- Early intent is real, but action is uneven

- Online shopping remains the default because it saves time

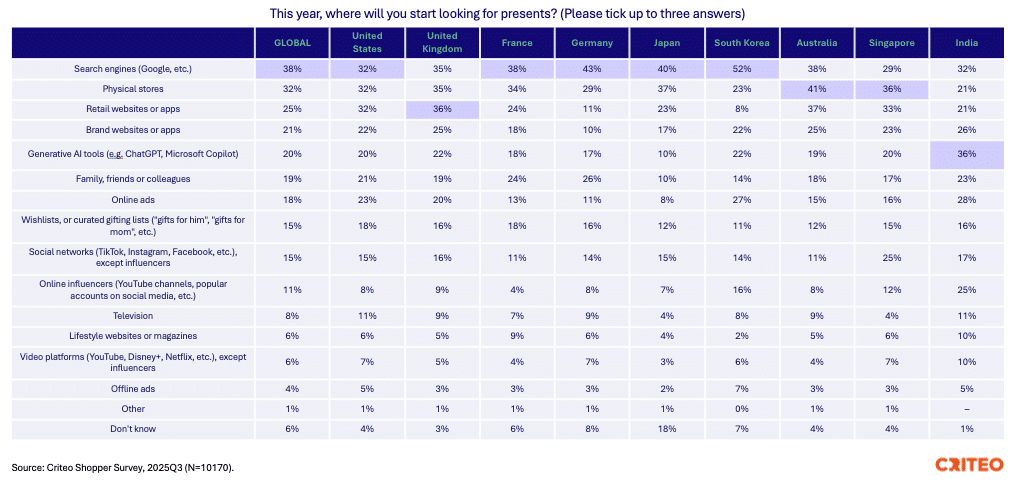

- Search kicks off the journey — with AI now in the mix

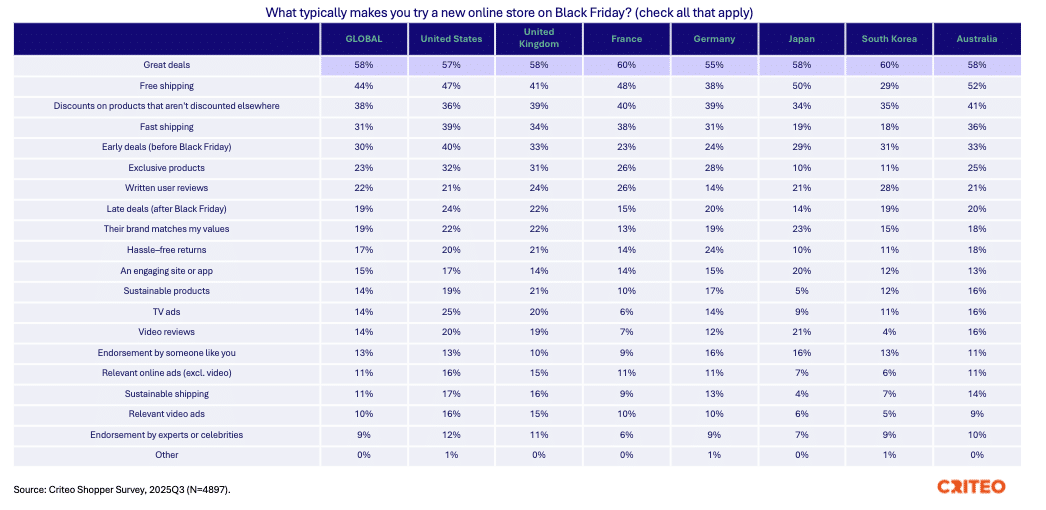

- Deals drive both discovery and loyalty

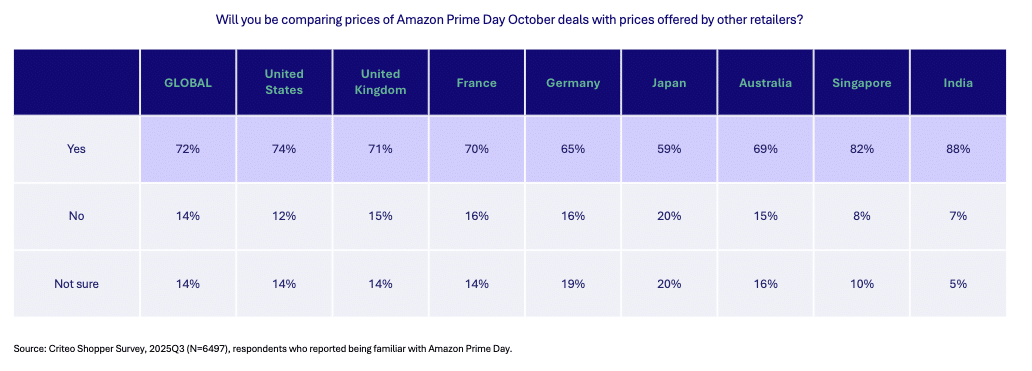

- October catalysts matter, and shoppers compare aggressively

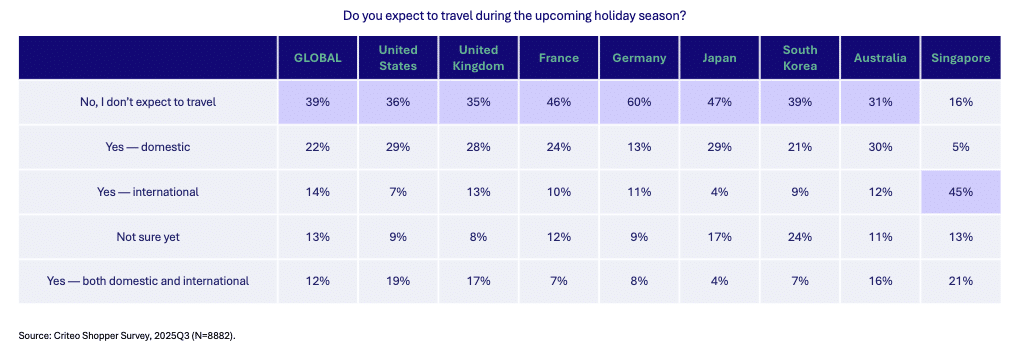

- Keep an eye on travel-adjacent demand

- Bonus trend: AI shopping help is mainstreaming

- What’s different this year

- How to win more holiday shoppers this season

Holiday and festive season shoppers are already warming up their carts, and they’re picky about price, time, and where they start the hunt. We combed through Criteo’s Q3 Consumer Survey, fielded in September, to pull the freshest signals for your Q4 2025 planning.

