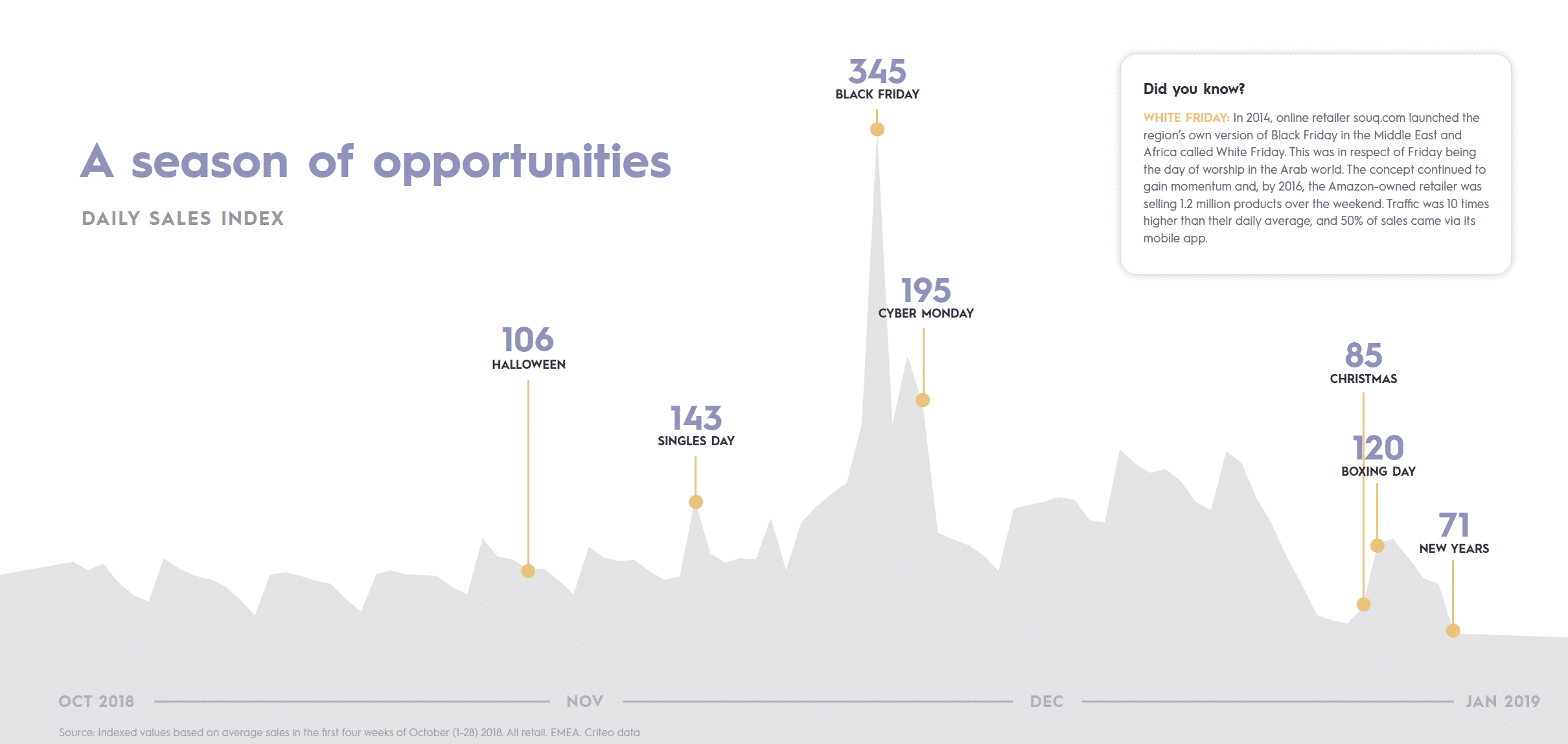

Overflowing with a number of key shopping moments, the “Golden Quarter” runs from October to December, rounding out the year with warmth, sparkle, and plenty of opportunities for retailers to reach consumers with special offers and messages.

This annual period is key for retailers in Europe, Middle East and Africa (EMEA), and knowing which points in the festive calendar to focus on in 2019 depend on four themes:

- Festive occasions

- Strategic importance

- Market diversity

- Consumer profiles

In our latest report, we outline the trends affecting these themes, and help retailers navigate through the festive season to make their marketing strategies and campaigns most effective.

