Q4 Revenue ex-TAC and Adjusted EBITDA Above Top End of Guidance

Company Targeting Low to Mid Single Digit Growth in Fiscal 2021

Announces a $100 Million Share Repurchase Authorization

NEW YORK – February 10, 2021 – Criteo S.A. (NASDAQ: CRTO), the global technology company powering the world’s marketers with trusted and impactful advertising, today announced financial results for the fourth quarter and fiscal year ended December 31, 2020 that exceeded the top end of its most recent quarterly guidance.

Fourth Quarter and Fiscal Year 2020 Financial Highlights:

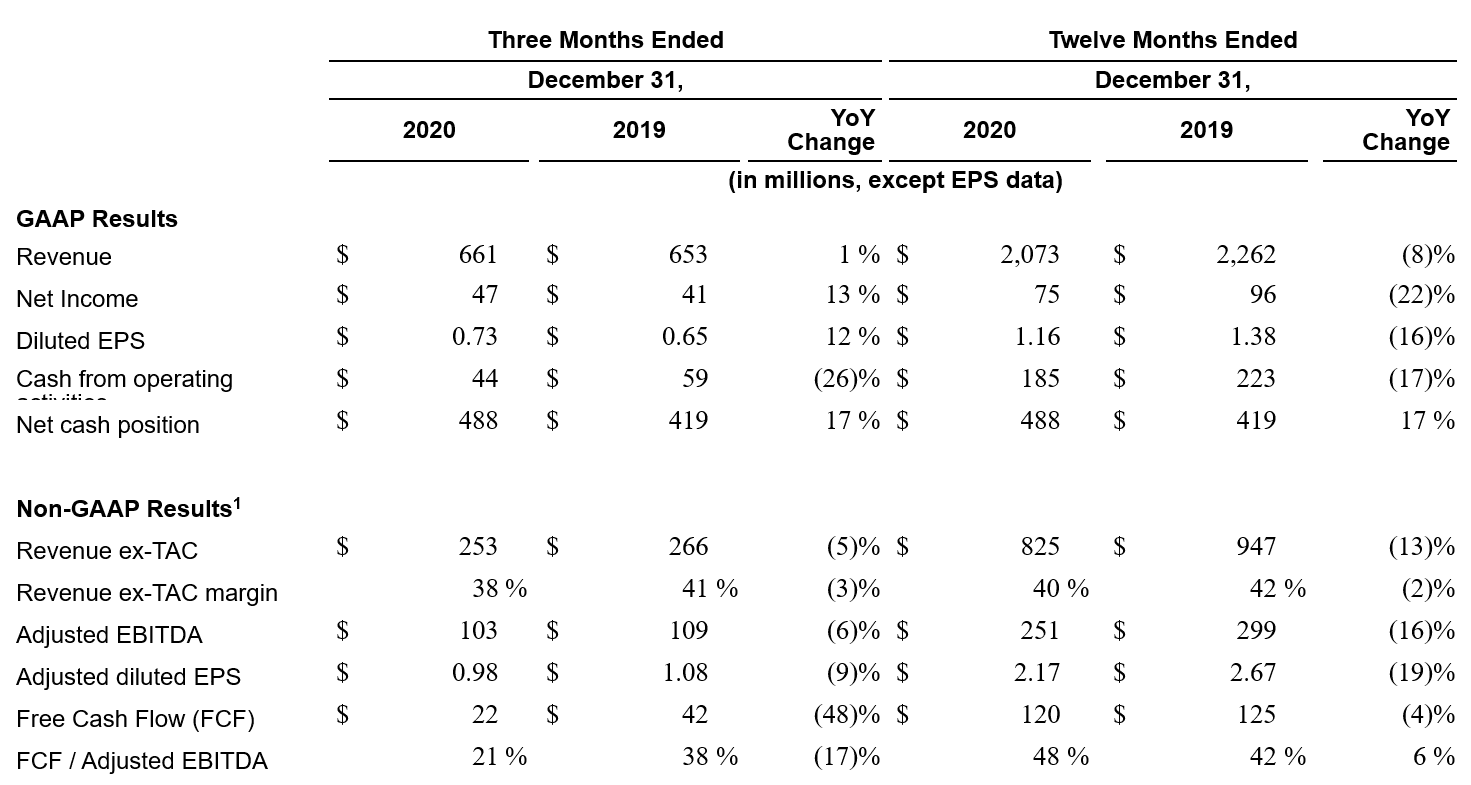

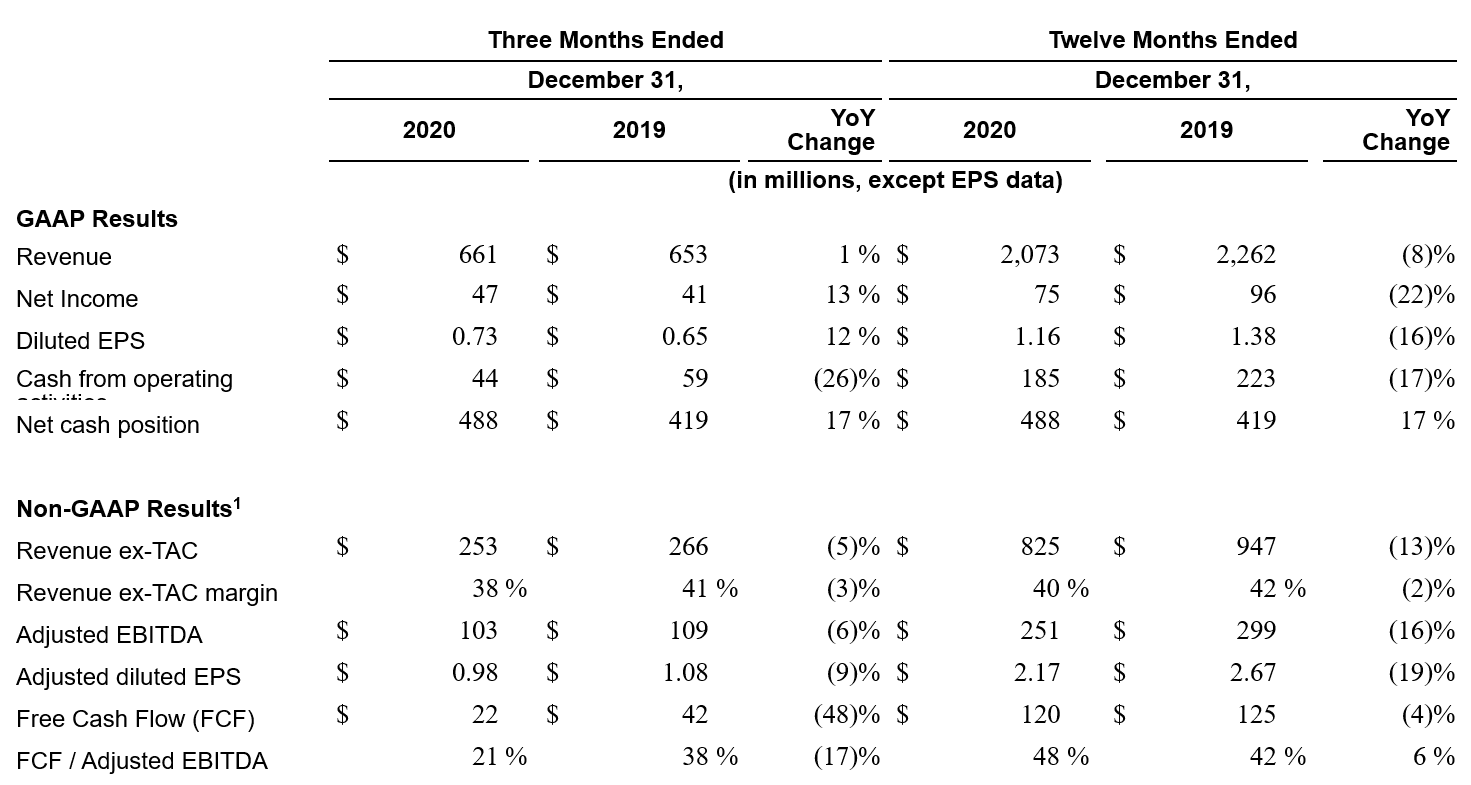

The following table summarizes our consolidated financial results for the three months and twelve months ended December 31, 2020 and 2019:

Megan Clarken, Chief Executive Officer of Criteo, said, “I am proud of how much we achieved in 2020. We made multiple structural changes across the company that we believe has set Criteo up for sustainable profitable growth and led to significant over-performance of guidance during Q4.”

