Even when financial uncertainty and global newsfeeds buzz with tension, one thing is clear: Travel demand is still standing strong. But the way people travel and what they expect along the way is shifting fast.

The Spring 2025 Travel Pulse reveals that travelers are becoming more price-conscious. They’re navigating financial fluctuations with a mix of creativity, flexibility, and smart planning. Built from survey responses from over 14,000 travelers worldwide and enriched with data from hundreds of top travel brands (OTAs, airlines, hotel chains, and more), our report has the travel insights marketers need to optimize their strategies.

Here are just a few of the travel industry trends we uncovered, each with clear implications for your travel campaigns.

Cost-conscious doesn’t mean couch-bound

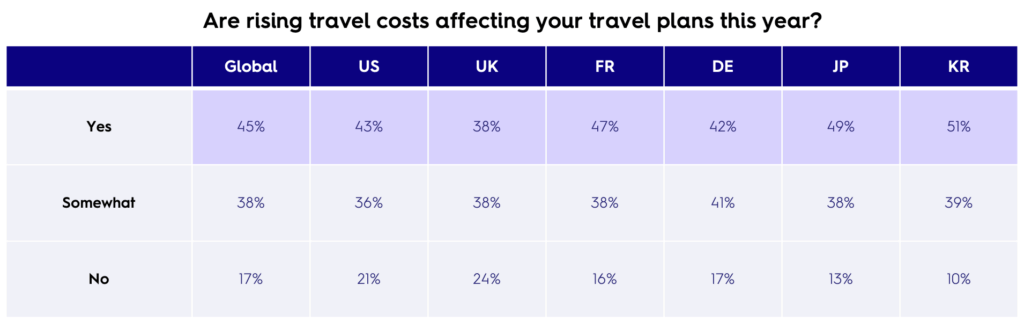

Rising costs are changing how people travel. In fact, 45% of travelers globally say that increased travel costs are affecting their plans.

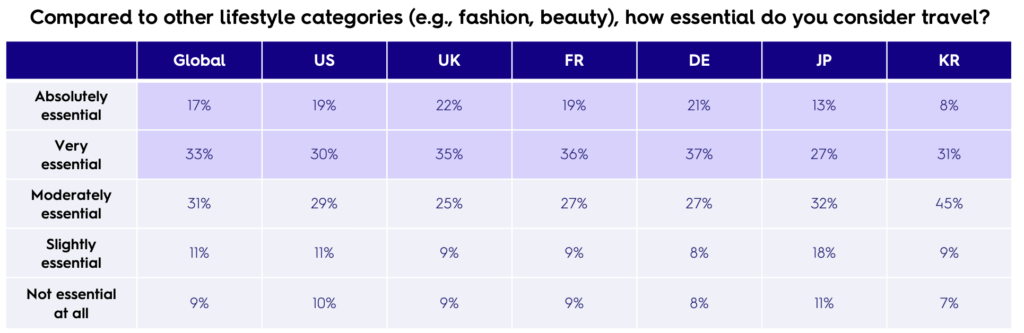

But travel is still non-negotiable. Half of travelers globally still consider travel an essential part of their lifestyle. This sentiment is especially strong in the UK, Germany, and Japan, where passion for travel is strong even in the face of rising prices.

Globally, two-thirds of travelers also say they’ve either maintained or increased their travel spend compared to last year, proof that the appetite to explore hasn’t faded.

Takeaway: Position travel as an essential escape hatch from the everyday, offering connection, meaning, and a much-needed layover from life.

