Earlier this year, we reported that travel was beginning to make an impressive return in Q1 as consumers around the world showed growing confidence due to declining COVID-19 infection rates and loosened travel restrictions in many countries.

Now in Q2, the travel industry’s comeback is continuing its momentum and, in some areas, is even accelerating. By analyzing data from more than 2,000 travel players in over 50 countries and the results from a travel survey of 11,000+ respondents across 11 countries, we uncovered the current state of global travel. Check out just some of what we learned about Q2’s global travel trends.

Summer travel intent is heating up a recovery

This summer is a big season for getaways. In our survey, 67% of travelers worldwide reported in May that they plan to travel at least once within the next three months.

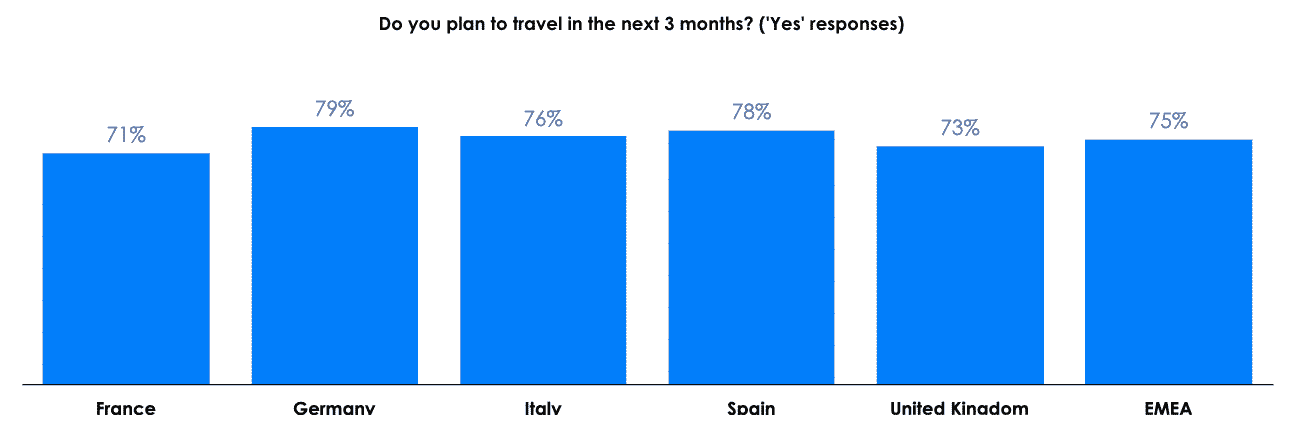

Let’s delve into the numbers by region:

Summer travel is especially strong in EMEA, as 3 in 4 travelers reported that they intend to travel at least once within the next three months.

Source: Travel survey, Q2 2022 base: All respondents EMEA n=5,576

Intent in APAC and the US is slightly lower, but still strong. In both regions, 3 in 5 travelers reported that they plan to go on at least one getaway within the next three months.

Those planning their summer getaways are getting ready by shopping for new travel gear. According to Criteo’s Commerce Trends Dashboard, which captures data from 22,000 retailers worldwide, online sales within several travel product categories increased year-over-year in Q2.

In the US, sales in the Luggage & Bags category jumped 21% during the last week of May 2022 compared to sales during the same week last year. Within the category, sales for specific products such as travel pillows (+17%), luggage straps (+17%), and travel pouches (+7%) all increased year-over-year, indicating stronger interest in travel accessories in the US.

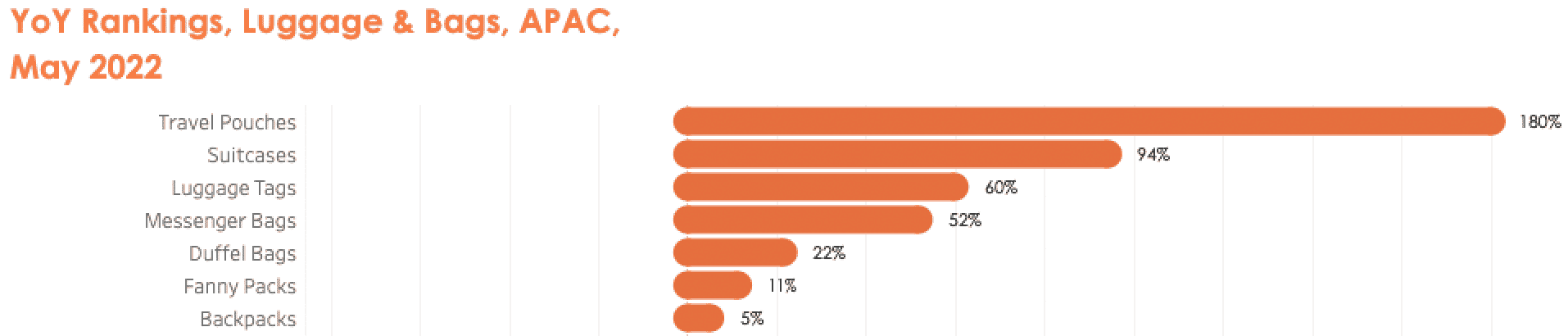

Q2 sales in the Luggage & Bags category also rose in APAC, showing a 9% YoY increase in May 2022. Year-on-year APAC sales for suitcases (+94%), travel pouches (+180%), and luggage tags (+60%) were particularly outstanding in this region.

Source: Criteo YoY Product Category Trends Dashboard, APAC, May 2022

Although overall Luggage & Bags sales decreased slightly in EMEA (-9% YoY), shopping for travel related products is still healthy in the region: EMEA sales for suitcases (+62%), travel pouches (+129%), and luggage covers (+37%) all increased YoY in May.

From bookings to site traffic, air travel reaches new heights

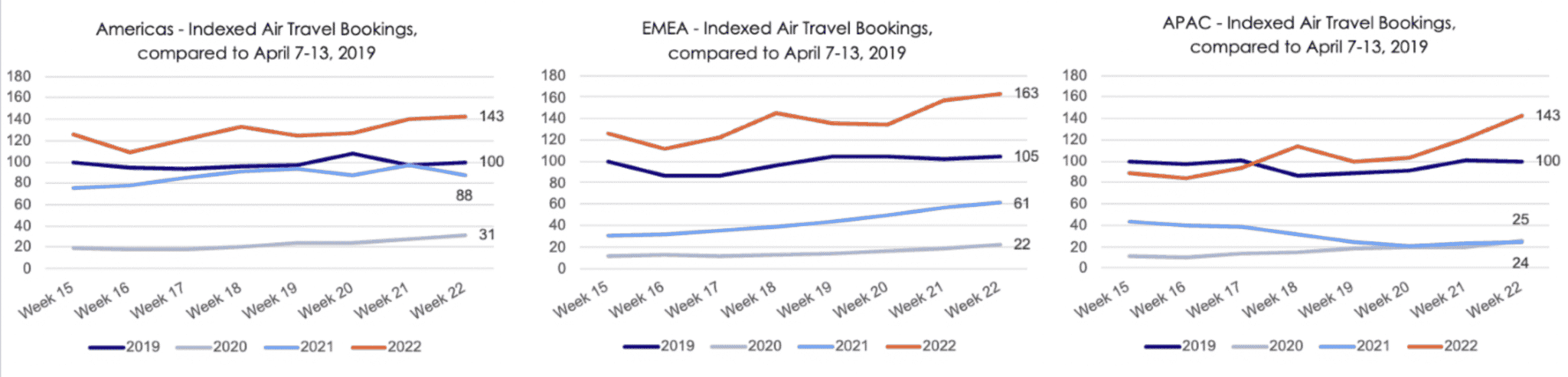

Following two years of declining air bookings, many travelers are now planning to travel by plane even more than they did before the pandemic. Our data shows that bookings for air travel surpassed 2019 levels in all major regions: Bookings jumped in EMEA (+55%), APAC (+43%), and the Americas (+43%) during the last week of May in 2022 when compared to the same week in 2019.

Source: Indexed Air Bookings compared to April 7-13, 2019 (pre-pandemic baseline). Americas, APAC, EMEA

Site traffic for air travel is also showing impressive growth worldwide, signifying that airline websites are an increasingly important touchpoint for consumers. In APAC, airline site traffic skyrocketed 176% during the last week of May versus the same week last year. Site traffic also jumped in EMEA and the US (+82% and +35% respectively) during the same window.

With air travel bookings exceeding pre-pandemic benchmarks and airline site traffic showing a strong YoY increase, the trends indicate that travelers are growing more comfortable with getting further away from home.

“Traditional” travel is making a return

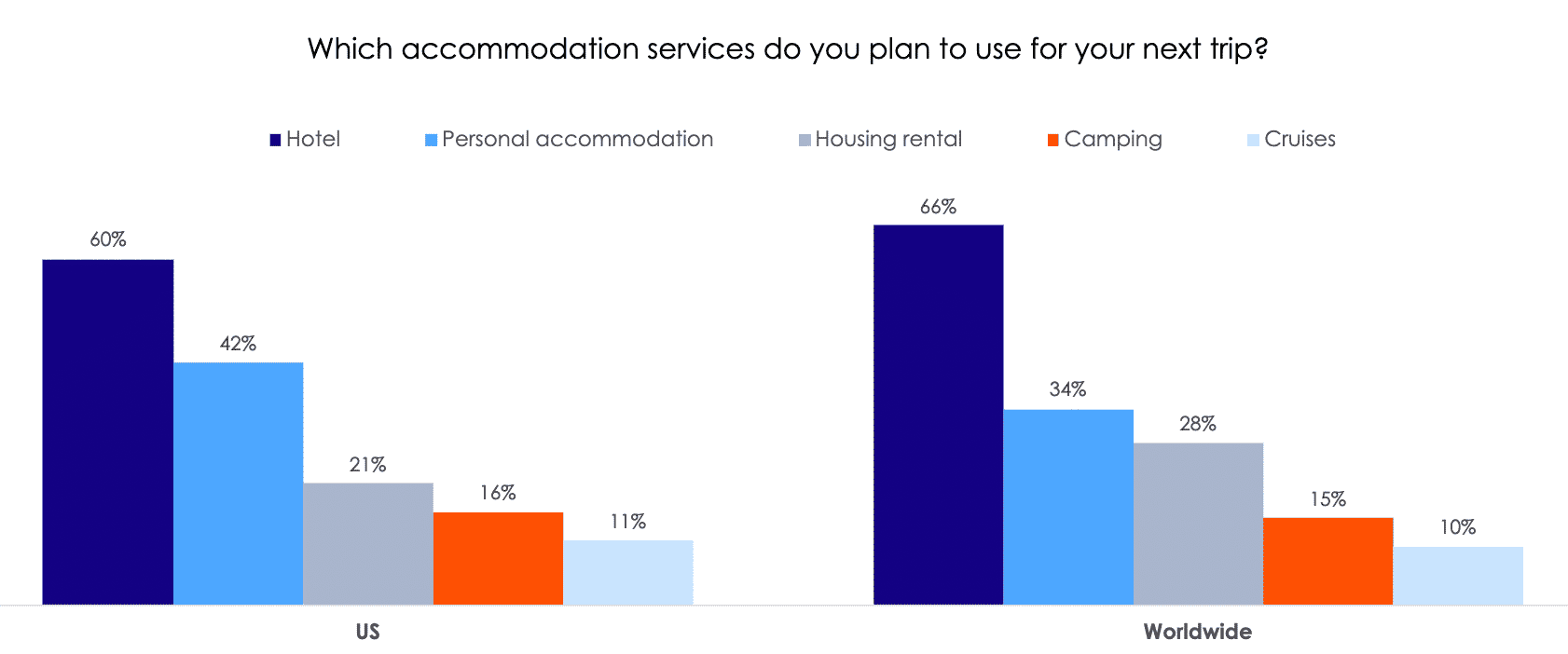

Around the world, travelers are beginning to favor “traditional” hotel accommodations over non-hotel rentals, pointing to a shift away from the stay-cation trend that rose in popularity earlier on in the pandemic.

A full 75% of APAC travelers, 59% of EMEA travelers, and 60% of US travelers reported that they plan to stay at a hotel during their next trip. Meanwhile, interest in housing rentals is now much lower, with 24% of APAC travelers, 33% of EMEA travelers, and 21% of US travelers planning to stay at a housing rental during their next trip.

Source: Travel survey, Q2 2022 base: All respondents US n=1150 / Worldwide n=11,822

Travelers favor domestic destinations as COVID-19 remains a concern

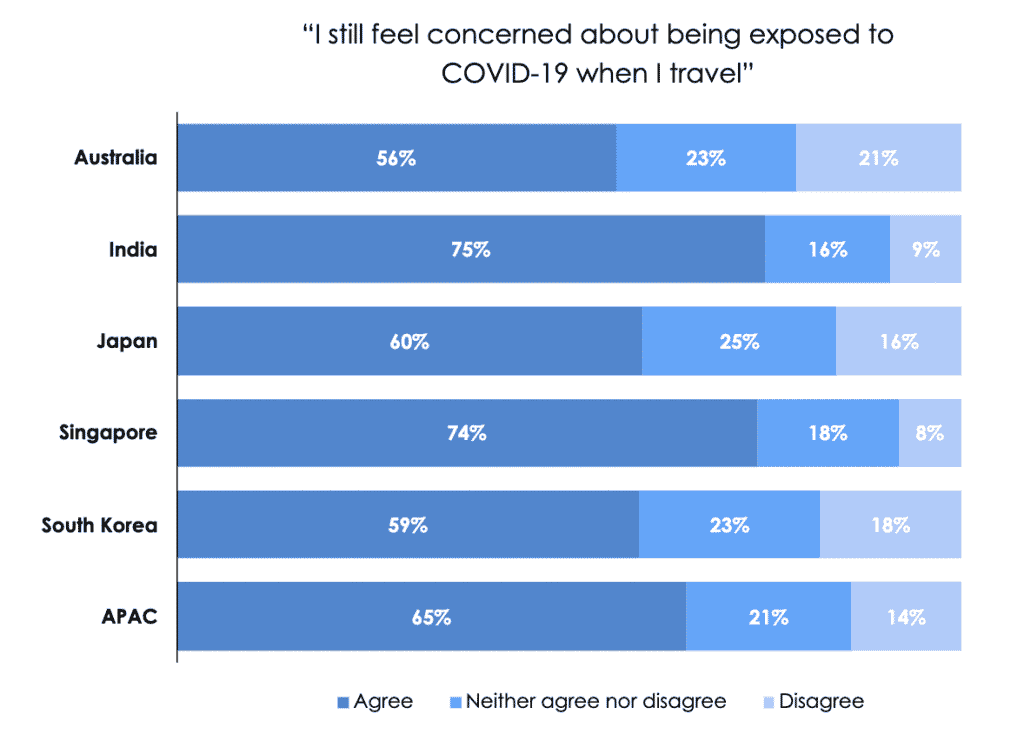

Despite growing comfortability with travel, people are still concerned about getting COVID-19 during their trips. Worldwide, 58% of travelers agree with the statement, “I still feel concerned about being exposed to COVID-19 when I travel.” This sentiment is the strongest in APAC where 65% of travelers in the region agree with the statement. Meanwhile, in the US 55% agree, and in EMEA 52% agree.

