The holiday ad campaign season is in full swing. But the question is… where?

Consumers could start looking at a product on their phone and buy it in a store. They could see something on Instagram and later decide to order it on a website. The customer journey is unpredictable, especially around the holidays.

We dug into our data and learn more about how people really buy during the season. To help you plan for online and in-store peaks, we analyzed 266.4 million in-store and 66.5 million online retail shopping transactions in the United States and EMEA from 51 major advertisers during Q4 2018.

What we found out is that there are three distinct phases between in-store and online shopping behavior as the holiday season progresses.

About the Data

By working with brick-and-mortar clients to integrate online and offline ad campaigns, Criteo can see the relationship between in-store and digital customer journeys. Clients regularly upload customer and offline data to the Criteo Shopper Graph to ensure there is a single view of each customer. That way, whether the transaction happens in the digital or physical world, that customer isn’t counted twice.

Let’s take a look:

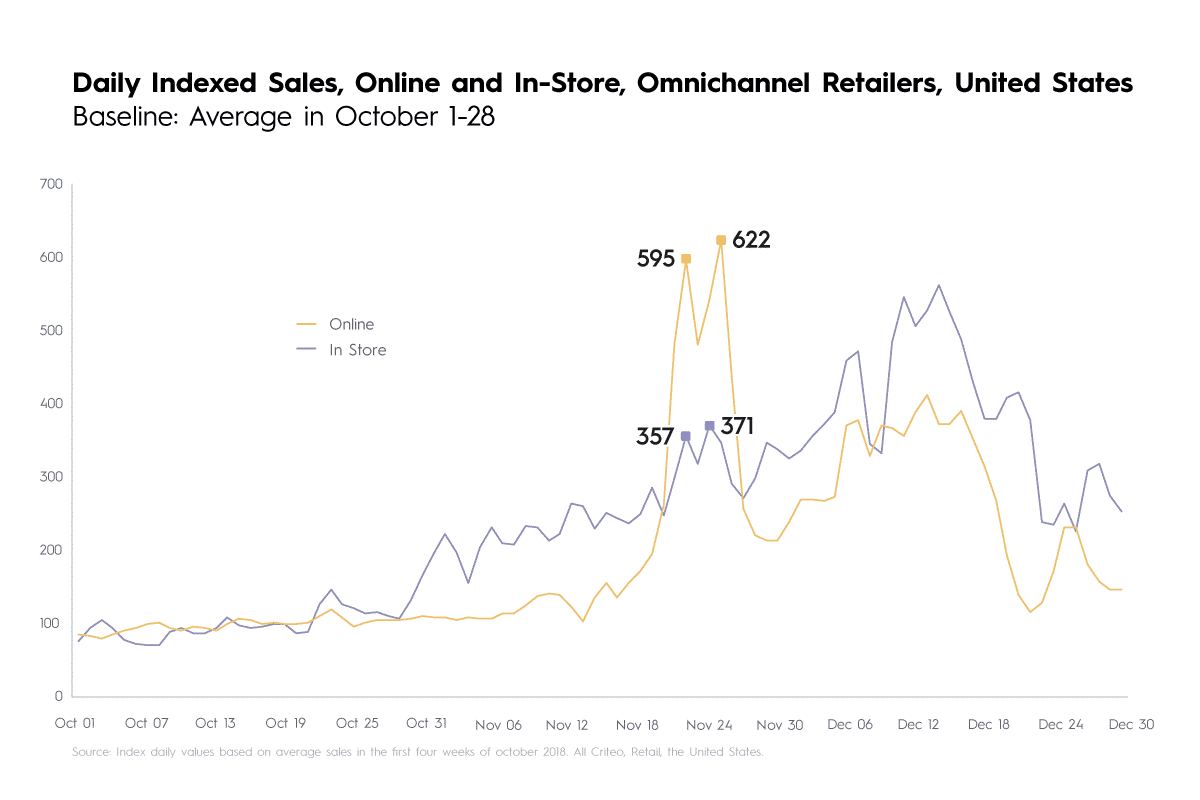

Phase 1: Black Friday & The Digital Rush

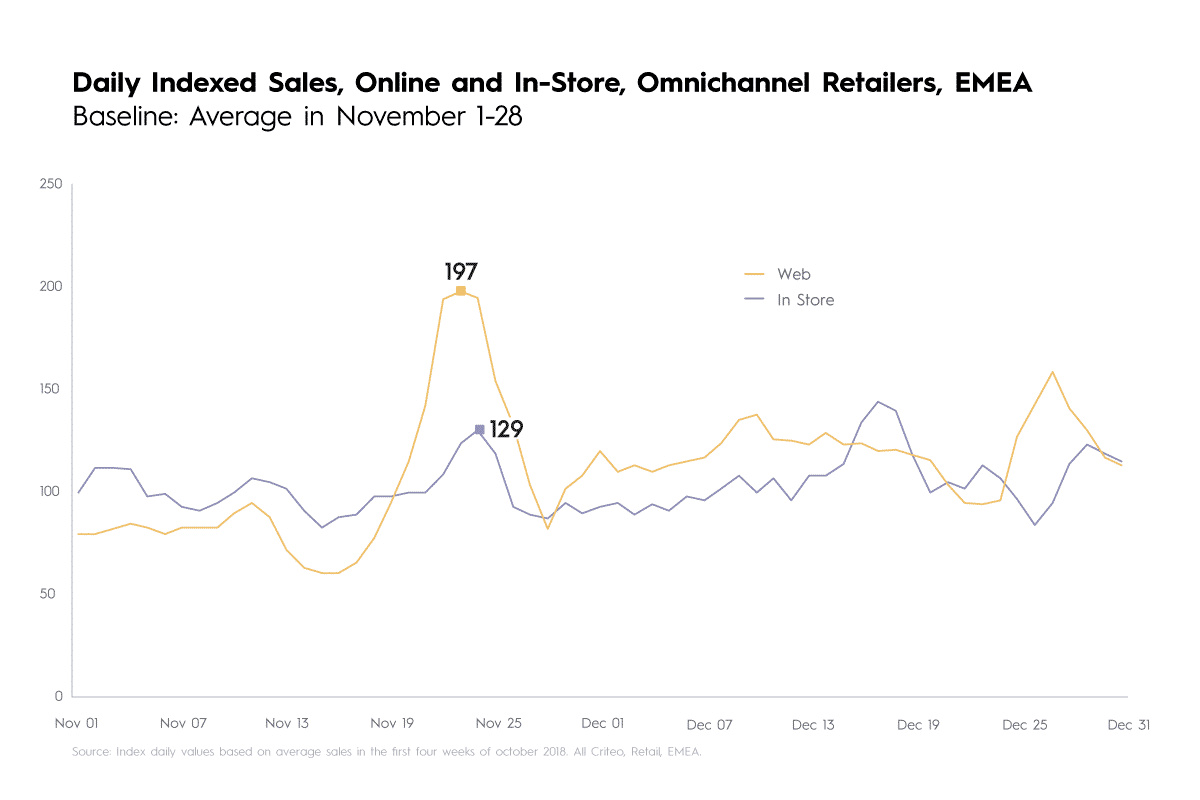

Last year in early November, in-store sales accounted for more than 60% of all retail sales in both the US and EMEA. But as Black Friday approached, online purchases accounted for more transactions than in-store purchases, likely because shoppers were anticipating big deals online. In fact, the share of in-store sales hit its November low point on Black Friday, with in-store sales dropping to below 30% of total sales in the US and below 56% in EMEA.

What’s interesting to note is that both in-store and online sales surged on Black Friday (online to a greater extent), indicating that one doesn’t cannibalize the other. In the US, in-store purchases grew 257% on Black Friday, and online purchases increased 495%. In EMEA, the growth was 29% and 97% respectively.

Across the US and EMEA, in-store sales make up the majority of sales throughout the month November, but online sales surge on Black Friday through Cyber Monday.

What’s clear is that people want to get online deals, but there is still a core contingent of shoppers who still love to go to the store.

