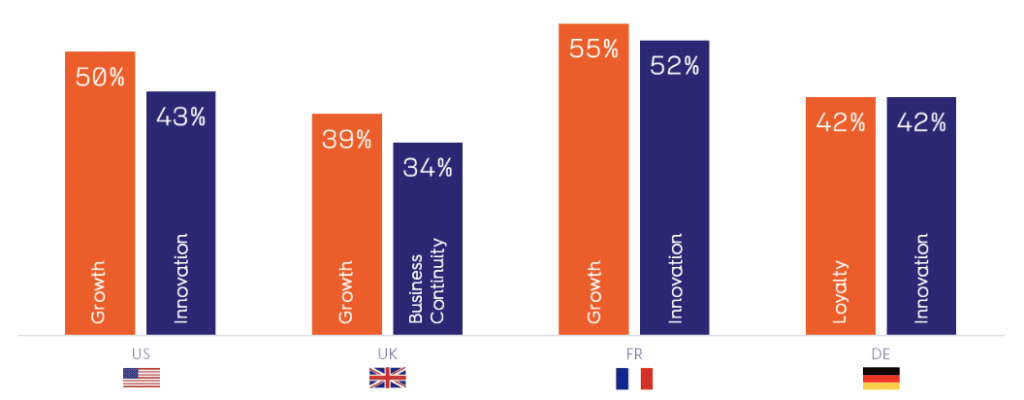

What word most accurately describes advertisers’ aspirations for 2023? ‘Continuity’ perhaps? How about ‘growth’ or ‘innovation’? While such hopes might feel lofty in the context of continued economic uncertainty, for many advertisers across the US and EMEA, these words perfectly sum up their goals for the next 12 months.

Criteo’s latest report, The Advertiser’s Guide to New and Emerging Channels in 2023, uncovered that the majority (60%) of media agency professionals are confident client growth is possible with the right strategy.

According to the report, which is packed with findings from a survey of 800 senior media agency professionals across Europe and the US, the right strategy boils down to one key recommendation: invest in emerging media. Overwhelmingly, 92% of media agency professionals agree their clients should be exploring new digital channels in 2023.

Brand Priorities for 2023

New horizons for media channels

While agency professionals are still allocating budgets for traditional channels, our report reveals that the benefits of emerging media, such as retail media, connected TV (CTV), audio, and the Metaverse, are catching their attention.

In fact, nearly two-thirds (64%) believe newer digital channels like retail media will deliver a greater return on investment than search or social. The hot topic of the latest industry headlines, retail media offers brands presence directly at the point of sale, meaning return on ad spend is easy to prove.

CTV, an advertising channel that’s proliferating thanks to new ad-supported tiers introduced by the likes of Netflix and Disney+, topped the survey respondents’ list for consumer experience, just edging out audio and retail media. Many streaming services are even looking at how they can strengthen their audiences with data from other channels. The recent partnership Walmart carved out with Paramount+ to boost subscribers is a great example.

With the cost of running campaigns across digital media channels expected to rise by 22% over the next 12 months (highest of all on social), agency professionals know that diversifying their spend across emerging channels—even the Metaverse—will be key to driving performance and maintaining media efficiency.

Performance above all

Rising costs leave clear priorities when it comes to campaign measurement. Cost-per-order is now a top metric for advertisers, alongside overall return on ad spend.

With growth tied to the exploration of new media channels, incrementality will be a north star for agencies and their clients. For many agency professionals, such metrics are pushing them towards retail media in particular (50%), which brings commerce data into the equation as a means to close the measurement loop across other channels such as CTV, where transaction data is less abundant. Criteo’s partnership with Magnite does just that for retailers, and their brand and agency partners.

As Rob Smolarski, Global Commerce Lead at Omnicom Media Group, commented for the report, “Client growth is possible with the right strategy, and we have to start thinking about where we make strategic pivots to achieve that. We’re entering a time of the most rational media investing in fifteen years. Agencies and clients will have to make some tough choices on the precise audiences, media channels, regional markets, and retail partners to invest in to support commerce. From an agency perspective, platforms will be crucial that bridge those gaps and get brands closer to consumers ready to buy.”

To learn more about how advertisers can make the most of this moment of change, read The Advertiser’s Guide to New and Emerging Media report, available here.