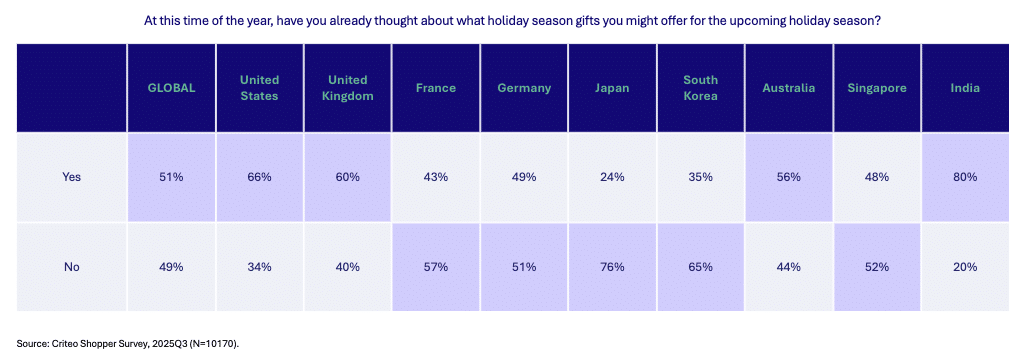

Early intent is real, but action is uneven

About half of shoppers have already thought about the gifts they’ll buy this year, yet only around a quarter (27%) have actually started purchasing — with the US notably ahead of the pack (39%). Consider launching mid-fall inspiration and gift-list campaigns.

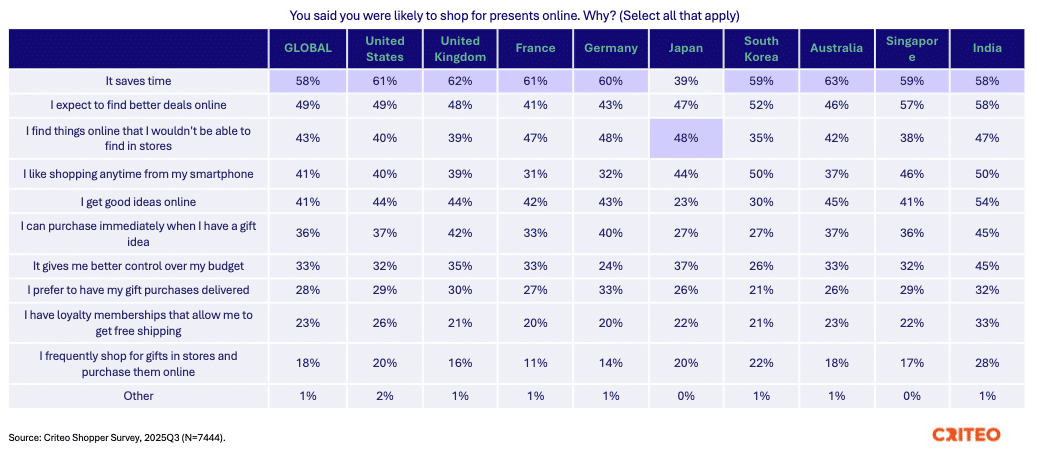

Online shopping remains the default because it saves time

Nearly three in four consumers say they’ll buy gifts online this season, and the top reason is simple: time. Shoppers also expect better deals and harder-to-find items online, which means your onsite selection, pricing, and delivery promises all have to pull their weight.