Here’s a glimpse at what’s inside:

Celebrations & Opportunities: A Festive Season Full of Magic

Whether it’s the eye-catching shop windows of London’s Oxford Street, the twinkling lights of the Champs Elysees, the sweet aromas of mulled wine and roasted chestnuts so evocative of the Christmas markets across western Europe, or enjoying a yuletide trip to Dubai, the festive season is when advertising is at its most inventive and appealing.

Consumers are in good cheer and in the mood to spend, generating a bumper sales period for retailers. We cover unique festive moments (eg Reyes Magos in Spain, Wigilia in Poland…) as well as unique peak days for retail (think Halloween, Singles Day, Boxing Day, and more):

The 2019 Golden Quarter Looks Bright

As the popularity of Black Friday and other promotional events grows, the festive season has become a strategic period for retailers. It’s when the ability to influence consumer spending is at its strongest, giving brands a powerful Q4 opportunity to boost annual revenues.

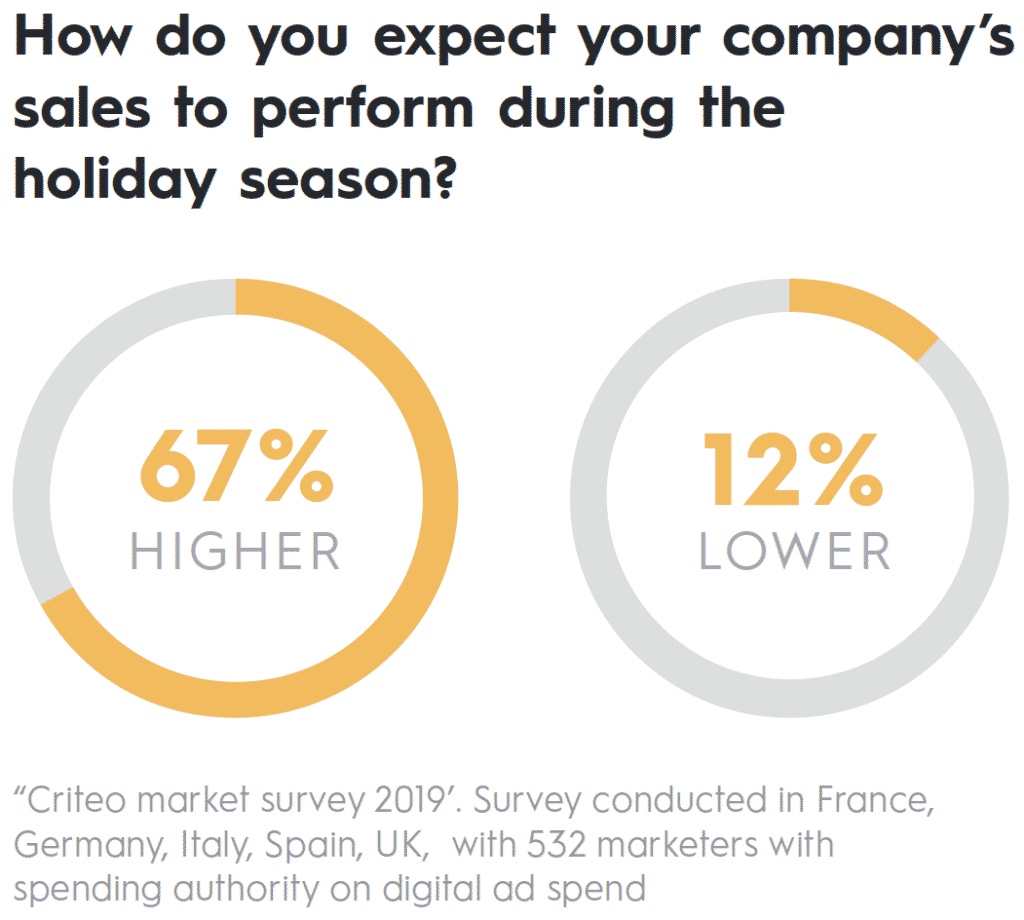

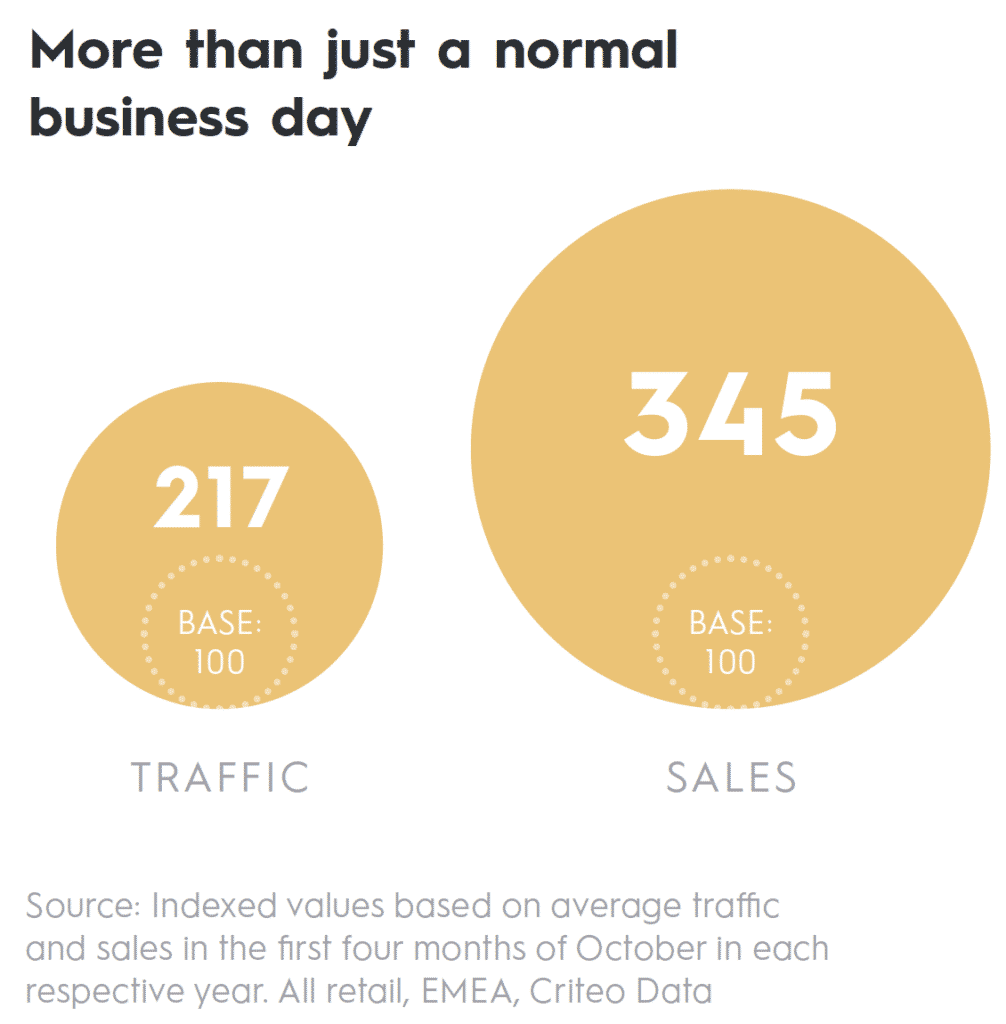

Black Friday remains immensely popular across EMEA, and the event has evolved into a consumer favourite, with year-on-year growth averaging 117% over the last five years. Furthermore, according to a recent Criteo survey, a full 67% of retailers expect sales to increase during Q4 2019.

Across EMEA, online traffic and sales on Black Friday also continue to rise. UK shoppers spent approximately $10.6bn between Black Friday and Cyber Monday, with the average online spend equating to $42.13m per hour. German shoppers spent an estimated $7.35bn online and in-store, and French consumers indulged in a $6bn weekend spending spree.