Source: Travel survey, Q2 2022 base: All respondents APAC n=5,082

Source: Travel survey, Q2 2022 base: All respondents APAC n=5,082

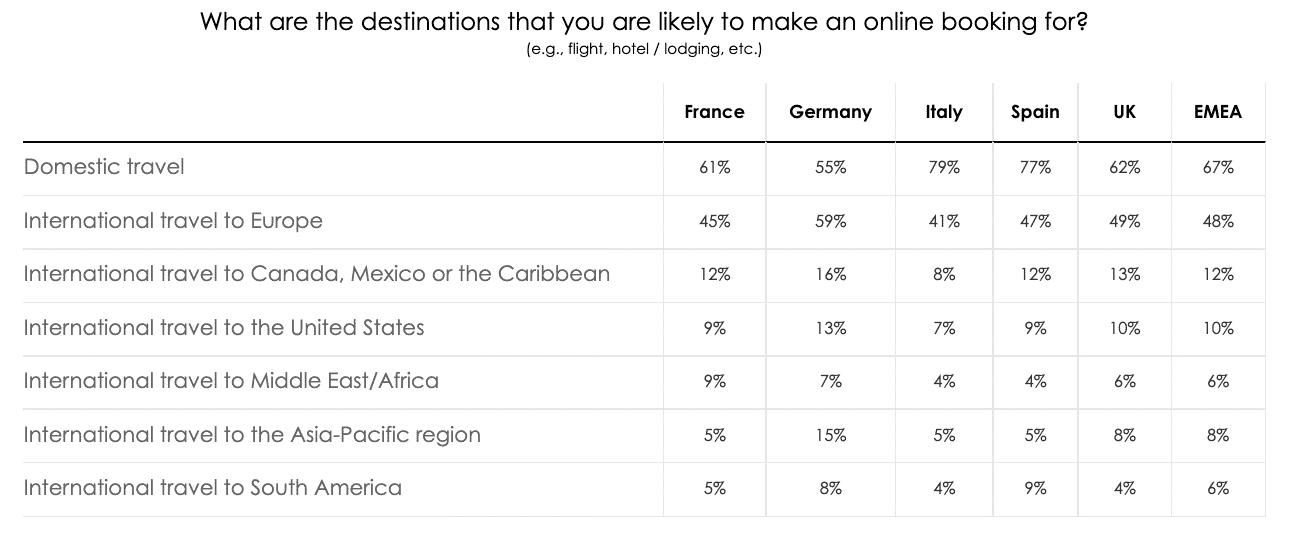

As COVID-19 related concerns persist, travelers show a preference for domestic destinations to reduce the complications that may come with international travel, including government travel restrictions and more potential for exposure. According to our survey, 70% of travelers worldwide favor domestic travel.

This preference is particularly strong in the US, where 86% of travelers shared that they’re likely to make an online booking for a domestic trip this year.

EMEA travelers are more confident about traveling beyond their country: 67% of EMEA travelers reported that they intend to travel domestically this year. Meanwhile, 48% shared that they plan to travel internationally within Europe this year.

Source: Travel survey, Q2, 2022, base: EMEA All respondents, n=5,576

Overall, the preference for domestic travel in APAC is also strong. 70% of travelers in this region reported that they’re most likely to travel domestically this year.

However, taking a closer look at APAC, country by country, shows a more diverse story. The preference for domestic travel is strong in most countries, such as Japan (90%), Australia (79%), and South Korea (75%). However, intent to travel domestically is relatively low in Singapore. Only 33% of Singaporean travelers plan to travel domestically, while 70% plan to travel internationally within the Asia-Pacific region.

Want more travel insights?

The travel industry was initially devastated by the pandemic, leaving worried advertisers racing with concerns about when and how the category would recover. However, global Q2 travel trends point to a recovering category that is now booming with opportunities for advertisers to meaningfully connect with travelers.

As consumer sentiments, preferences, and shopping journeys within the travel industry continue to evolve, advertisers can prepare for further category growth by leveraging high-quality data across their full-funnel growth strategies. With Criteo’s Commerce Media Platform, which includes robust audience targeting solutions, advertisers can access the largest commerce dataset on the open internet to strategically identify, engage, and convert high-value customers and achieve their business goals.

To keep up with the latest global travel data, visit Criteo’s Seasonal Travel Dashboard and Commerce Trends Dashboard.