So far in 2024, the global travel industry is seeing a significant resurgence, accompanied by a noticeable trend: People are becoming more skilled at planning their trips and are mastering the art of travel.

Equipped with a wealth of online tools, these travelers are tailoring their itineraries to ensure enriching experiences at maximum value. Resources like AI assistants to one-stop-shop booking platforms empower travelers to curate highly personalized getaways.

To understand the state of global travel in 2024, we analyzed Criteo’s dataset from hundreds of travel players and results from a survey of 10,000+ travelers globally. These are the trends that will help advertisers adapt to this year’s evolving landscape.

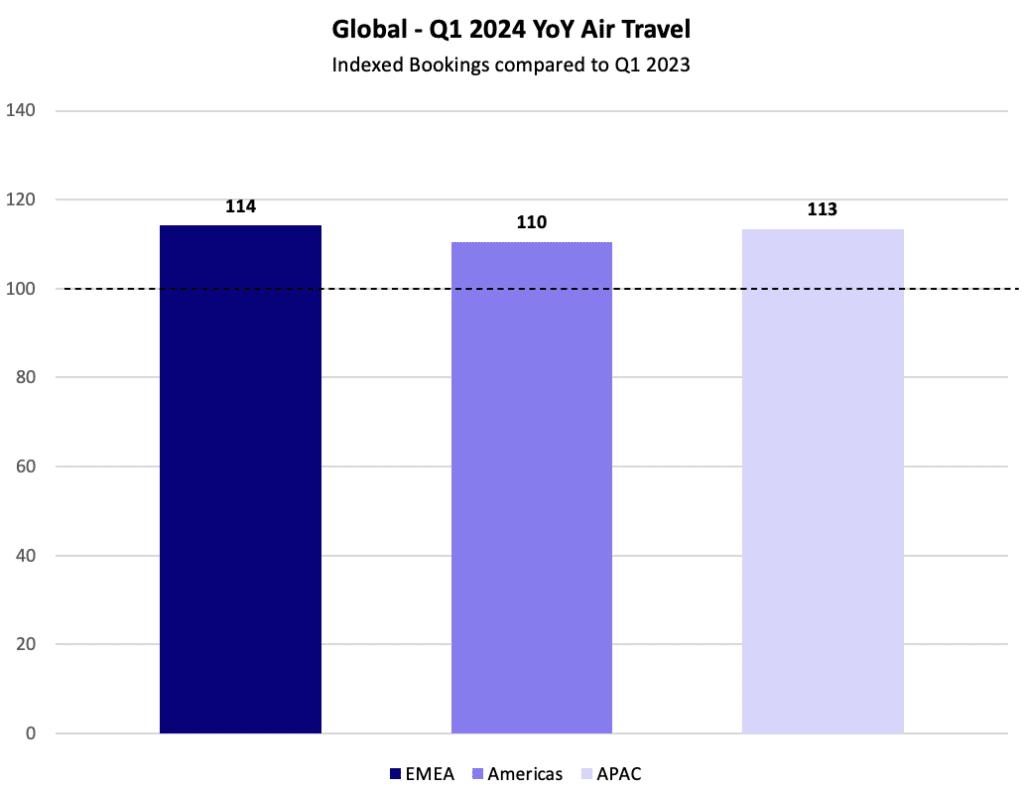

1. People are surfing the travel surge.

Across all major regions, bookings for air travel soared by double digits year-over-year during the first quarter of 2024, signaling a robust boost in travel for the upcoming months. Air bookings rose +14% in EMEA, +13% in APAC, and +10% in the Americas YoY.

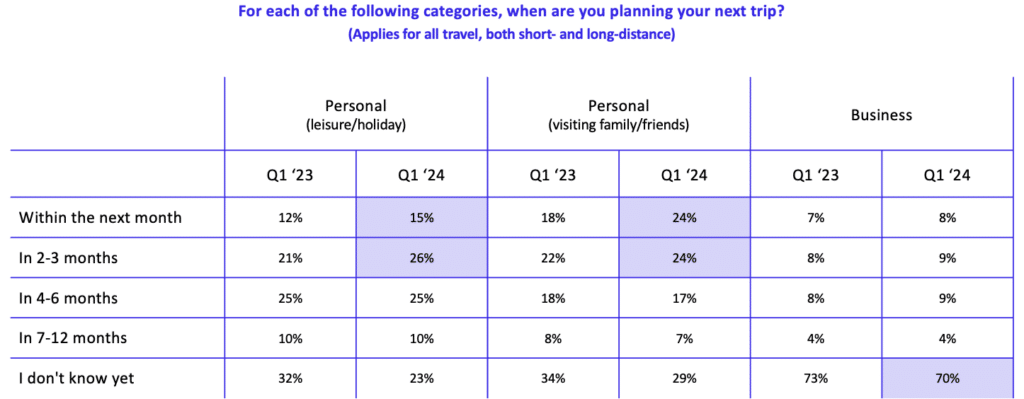

Anticipate a surge in personal getaways this spring and early summer. According to Criteo’s survey, more people around the world plan to travel for leisure or visit friends/family in the next 1-3 months.