Clarken continued: “We believe that our transformation into a Commerce Media Platform, building on our unique Commerce data and Reach assets and purpose-built marketing and monetization capabilities, positions us for durable growth and long-term shareholder value.”

Q4 2020 Operating Highlights

- Total clients grew 6% year-over-year to 21,460 after adding close to 900 net new clients, the highest level for over three years (since Q3 2017).

- Same-client revenue2 increased 7% year-over-year (vs. a 6% decline in Q3 2020) and same-client Revenue ex-TAC2 decreased 1% year-over-year (vs. 11% decline in Q3 2020) at constant currency3, including approximately 11 points directly attributable to the COVID-19 disruption on both metrics.

- New solutions grew 38% year-over-year to 24% of total Revenue ex-TAC.

- Retail Media grew 41% year-over-year, and same-client Revenue for Retail Media increased 72% year-over-year (69% on a same-client Revenue ex-TAC basis).

- Pacvue integrated with Retail Media’s Sponsored Products ads, through the Retail Media API, on Target’s website and app.

Financial Summary

Revenue for the quarter was $661 million and Revenue ex-TAC was $253 million. Q4 2020 Adjusted EBITDA was $103 million, resulting in an adjusted diluted EPS of $0.98. At constant currency, Q4 2020 Revenue was flat and Revenue ex-TAC declined by 6%, largely due to continued and anticipated negative COVID impact. Excluding the estimated $26 million impact of the pandemic, we estimate that Revenue ex-TAC increased about 3% in Q4 2020. Revenue for the fiscal year 2020 was $2,073 million and Revenue ex-TAC was $825 million, declining by 8% and 13% respectively at constant currency. FY 2020 Adjusted EBITDA was $251 million, resulting in an adjusted diluted EPS of $2.17. Free cash flow was $22 million in Q4 2020 and $120 million for the fiscal year 2020, down only 4% year-over-year. Free cash flow conversion of 48% of Adjusted EBITDA in fiscal year 2020 was the highest level since 2014. We had $488 million in cash on our balance sheet at fiscal year-end.

Sarah Glickman, Chief Financial Officer, said, “Solid execution across the board, in particular in our core business and new solutions, allowed us to beat the high-end of our most recent top line guidance by 10% in Q4. Our focus now is to drive growth across the business while balancing smart investments with a more efficient organization.”

Revenue and Revenue ex-TAC

Q4 2020

Revenue increased by 1% year-over-year, or was flat at constant currency, to $661 million (Q4 2019: $653 million), after an estimated $68 million net negative business impact from the COVID-19 disruption, or approximately 10 points of the year-over-over decline at constant currency. Revenue ex-TAC decreased 5% year-over-year, or 6% at constant currency, to $253 million (Q4 2019: $266 million), after an approximately $26 million net negative business impact from the COVID-19 disruption, or approximately 10 points of the year-over-over decline at constant currency. Strong performance of our retargeting product during an extended shopping season, sustained growth of our Retail Media business, and continued growth of our Audience Targeting and Omnichannel solutions were offset by the COVID-19 pandemic impact, which we consider as retail bankruptcies and softness with our Travel and Classifieds clients. Revenue ex-TAC as a percentage of revenue, or Revenue ex-TAC margin, was 38% (Q4 2019: 41%).

- In the Americas, Revenue increased 2% year-over-year, or 3% at constant currency, to $313 million and represented 47% of total Revenue. Revenue ex-TAC declined 7% year-over-year, or 5% at constant currency, to $109 million and represented 43% of total Revenue ex-TAC.

- In EMEA, Revenue increased 7% year-over-year, or 3% at constant currency, to $232 million and represented 35% of total Revenue. Revenue ex-TAC increased 3% year-over-year, or decreased 1% at constant currency, to $95 million and represented 38% of total Revenue ex-TAC.

- In Asia-Pacific, Revenue declined 10% year-over-year, or 14% at constant currency, to $116 million and represented 18% of total Revenue. Revenue ex-TAC declined 15% year-over-year, or 18% at constant currency, to $49 million and represented 19% of total Revenue ex-TAC.

