What does the new normal look like? What are the new routines and values that guide consumers? How are markets being reshaped by a world-changing phenomenon?

As social distancing becomes the standard after the COVID-19 pandemic, consumers are adapting their behavior to a new reality. An important success factor in the advertising business is our capacity to anticipate changes in consumers’ behavior and set up relevant long-term strategies that accelerate the recovery of heavily affected industries.

Criteo data shows significant increases across a wide range of product categories in recent weeks, including food products, home office gear, consumer electronics, and pet supplies.

In this article, we’ll recap some of the emerging patterns we and other researchers have noticed recently, alongside an analysis into their potential implications for various markets.

Let’s review a few recent trends in the context of a new normal:

1. Consumers are spending more time viewing media – especially online video.

Video consumption has skyrocketed during the crisis and is expected to stay strong in the post-COVID era.

Gen Zers have demonstrated the largest increase in media consumption, with 58 percent of them reporting greater use of social media during the coronavirus pandemic according to research by GlobalWebIndex.

Consumers are filming themselves and uploading to social networks like Instagram and TikTok. Brands now have a unique opportunity to reach younger audiences with fewer distractions through video content that emphasizes authenticity over high production values.

2. There’s a feeling of economic insecurity, leading to price sensitivity.

A new outlook on economic assets is causing many shoppers to focus on:

- Deal seeking, i.e. looking for promotions and offers

- Cutting back on non-essentials (e.g. High-end/Luxury Goods)

- Cheaper brands, local brands, or private labels

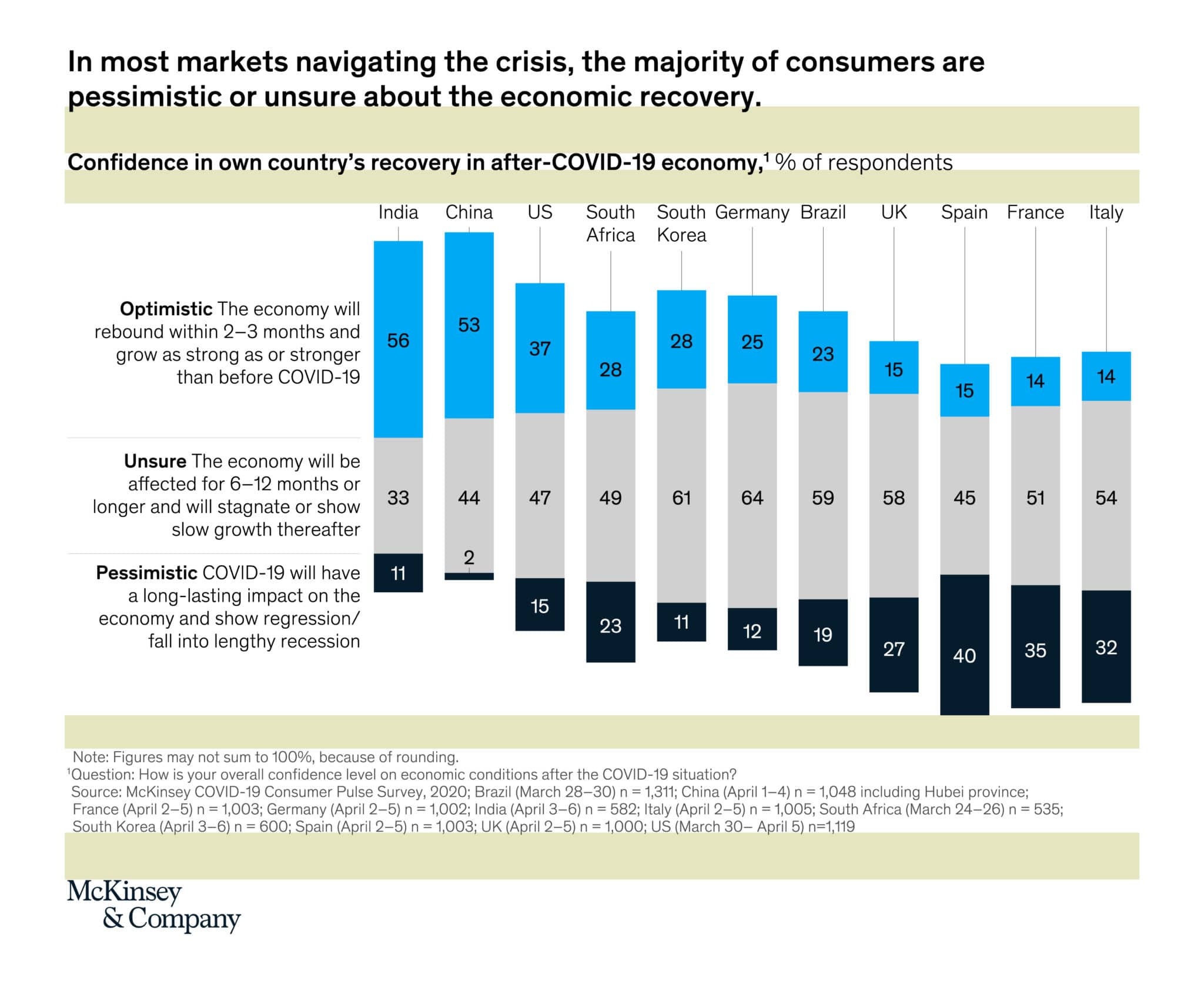

McKinsey & Company noted in an April analysis that two-thirds of consumers globally are unsure and less optimistic about the long-term effects of this pandemic. Even among those that maintain a positive outlook on economic recovery, cautious spending is the preferred approach for the coming weeks.

3. A “Maintain” mentality is more prevalent than a “Gain/Grow” mentality right now.

Experimenting with new products or services is not a natural human reaction in a time of insecurity. Individuals are transitioning from the previous “gain” mentality where everything was permitted and curiously explored, to a “secure the field and maintain assets” position.

According to Simon Moore, CEO of Innovation Bubble, a behavioral science company, now is not the time to launch new products or services, but rather to improve existing client services and remove inconveniences that could turn off anxious customers or audiences that have tried your offer for the first time because of COVID-19.

4. Consumers appreciate brands that focus on their needs during this difficult time.

In a study conducted this April by Intelligence Central, 58% of consumers are impressed by brands providing a necessary service, and 55% say they value brands that have made changes to help consumers. This includes brands helping communities as well as individuals – 58% value responsible messaging, 54% value charitable contributions by brands, and half of all consumers value brands that are addressing coronavirus concerns.

In 2020, many brands have shifted their communications to cover sustainability, community aid, and support. Examples of topics they’re addressing today include:

- A sense of purpose and solidarity that shows the brand cares about more than revenue

- How they’ve helped the community, since consumers value charitable actions by brands

- What they are doing to address COVID-19 concerns

- How the brand can be useful to consumers in unexpected ways

Brands whose personalities touch on the cheeky side have understandably shifted to be sensitive during this time. Getting the tone right is crucial, as is communicating how a brand can be helpful in daily life. Along those same lines, many consumers believe brands shouldn’t “exploit” COVID-19 as a commercial opportunity.

5. While consumers see ridesharing is as risky, there are big opportunities for automotive.

It’s expected that many consumers will avoid public transportation and ridesharing following the crisis, as they either intend to use their vehicle more often or acquire a personal mode of transportation (car, scooter, bikes) after the restrictions are lifted.

According to an IBM study in May, in the United States, more than 17% of people surveyed said that they intend to use their vehicle more as a result of COVID-19, with approximately 1 in 4 saying they will use it as their exclusive mode of transportation going forward. One-third of respondents said that “constraints on their finances” will have a significant impact on their decision to buy a vehicle once COVID-19 is over.

6. Many consumers are likely to avoid large crowds in the months ahead.

According to the same IBM study, conferences and trade shows are going to be highly impacted during the new normal: 75% of respondents indicated that they are unlikely to attend one of these events in 2020. However, bars and restaurants are on track to recover in the next few months. In the study, IBM also explains:

“More than one-third of consumers indicated they will visit these establishments, with only about 10% saying they will not. Outdoor parks also represent a favored destination; one-third of respondents said they are very likely to visit an outdoor park after restrictions are lifted. Approximately 25% of consumers also indicated they will be ready to visit the beach and 1 in 5 will be ready to go shopping at malls and shopping centers.”

7. Consumers are seeking contact-less retail.

Players that propose contactless payments as well as other services that deliver payments instantly via your phone or other mobile devices are the partner of choice for the 2020 shopper who wants to avoid handling their wallet.

In the IBM study, 40% of consumers said they are likely to use contactless payment moving forward.

8. The pandemic has created a priority on shopping local.

Proximity, product origin, and stock availability are now key for shoppers no longer willing to venture far to get their favorites. In a time when many consumers are trying to avoid crowds when possible, promotions and deep discounts aren’t enough to drive foot traffic to previously frequented stores.

According to the IBM study, 25% of U.S. respondents indicated they are now shopping more often at locally owned stores and buying more locally made, grown, or sourced products.

9. Consumer attitudes toward healthy lifestyles have evolved.

In the wake of COVID-19, consumers are re-evaluating their priorities, lifestyles, and values, looking to improve how they manage their own health and wellness.

A McKinsey & Company study of Chinese consumers backs the trend, noting that “…some of the themes created during the crisis, such as at-home sports training (offered by several sports apparel brands), may continue to be valuable. This would reflect many people’s plans after the outbreak to keep themselves fit and healthy.”

10. New users are one driver of ecommerce growth.

Early lessons from China suggest that at least 3-6% of online marketshare will be driven by older generations who are now comfortable with digital channels and by new consumer segments who have overcome barriers to trial (such as account setup), according to McKinsey & Co.

For many product categories, ecommerce has become an even more important channel as stores have closed or reduced their physical presence. For the post-COVID era, this shift is expected to continue, especially in countries where retailers had enough existing capability to offer a positive online experience.

It’s expected that consumers of all ages will continue to appreciate the perceived “safer” experience of shopping online, as opposed to crowded stores.

For more insights, visit our Coronavirus Impact Dashboard here.