Travel leaves Retail in the rearview

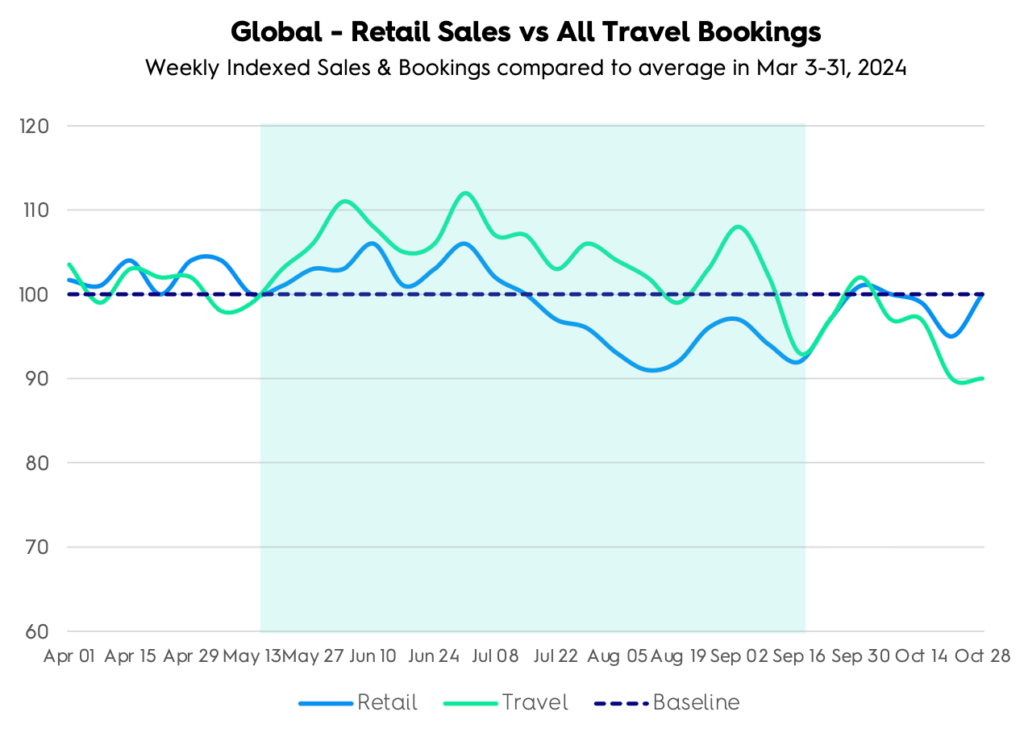

When Spring hits, travel demand outpaces retail around the globe. From late May to early September of 2024, travel bookings outperformed retail sales by 6 index points on average.

The travel boom didn’t look the same everywhere. In the Americas, momentum remained high throughout Q2 and Q3, with travel bookings pulling ahead of retail by 17 index points. EMEA saw a strong seasonal spike, with bookings exceeding retail by over 8 points. Meanwhile, in APAC, the peak came later – between July and October, travel consistently led retail by more than 12 index points.

Takeaway: When travel takes the spotlight, make sure your campaigns are ready for prime time. Prioritize seasonal pacing, front-load acquisition in Q2, and extend spend into late Q3 and Q4 in markets like APAC where demand builds later.

The booking path is longer than you think

Travelers aren’t booking on a whim. In late March 2025, air travel bookings took an average of 9 days from first search to final purchase. Hotel bookings took even longer: 12 days on average.

But it’s not just about time, it’s about touchpoints. Travelers consider 4 air travel options and 21 hotel listings before booking. That’s 5 times more hotel options than flights, making the hotel booking path especially crowded and competitive. With more listings, more filters, and more consideration along the way, every moment in the funnel counts.

Takeaway: Stay visible throughout the full booking window with mid-funnel strategies like dynamic creatives, retargeting, and personalized messaging that keeps you top of mind while travelers weigh their options.

Newsfeeds are shaping travel plans

Planning a trip now includes more scrolling than ever before, and not just through hotel listings.