Fiscal Year 2020

Revenue declined 8% year-over-year (8% at constant currency), to $2,073 million (FY 2019: $2,262 million), after an estimated $266 million net negative business impact from the COVID-19 disruption, or approximately 12 points of the year-over-over decline at constant currency. Revenue ex-TAC decreased 13% year-over-year (13% at constant currency), to $825 million (FY 2019: $947 million), after an approximately $106 million net negative business impact from the COVID-19 disruption, or approximately 11 points of the year-over-over decline at constant currency. Growth in our midmarket business and increased adoption of new solutions, in particular Retail Media and our Audience Targeting solutions, were offset by the decline in our core business with large clients, primarily as a result of the COVID-19 pandemic impact, which we consider as retail bankruptcies and softness with our Travel and Classifieds clients. Revenue ex-TAC as a percentage of revenue, or Revenue ex-TAC margin, was 40% (FY 2019: 42%).

- In the Americas, Revenue declined 6% year-over-year, or 5% at constant currency, to $895 million and represented 43% of total Revenue. Revenue ex-TAC declined 13% year-over-year, or 11% at constant currency, to $325 million and represented 39% of total Revenue ex-TAC.

- In EMEA, Revenue declined 7% year-over-year, or 8% at constant currency, to $750 million and represented 36% of total Revenue. Revenue ex-TAC declined 10% year-over-year, or 11% at constant currency, to $316 million and represented 38% of total Revenue ex-TAC.

- In Asia-Pacific, Revenue declined 15% year-over-year, or 16% at constant currency, to $428 million and represented 21% of total Revenue. Revenue ex-TAC declined 17% year-over-year, or 18% at constant currency, to $183 million and represented 23% of total Revenue ex-TAC.

Net Income and Adjusted Net Income

Q4 2020

Net income increased 13% year-over-year to $47 million (Q4 2019: $41 million). Net income margin as a percentage of revenue was 7% (Q4 2019: 6%). In the fourth quarter 2020, we incurred $4 million in restructuring related and transformation costs. Net income available to shareholders of Criteo S.A. increased 8% year-over-year to $45 million, or $0.73 per share on a diluted basis (Q4 2019: $42 million, or $0.65 per share on a diluted basis).

Adjusted Net Income, or net income adjusted to eliminate the impact of equity awards compensation expense, amortization of acquisition-related intangible assets, acquisition-related costs and deferred price consideration, restructuring related and transformation costs and the tax impact of these adjustments, decreased 12% year-over-year to $61 million, or $0.98 per share on a diluted basis (FY 2019: $70 million, or $1.08 per share on a diluted basis).

Fiscal Year 2020

Net income decreased 22% year-over-year to $75 million (FY 2019: $96 million). Net income margin as a percentage of revenue was 4% (FY 2019: 4%). In the course of the fiscal year 2020, we incurred $20 million in restructuring related and transformation costs. Net income available to shareholders of Criteo S.A. decreased 21% year-over-year to $72 million, or $1.16 per share on a diluted basis (FY 2019: $91 million, or $1.38 per share on a diluted basis).

Adjusted Net Income decreased 24% year-over-year to $134 million, or $2.17 per share on a diluted basis (FY 2019: $175 million, or $2.67 per share on a diluted basis).

Adjusted EBITDA and Operating Expenses

Q4 2020

Adjusted EBITDA decreased 6% year-over-year, or 9% at constant currency, to $103 million (Q4 2019: $109 million), driven by the Revenue ex-TAC performance over the period, including the still meaningful impact of the COVID-19 pandemic, partly offset by effective cost discipline, including in lower headcount and the optimization of real estate footprint. Adjusted EBITDA as a percentage of Revenue ex-TAC, or Adjusted EBITDA margin, was 41% (Q4 2019: 41%).

Operating expenses decreased 14% or $25 million, to $151 million (Q4 2019: $176 million), mostly driven by lower headcount-related expense and disciplined expense management across the Company. Operating expenses, excluding the impact of equity awards compensation expense, pension costs, restructuring related and transformation costs, depreciation and amortization and acquisition-related costs and deferred price consideration, which we refer to as Non-GAAP Operating Expenses, decreased 6% or $8 million, to $130 million (Q4 2019: $138 million), largely driven by lower headcount and effective cost discipline across the Company.

Fiscal Year 2020

Adjusted EBITDA decreased 16% year-over-year, or 17% at constant currency, to $251 million (FY 2019: $299 million), driven by the Revenue ex-TAC performance over the period, including the still meaningful impact of the COVID-19 pandemic, partly offset by effective cost discipline, including in lower headcount and the optimization of real estate footprint. Adjusted EBITDA as a percentage of Revenue ex-TAC, or Adjusted EBITDA margin, was 30% (FY 2019: 32%).