Search kicks off the journey — with AI now in the mix

The most common starting point for gift discovery is search engines, followed by retail and brand sites. This year, a notable share (20%) will open a generative AI tool to brainstorm ideas. Make sure your feeds and onsite content are AI- and SEO-ready so your products show up cleanly wherever the journey begins.

Deals drive both discovery and loyalty

Black Friday is still a multi-channel event, with strong intent to shop online and solid foot traffic, and the why remains the same: Great deals and free shipping tempt shoppers to try new stores, and great deals bring them back, too. Most people start scoping offers a few days to two weeks out, so front-load your teaser pricing and shipping perks.

October catalysts matter, and shoppers compare aggressively

October’s Prime Day has become a season starter for many, and the majority plan to compare those prices against other retailers. Treat it as an on-ramp: Entice “window shoppers” with list-save nudges and build an audience you can retarget into November.

Keep an eye on travel-adjacent demand

A meaningful share of consumers plan to travel over the end-of-year break, with domestic trips dominating. Expect steady demand for luggage, travel accessories, beauty minis, and giftable experiences well into December.

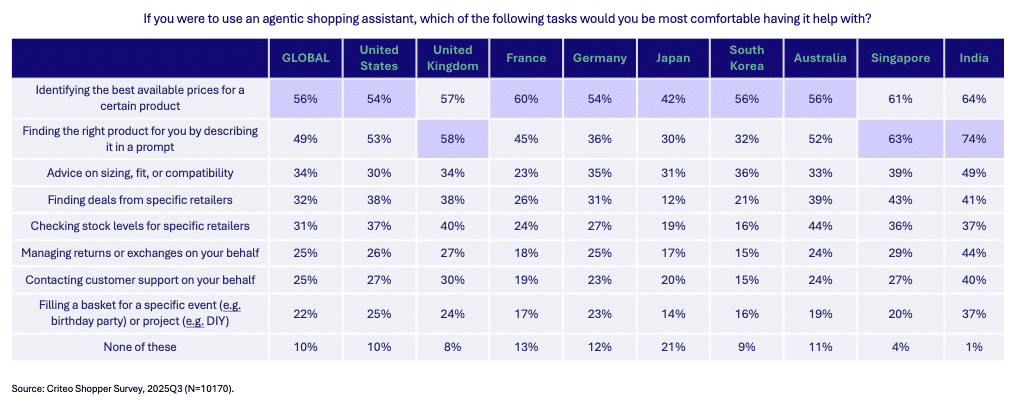

Bonus trend: AI shopping help is mainstreaming

Shoppers find AI most useful for comparing products and prices, many are open to agent-style assistants, and trust grows when assistants show side-by-side pricing and verified reviews. If you’re experimenting with AI assistants or chat, make transparency a feature, not a footnote.

What’s different this year

Compared to 2024, this season’s shoppers are signaling intent earlier but buying more selectively. Last year’s data showed steady growth in in-store activity and a wave of early planners in markets like the US and UK; this year, the balance tilts back online, driven by time savings and deal precision. October’s deal events have evolved from warm-up acts to major purchase triggers, pulling demand forward by weeks. AI tools are also moving from novelty to necessity in product discovery — a clear evolution from last year’s light experimentation. And while 2024’s growth story centered on “more of everything,” 2025’s is about optimization: tighter budgets, more comparison shopping, and a sharper focus on value, speed, and clarity.

How to win more holiday shoppers this season

- Lead with price clarity. Use dynamic price-compare creatives, strikethrough logic, and total-cost transparency (shipping, fees) to win the researchers who check multiple sites.

- Make onsite discovery faster. Elevate curated gift paths — by persona, price, and occasion — and surface verified reviews prominently to mirror what AI assistants and savvy shoppers look for.

- Treat shipping as a conversion lever. Free or fast shipping turns trial into purchase and repeat. Promote thresholds early, and add pickup options for late buyers.

- Invest in retail media for incremental reach. Shoppers try new stores during deal events. Meet them with high-intent placements across retailer sites, then retarget post-event with tailored offers.

- Plan an AI-friendly experience. Ensure structured product data, clean titles, and rich attributes so assistants (and shoppers) can compare specs, prices, and availability without friction.

Maximize Black Friday with strong deals and free shipping, and be sure to make your content AI-ready across search and assistants through the New Year. Put these insights to work now to deliver holiday shopping experiences that feel festive, personal, and memorable.