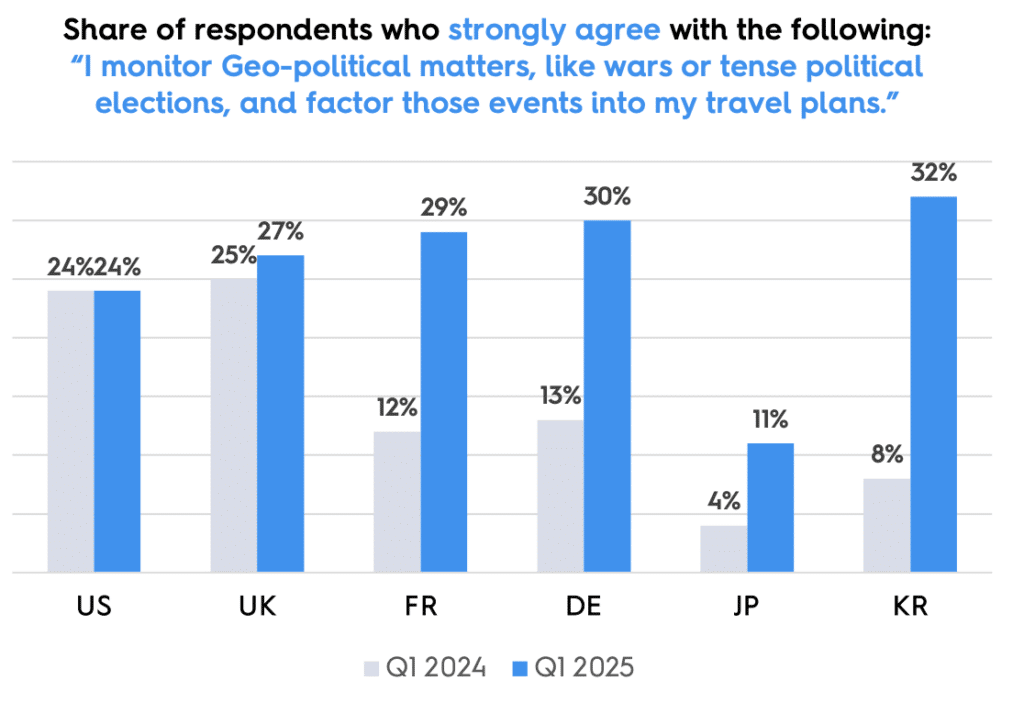

While only 26% of travelers globally currently factor geopolitics into their decisions, concern is climbing fast. It’s now the fastest-growing planning consideration, up 12 points year over year, with sharp increases in South Korea (+24pp) and France and Germany (+17pp).

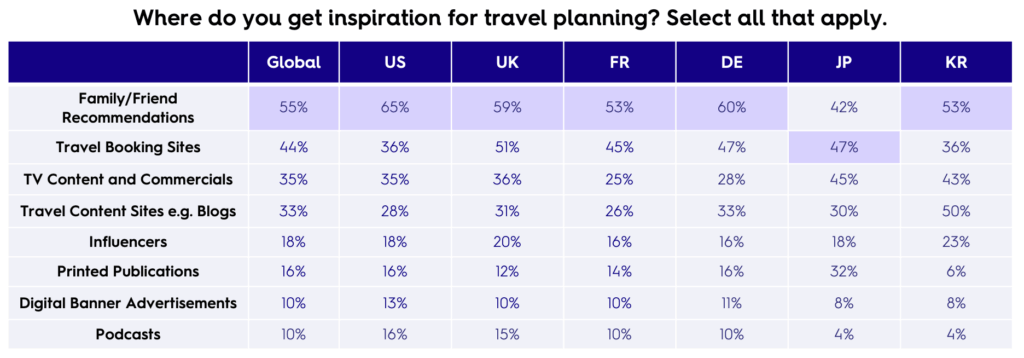

Outside of recommendations from friends and family, travelers turn to a diverse mix of media to shape their itineraries. Globally, top online sources of inspiration include travel booking sites, TV content, and travel blogs.

However when marketers zoom in, and the picture shifts. Japan still values print, South Korea favors influencer content, and in the US and UK, podcasts and peer recommendations drive decisions.

Takeaway: Don’t just show up, show up in the right feed. Tailor messaging to regional content preferences, blend traditional and digital placements, and use data to keep your brand in view wherever travelers are planning their next escape.

Travelers get smart to save more

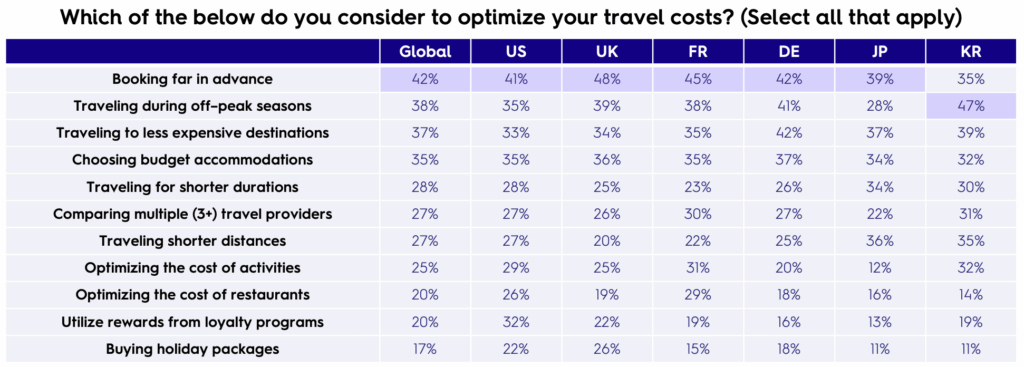

Travelers are finding creative ways to make the most of their budgets without giving up their getaways. Globally, 42% book far in advance, while 38% choose to travel during the off-peak season to cut costs.

How travelers save varies widely across regions. In the US and UK, budget accommodations are a go-to strategy. German travelers opt for more affordable destinations. And in APAC, the focus shifts to shorter trips in Japan and low-cost, experience-led activities in South Korea.

Takeaway: Align your offers and messaging with region-specific savings behaviors to keep value-focused travelers on board.

Meet travelers where they are

Travelers aren’t hitting pause on their trips. They’re just getting smarter about when, where, and how they book. In a season shaped by shifting budgets and evolving expectations, marketers who stay flexible, localized, and value-driven will be best positioned to capture demand.

Read the Spring 2025 Travel Pulse to explore even more consumer travel trends and insights that will take your next campaign from booked to fully boarded.