Operating expenses decreased 16% or $109 million, to $579 million (FY 2019: $688 million), mostly driven by lower headcount-related expense and disciplined expense management across the Company. Non-GAAP Operating Expenses decreased 14% or $82 million, to $493 million (FY 2019: $575 million), largely driven by lower headcount and effective cost discipline across the Company.

Cash Flow, Cash and Financial Liquidity Position

Q4 2020

Cash flow from operating activities decreased 26% year-over-year to $44 million (Q4 2019: $59 million).

Free Cash Flow, defined as cash flow from operating activities less acquisition of intangible assets, property, plant and equipment and change in accounts payable related to intangible assets, property, plant and equipment, decreased 48% to $22 million (Q4 2019: $42 million), or 21% of Adjusted EBITDA (Q4 2019: 38%), due to the Adjusted EBITDA decline over the period and negative changes in payables relating to capital expenditures.

Fiscal Year 2020

Cash flow from operating activities decreased 17% year-over-year to $185 million (FY 2019: $223 million).

Free Cash Flow decreased only 4% to $120 million (FY 2019: $125 million), representing 48% of Adjusted EBITDA (FY 2019: 42%), or the highest level since fiscal year 2014.

Cash and cash equivalents increased $69 million compared to December 31, 2019 to $488 million, after spending $44 million on share repurchases in the fiscal year 2020.

The Company had financial liquidity of approximately $960 million, including its cash position, marketable securities and its Revolving Credit Facility as of December 31, 2020.

Business Outlook

The following forward-looking statements reflect Criteo’s expectations as of February 10, 2021.

Fiscal year 2021 guidance:

- We are targeting low to mid-single digit growth in Revenue ex-TAC at constant-currency.

- We expect an Adjusted EBITDA margin above 30% of Revenue ex-TAC.

First quarter 2021 guidance:

- We expect Revenue ex-TAC to be around $200 million, implying constant-currency decline of about 4% year-over-year.

- We expect Adjusted EBITDA to be above $60 million.

The above guidance for the first quarter and the fiscal year ending December 31, 2021 assumes the following exchange rates for the main currencies impacting our business: a U.S. dollar-euro rate of 0.847, a U.S. dollar-Japanese Yen rate of 108, a U.S. dollar-British pound rate of 0.76, a U.S. dollar-Korean Won rate of 1,200 and a U.S. dollar-Brazilian real rate of 5.7.

The above guidance assumes no acquisitions are completed during the first quarter ending March 31, 2021 and fiscal year ended December 31, 2021.

Reconciliation of Revenue ex-TAC and Adjusted EBITDA guidance to the closest corresponding U.S. GAAP measure is not available without unreasonable efforts on a forward-looking basis due to the high variability, complexity and low visibility with respect to the charges excluded from these non-GAAP measures; in particular, the measures and effects of equity awards compensation expense specific to equity compensation awards that are directly impacted by unpredictable fluctuations in our share price. The variability of the above charges could potentially have a significant impact on our future U.S. GAAP financial results.

Announcement of a Share Repurchase Authorization of up to $100 million

The Company is executing on its strategic plan, continues to invest in the growth of the business, leveraging its strong balance sheet position, and is confident in its transformation. In order to meet its equity obligations to employees while taking advantage of the attractive level of its share price, Criteo today announces that the Board of Directors has authorized a share repurchase program of up to $100 million of the Company’s outstanding American Depositary Shares. The Company intends to use repurchased shares under this new program to satisfy employee equity obligations in lieu of issuing new shares, which would limit future dilution for its shareholders.

Under the terms of the authorization, the stock purchases may be made from time to time on the NASDAQ Global Select Market in compliance with applicable state and federal securities laws and applicable provisions of French corporate law. The timing and amounts of any purchases will be based on market conditions and other factors including price, regulatory requirements and capital availability, as determined by Criteo’s management team. The program does not require the purchase of any minimum number of shares and may be suspended, modified or discontinued at any time without prior notice.