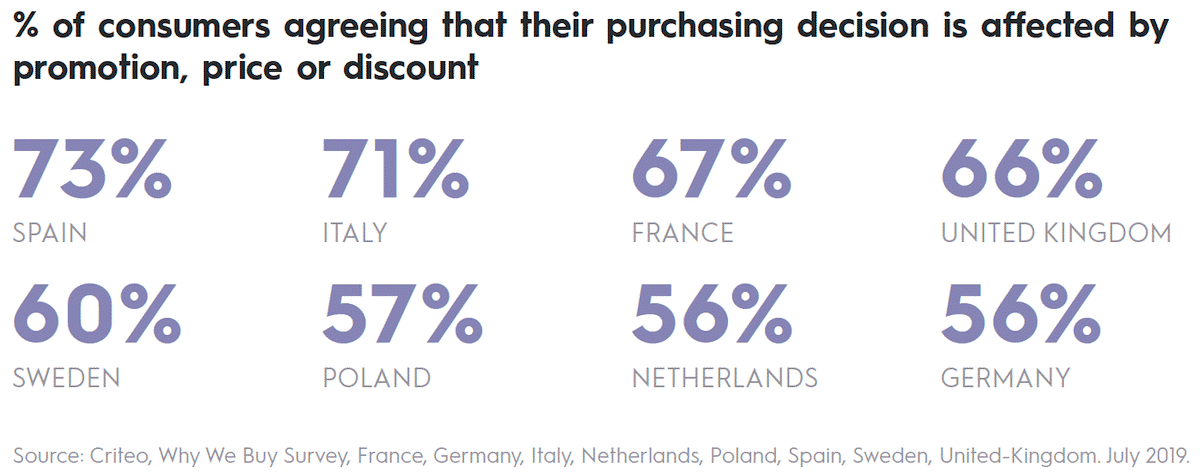

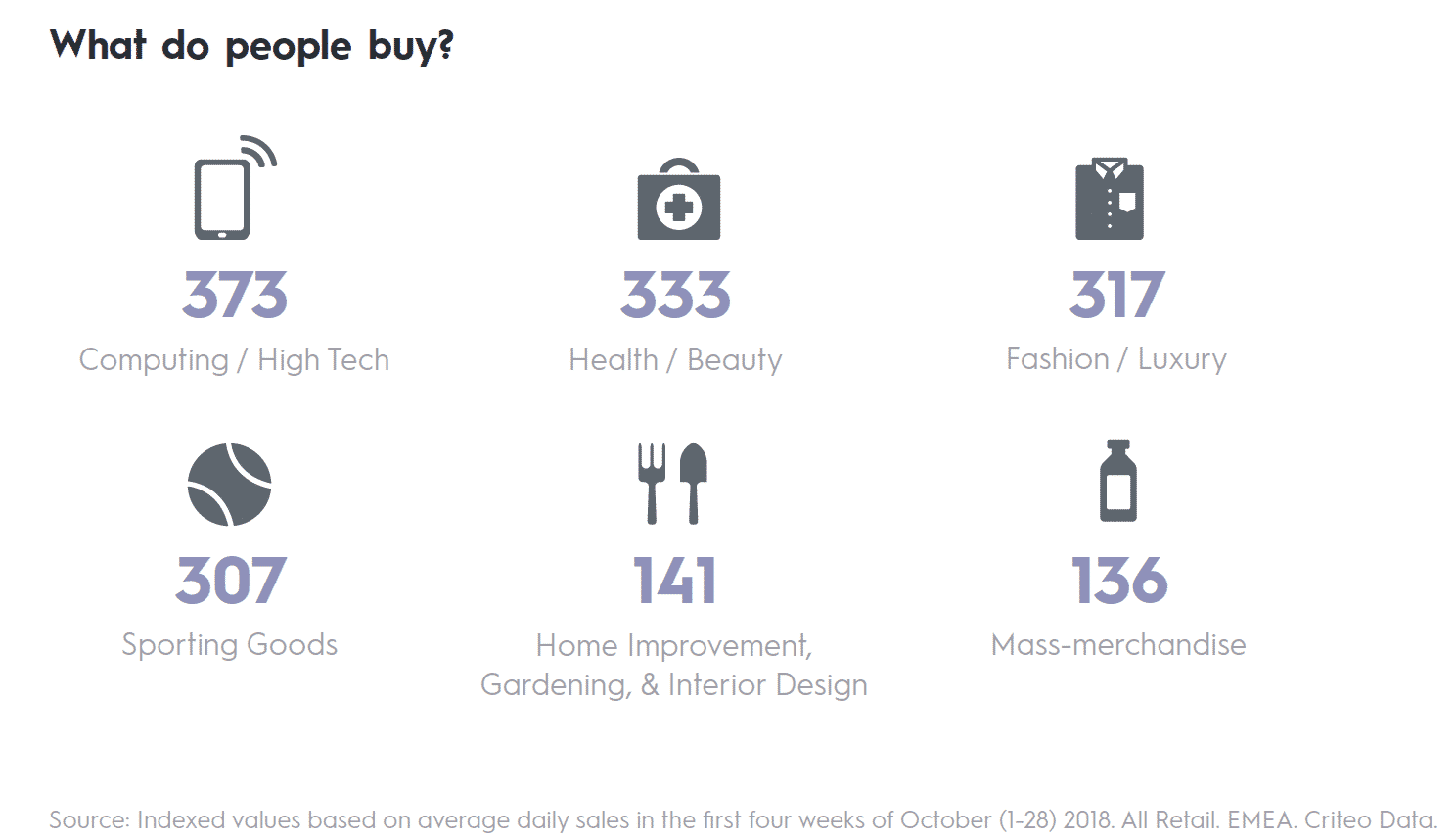

In addition, the festive season is a period when consumer spending habits change from essential buys to bargain hunting, gift buying and luxury purchases. Top selling items during the period include high tech, beauty, fashion, and sporting goods.

EMEA Market Complexity & Shopper Personas

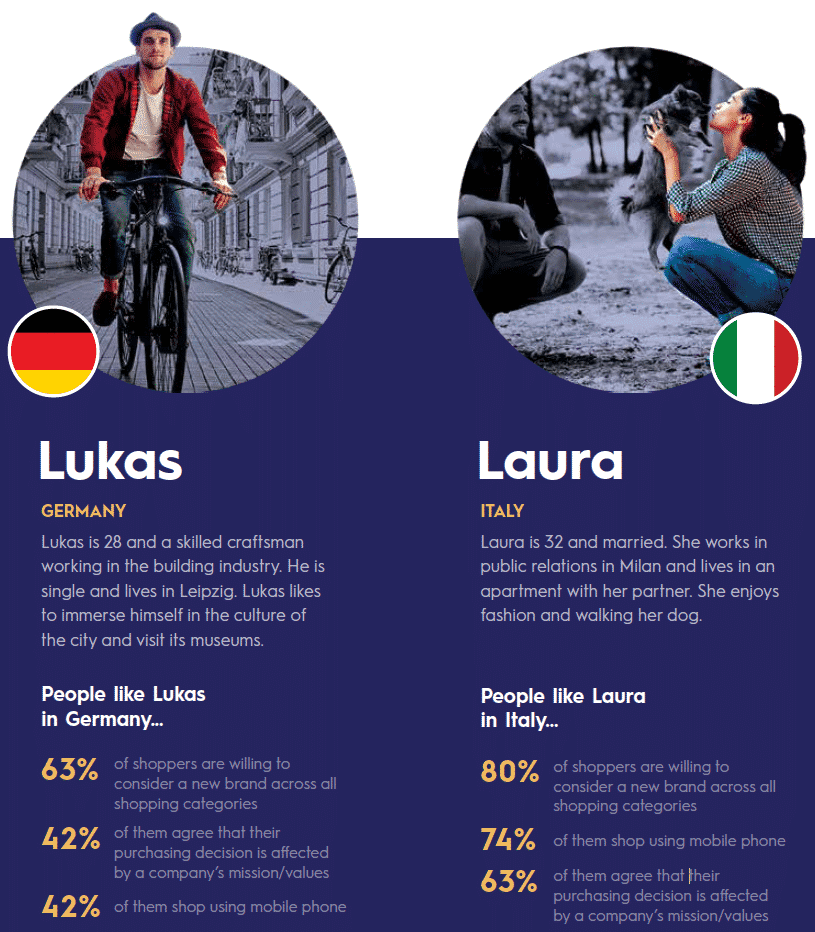

“One size fits all” marketing approaches in Europe increasingly fall flat, failing to resonate with consumers who come from different backgrounds or circumstances. Taking into account factors like the economic landscape, cultural and demographic differences is essential to understanding festive season shopping habits across divides.

In the report, we take a deeper look at what really motivates EMEA shoppers to purchase in-store or online, the omnichannel festive season journey, and different shopper personas across EMEA.

Rise of the Conscious Consumer

Conscious consumers, or those who base purchasing decisions on brands they closely identify with, want to feel more emotionally connected to the products they buy and are more prone to supporting brands who appeal to their conscious shopping selves. The Golden Quarter provides retailers with the ultimate period to appeal to the conscious shopper, particularly in the run up to Christmas when emotional investment in gifts is at its highest.

During the Gold Quarter, retailers have a three month window to emphasize those values. Equally important, brands need to promote those values before, during and after promotional periods in order to truly keep the conscious shopper engaged.

For more festive season trends, data, and insights, download the report: