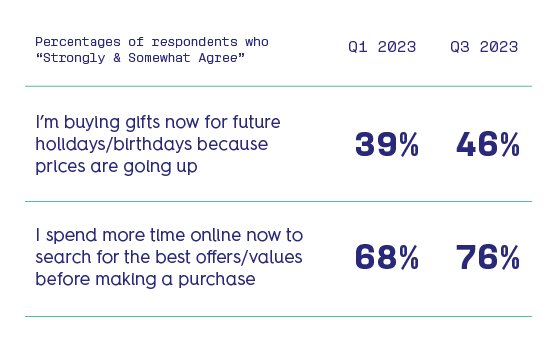

Loyalty is up for grabs

Our survey findings showed that shoppers are increasingly spending more time online searching for deals. Around three quarters of survey respondents in both the US and UK confirm this behavior.

Make sure your promotions, messaging, and budget are putting you in the best position to beat the competition.

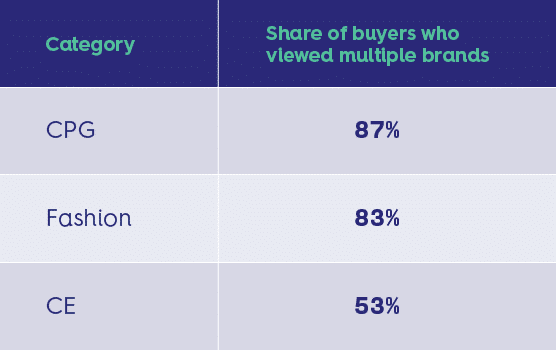

Shoppers browse many brands within a category before buying

In the US, more than 80% of shoppers who purchased key CPG and Fashion goods and more than 50% of CE shoppers visited multiple brands during their journey. In the UK, about half of CPG, Fashion, and CE shoppers looked at multiple brands before making a purchase.

For categories where a shopper is more likely to browse brands, consider boosting ad spend to increase the chances of competitive steal.

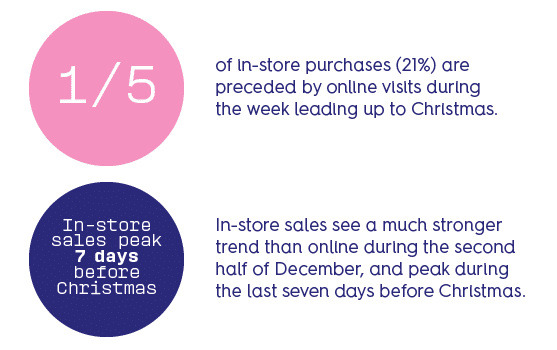

As time runs out, more holiday shoppers research online before buying in a physical store

During the week leading up to Christmas, about 1/5 of in-store purchases were preceded by online visits, as shoppers research and compare online before buying in store. This is an increase compared to earlier in November.

Be sure to maintain campaigns through the entirety of the season to influence these last-minute shoppers who are evaluating which physical store to purchase from.

2023 Holiday and Festive Season Consumer Confidential: 10 insights that could change your marketing plans

Curious about the other six insights? For more learnings about consumer plans for the holiday and festive season–and how to adjust your marketing plans accordingly–download the full report.

- Exclusive consumer survey insights from thousands of US and UK shoppers

- Unique findings based on Criteo data from millions of consumer transactions across thousands of retailer partners

- Recommendations to help marketers plan for all phases of the holiday and festive season