2. AI and booking sites offer algorithmic adventures.

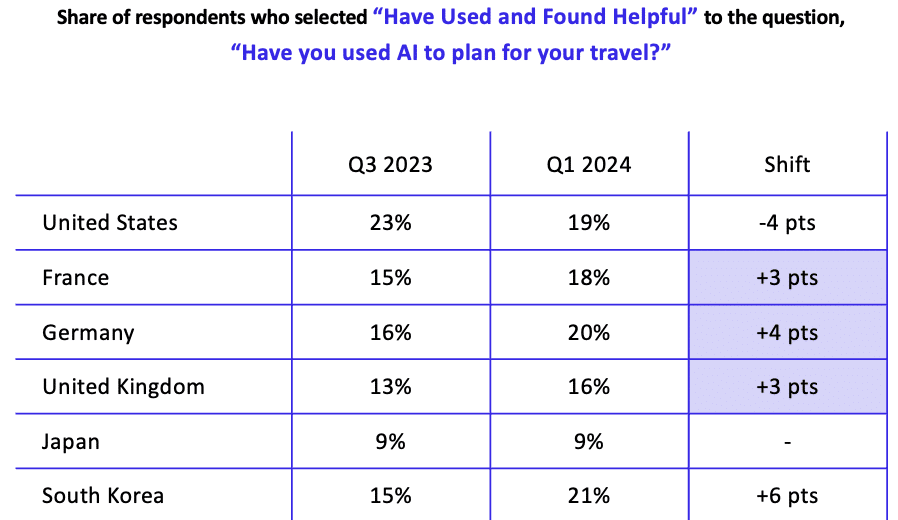

In the past 6 months, more travelers are finding AI tools useful for recommendations—especially for dining experiences, accommodations, and activities. This shift is the strongest among travelers in South Korea, with a 6-point growth when comparing Q3 2023 and Q1 2024.

The adoption of AI tools by travelers is also gaining momentum in Europe. More travelers in Germany (+4 points), France (+4 points), and the UK (+3 points) said they found AI tools useful over the same period.

Throughout the online booking journey, travelers are also open to suggestions from travel providers. Half of travelers around the world (48%) get inspiration from travel booking sites.

3. People value personal travel advice.

While assistance from AI and travel booking websites influence the planning journey, travelers still prefer word-of-mouth suggestions. A full 61% of travelers globally said that recommendations from family and friends is a strong decision-making factor. Over one-third of people globally also find inspiration from personal travel content sites like blogs.

Positive reviews are another highly influential factor and are gaining traction. When choosing a travel provider, two-thirds of travelers globally consider positive reviews. This was up 8 points in Q1 2024 compared to in Q3 2023.

4. Travelers are finding ways to adapt to rising costs.

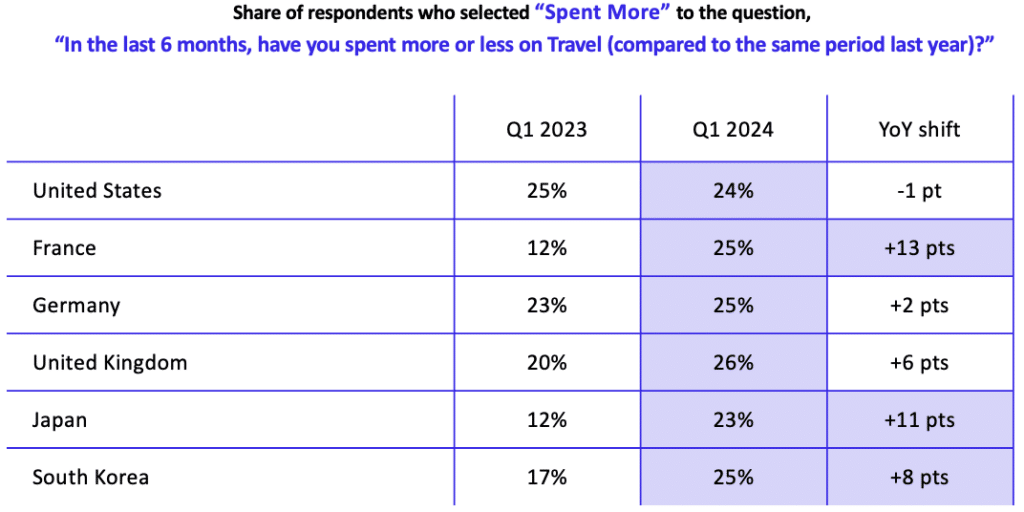

In Q1 2024, 25% of travelers around the world said they spent more on travel within the last six months compared to the same period a year prior.

Rising costs were felt most by travelers in France (+13 points), Japan (+11 points), and South Korea (+8 points).

To secure better travel deals, 38% of people globally said they have or would consider changing the timing of their trips. This trend is even more pronounced among travelers in Japan, where 52% are open to adopting this strategy.

One in four travelers worldwide also plan to save money by engaging in fewer activities and opting for more affordable dining experiences. A third of US travelers will also leverage rewards from loyalty programs.

While many travelers aim to cut costs, a growing portion are embracing higher expenditures. A striking 75% of those who spent more on travel in the last six months also splurged on non-essential costs like luxury goods, dining out, health and beauty products, and apparel and accessories.

5. Booking everything from one source offers convenience.

Half of travelers compare multiple (3+) travel providers in search of the best deals.

However, many people prefer to book all travel services from a single source for added convenience and ease of coordination. Three in five travelers globally booked all aspects of their most recent trip—such as flights, hotels, rental cars, and activities—through a single platform, website, app, or provider.

6. Mobile helps travelers embrace their spontaneity.

Travelers enjoy having the freedom to make spur of the moment decisions. Nearly 1in 5 opt to leave some bookings for mid-trip. US travelers lead in flexibility, with 77% stating they booked most aspects of their trip right before departure.

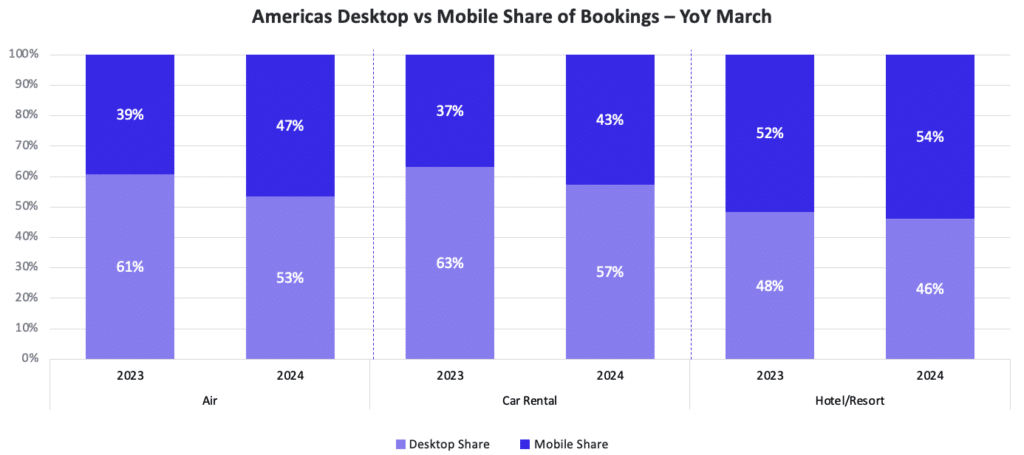

Booking while on-the-go is also popular. In the Americas and EMEA, the share of air travel bookings completed on mobile devices increased by 8 points in March 2023 compared to March 2024. Similarly, there was a 6-point increase in APAC.

Source: Organic Criteo Data. Americas Travel Partners. Comparing March Bookings in 2023 vs 2024. Desktop and Mobile included, App and Tablet included in Mobile, sample permitting.

Embark on your advertising odyssey

Capturing the attention of travelers demands a highly personalized approach. By crafting ads that directly address their needs and interests—like discounts, loyalty rewards, destination ideas, and activity recommendations—advertisers can boost engagement and bookings.

Given that travelers explore multiple options before making a purchase, a retargeting strategy also helps keeps users engaged until they decide where to go and what they want to experience on their next trip. Meanwhile, retention campaigns can encourage stronger lifetime value as existing travel customers tend to have higher spend compared to first-time buyers.

For more global travel trends, read our full report, Travel Insights: Unpacking the Landscape of the Escape Industry and register for immediate access to our on-demand webinar.