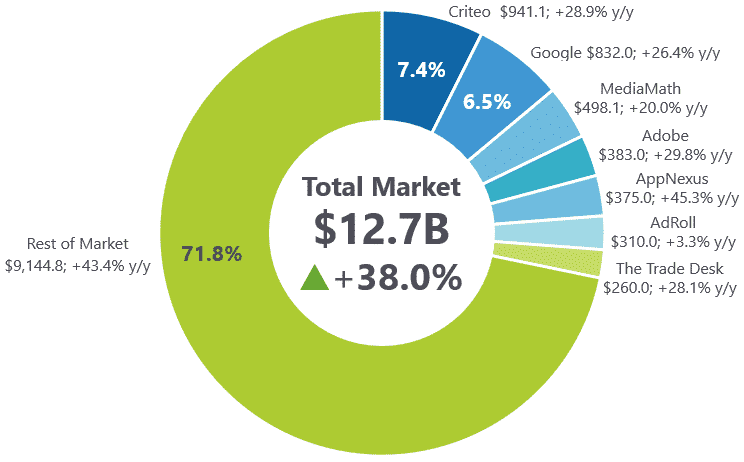

On the 7thSeptember 2018, industry analyst Karsten Weide (@KarstenW) at IDC published a market share report titled Worldwide Digital Advertising Software Market Shares, 2017: Despite Intense M&A Activity, Ad Tech Still a Fragmented Market (DOC #US44240218).

Who’s the number one for market share in this space?

Criteo.

According to the author Karsten Weide, IDC’s Program Vice President, Digital Media and Entertainment (@karstenw):

“Criteo came out as a market leader in our first ever analysis of advertising technology vendors. This is mostly due to the strong position they have built in retargeting over the past 13 years, and they have become an end-to-end player by offering other solutions as well for both brands and publishers.”

Key trends detailed in the report

- The digital advertising software segment is very fragmented with the top 15 vendors represent not even 40% of the market despite the ongoing intense merger and acquisition activity

- The overall market for advertising software grew at 38% year on year, from $9.2 billion in 2016 to $12.7 billion in 2017

- AdTech sales (ex-TAC) represent 4.7% of ad spend in 2017, up from 4.0% in 2016 ; IDC forecasts this to grow to 7.8% by 2022 thanks to ad spend growth (+19% CY16/CY17) and automation continues pushing a transition from traditional TV advertising to digital video advertising, specifically connected TV advertising

Listen to the on-demand webinar

Check the fireside conversation between Karsten Weide / Programme Vice President Media & Entertainment, IDC and Jen Whelan / SVP Marketing, Criteo on future trends for AdTech. Click on the image to view it.