Non-GAAP Financial Measures

This press release and its attachments include the following financial measures defined as non-GAAP financial measures by the U.S. Securities and Exchange Commission (“SEC”): Revenue ex-TAC, Revenue ex-TAC by Region, Revenue ex-TAC margin, Adjusted EBITDA, Adjusted EBITDA margin, Adjusted Net Income, Adjusted diluted EPS, Free Cash Flow and Non-GAAP Operating Expenses. These measures are not calculated in accordance with U.S. GAAP.

Revenue ex-TAC is our revenue excluding Traffic Acquisition Costs (“TAC”) generated over the applicable measurement period and Revenue ex-TAC by Region reflects our Revenue ex-TAC by our geographies. Revenue ex-TAC, Revenue ex-TAC by Region and Revenue ex-TAC margin are key measures used by our management and board of directors to evaluate our operating performance, generate future operating plans and make strategic decisions regarding the allocation of capital. In particular, we believe that the elimination of TAC from revenue can provide a useful measure for period-to-period comparisons of our business and across our geographies.

Accordingly, we believe that Revenue ex-TAC, Revenue ex-TAC by Region and Revenue ex-TAC margin provide useful information to investors and the market generally in understanding and evaluating our operating results in the same manner as our management and board of directors.

Adjusted EBITDA is our consolidated earnings before financial income (expense), income taxes, depreciation and amortization, adjusted to eliminate the impact of equity awards compensation expense, pension service costs, restructuring related and transformation costs, acquisition-related costs and deferred price consideration.

During the period, we have broadened the definition of Adjusted EBITDA to exclude costs related to restructuring and transformation costs, in addition to restructuring charges previously excluded. Adjusted EBITDA and Adjusted EBITDA margin are key measures used by our management and board of directors to understand and evaluate our core operating performance and trends, to prepare and approve our annual budget and to develop short- and long-term operational plans. In particular, we believe that by eliminating equity awards compensation expense, pension service costs, restructuring related and transformation costs, acquisition-related costs and deferred price consideration, Adjusted EBITDA and Adjusted EBITDA margin can provide useful measures for period-to-period comparisons of our business. Accordingly, we believe that Adjusted EBITDA and Adjusted EBITDA margin provide useful information to investors and the market generally in understanding and evaluating our results of operations in the same manner as our management and board of directors.

Adjusted Net Income is our net income adjusted to eliminate the impact of equity awards compensation expense, amortization of acquisition-related intangible assets, acquisition-related costs and deferred price consideration, restructuring related and transformation costs and the tax impact of these adjustments. Adjusted Net Income and Adjusted diluted EPS are key measures used by our management and board of directors to evaluate operating performance, generate future operating plans and make strategic decisions regarding the allocation of capital.

In particular, we believe that by eliminating equity awards compensation expense, amortization of acquisition-related intangible assets, acquisition-related costs and deferred price consideration, restructuring related and transformation costs and the tax impact of these adjustments, Adjusted Net Income and Adjusted diluted EPS can provide useful measures for period-to-period comparisons of our business. Accordingly, we believe that Adjusted Net Income and Adjusted diluted EPS provide useful information to investors and the market generally in understanding and evaluating our results of operations in the same manner as our management and board of directors.

Free Cash Flow is defined as cash flow from operating activities less acquisition of intangible assets, property, plant and equipment and change in accounts payable related to intangible assets, property, plant and equipment. Free Cash Flow Conversion is defined as free cash flow divided by Adjusted EBITDA. Free Cash Flow and Free Cash Flow Conversion are key measures used by our management and board of directors to evaluate the Company’s ability to generate cash. Accordingly, we believe that Free Cash Flow and Free Cash Flow Conversion permit a more complete and comprehensive analysis of our available cash flows.

Non-GAAP Operating Expenses are our consolidated operating expenses adjusted to eliminate the impact of depreciation and amortization, equity awards compensation expense, pension service costs, restructuring related and transformation costs, acquisition-related costs and deferred price consideration. The Company uses Non-GAAP Operating Expenses to understand and compare operating results across accounting periods, for internal budgeting and forecasting purposes, for short-term and long-term operational plans, and to assess and measure our financial performance and the ability of our operations to generate cash. We believe Non-GAAP Operating Expenses reflects our ongoing operating expenses in a manner that allows for meaningful period-to-period comparisons and analysis of trends in our business. As a result, we believe that Non-GAAP Operating Expenses provides useful information to investors in understanding and evaluating our core operating performance and trends in the same manner as our management and in comparing financial results across periods. In addition, Non-GAAP Operating Expenses is a key component in calculating Adjusted EBITDA, which is one of the key measures the Company uses to provide its quarterly and annual business outlook to the investment community.

Please refer to the supplemental financial tables provided in the appendix of this press release for a reconciliation of Revenue ex-TAC to revenue, Revenue ex-TAC by Region to revenue by region, Adjusted EBITDA to net income, Adjusted Net Income to net income, Free Cash Flow to cash flow from operating activities, and Non-GAAP Operating Expenses to operating expenses, in each case, the most comparable U.S. GAAP measure. Our use of non-GAAP financial measures has limitations as an analytical tool, and you should not consider such non-GAAP measures in isolation or as a substitute for analysis of our financial results as reported under U.S. GAAP. Some of these limitations are: 1) other companies, including companies in our industry which have similar business arrangements, may address the impact of TAC differently; and 2) other companies may report Revenue ex-TAC, Revenue ex-TAC by Region, Adjusted EBITDA, Adjusted Net Income, Free Cash Flow, Non-GAAP Operating Expenses or similarly titled measures but calculate them differently or over different regions, which reduces their usefulness as comparative measures. Because of these and other limitations, you should consider these measures alongside our U.S. GAAP financial results, including revenue and net income.

Forward-Looking Statements Disclosure

This press release contains forward-looking statements, including projected financial results for the quarter ending March 31, 2021 and the year ended December 31, 2021, our expectations regarding our market opportunity and future growth prospects and other statements that are not historical facts and involve risks and uncertainties that could cause actual results to differ materially. Factors that might cause or contribute to such differences include, but are not limited to: failure related to our technology and our ability to innovate and respond to changes in technology, uncertainty regarding the scope and impact of the COVID-19 pandemic on our employees, operations, revenue and cash flows, uncertainty regarding our ability to access a consistent supply of internet display advertising inventory and expand access to such inventory, investments in new business opportunities and the timing of these investments, whether the projected benefits of acquisitions materialize as expected, uncertainty regarding international growth and expansion, the impact of competition, uncertainty regarding legislative, regulatory or self-regulatory developments regarding data privacy matters and the impact of efforts by other participants in our industry to comply therewith, the impact of consumer resistance to the collection and sharing of data, our ability to access data through third parties, failure to enhance our brand cost-effectively, recent growth rates not being indicative of future growth, our ability to manage growth, potential fluctuations in operating results, our ability to grow our base of clients, and the financial impact of maximizing Revenue ex-TAC, as well as risks related to future opportunities and plans, including the uncertainty of expected future financial performance and results and those risks detailed from time-to-time under the caption “Risk Factors” and elsewhere in the Company’s SEC filings and reports, including the Company’s Annual Report on Form 10-K filed with the SEC on March 2, 2020, and in subsequent Quarterly Reports on Form 10-Q as well as future filings and reports by the Company. Importantly, at this time, the COVID-19 pandemic continues to have a significant impact on Criteo’s business, financial condition, cash flow and results of operations. There are significant uncertainties about the duration and the extent of the impact of the virus.

Except as required by law, the Company undertakes no duty or obligation to update any forward-looking statements contained in this release as a result of new information, future events, changes in expectations or otherwise.

Conference Call Information

Criteo’s senior management team will discuss the Company’s earnings on a call that will take place today, February 10, 2021, at 8:00 AM ET, 2:00 PM CET. The conference call will be webcast live on the Company’s website http://ir.criteo.com and will be available for replay.

- S. callers: +1 855 209 8212

- International callers: +1 412 317 0788 or +33 1 76 74 05 02

Please ask to be joined into the “Criteo S.A.” call.

About Criteo

Criteo (NASDAQ: CRTO) is the global technology company powering the world’s marketers with trusted and impactful advertising. 2,600 Criteo team members partner with over 21,000 customers and thousands of publishers around the globe to deliver effective advertising across all channels, by applying advanced machine learning to unparalleled data sets. Criteo empowers companies of all sizes with the technology they need to better know and serve their customers. For more information, please visit www.criteo.com.

Contacts

Criteo Investor Relations

Edouard Lassalle, SVP, Market Relations & Capital Markets, e.lassalle@criteo.com

Clemence Vermersch, Director, Investor Relations, c.vermersch@criteo.com

Criteo Public Relations

Jessica Meyers, Director, Public Relations, Americas, j.meyers@criteo.com