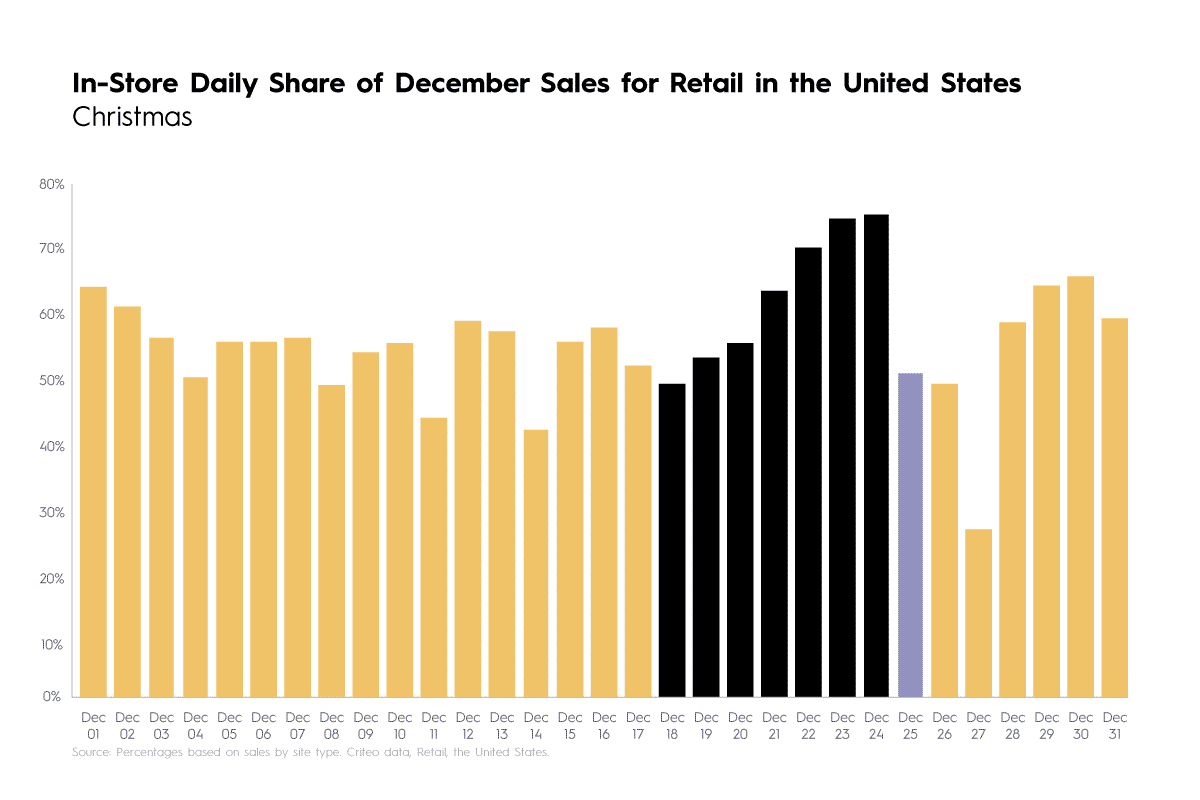

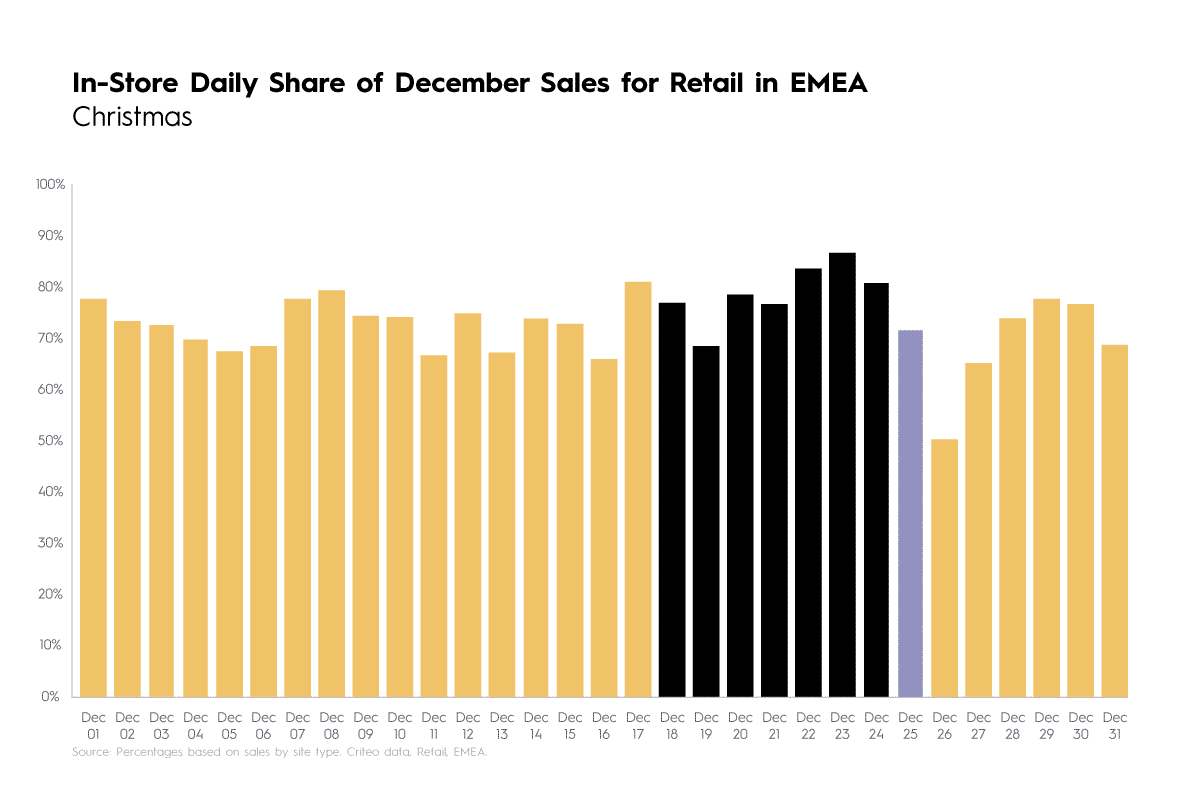

Phase 2: Last-Minute Shoppers Go to the Store

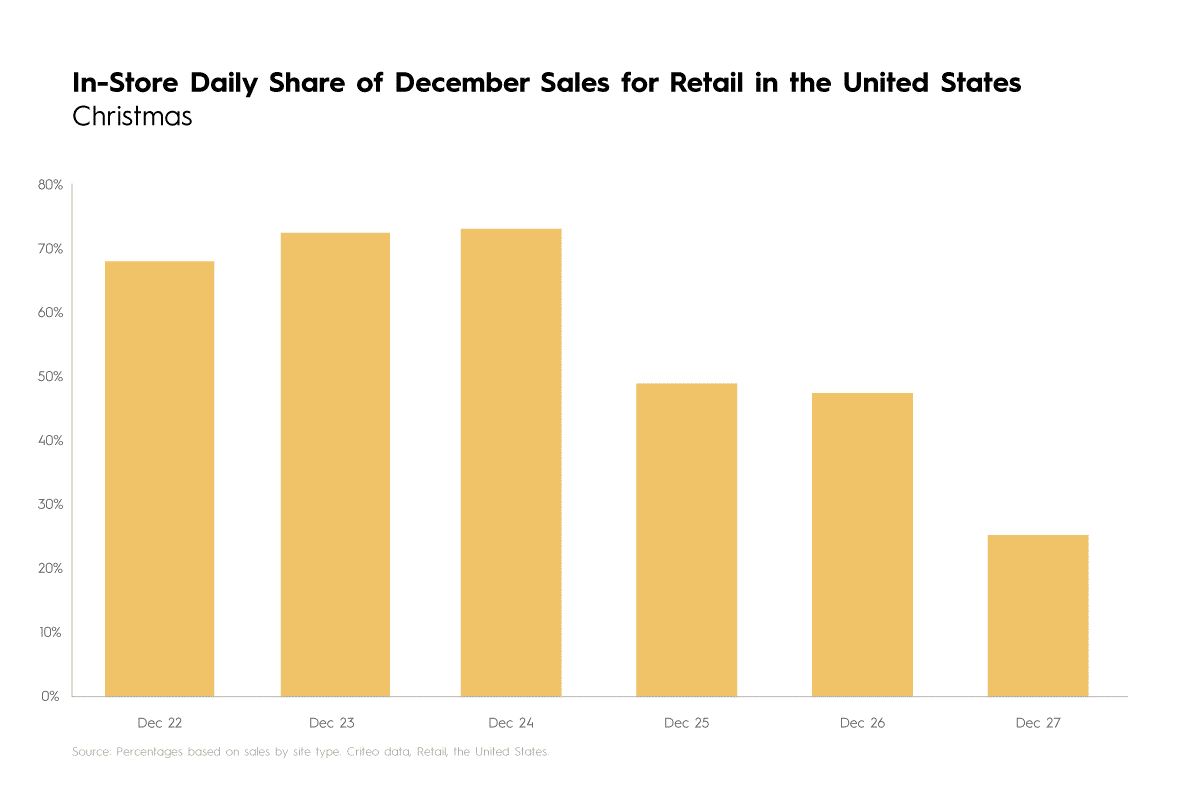

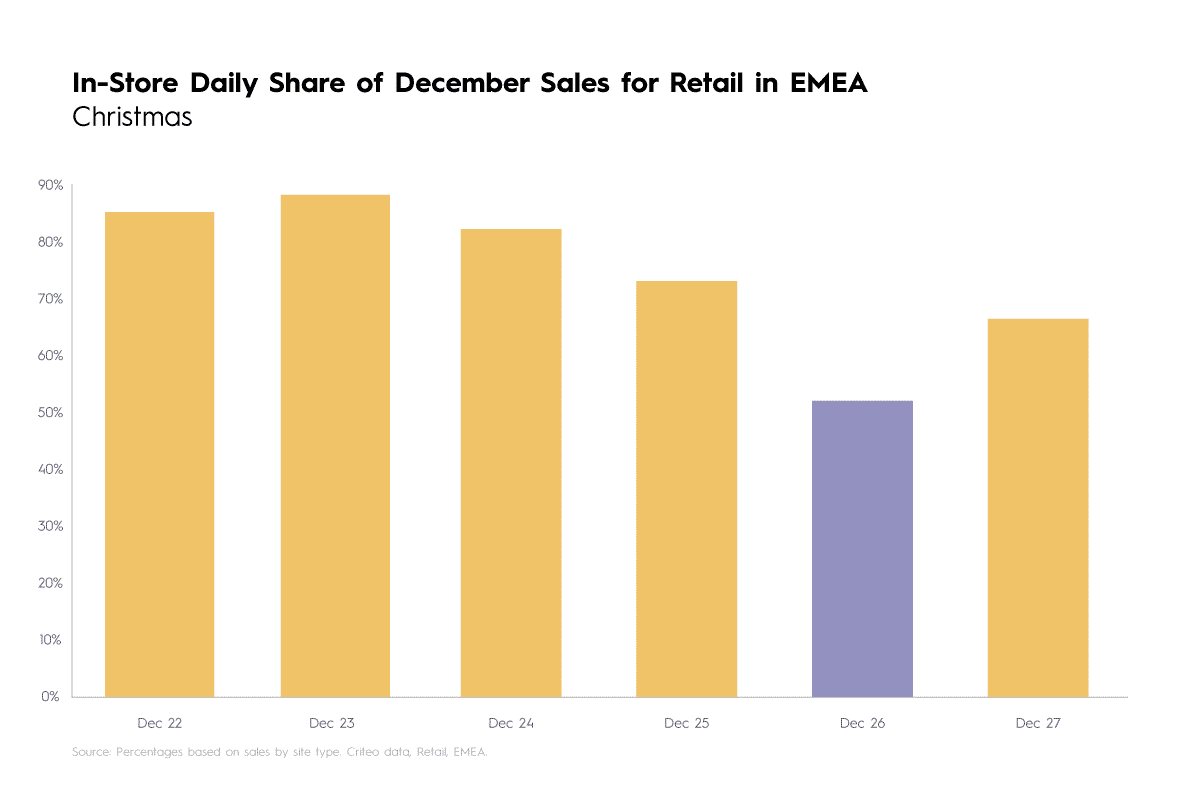

In 2018, when shoppers started feeling the time crunch, they headed to the store to see, touch, and bring gifts home, likely due to fear of orders not being delivered on time.

In the US, 73% of purchases in the week preceding Christmas were in-store. EMEA in-store share of purchases reached up to 87% during the same time frame.

Phase 3: Post-Christmas Shoppers Go Online

Immediately after Christmas, in-store shopping drops drastically as shoppers tend to spend more time with family or are traveling. In EMEA, Boxing Day (December 26th) saw a sharp decline in in-store purchases, since most stores are closed for the holiday.

How Retail Categories Are Affected by the Holidays

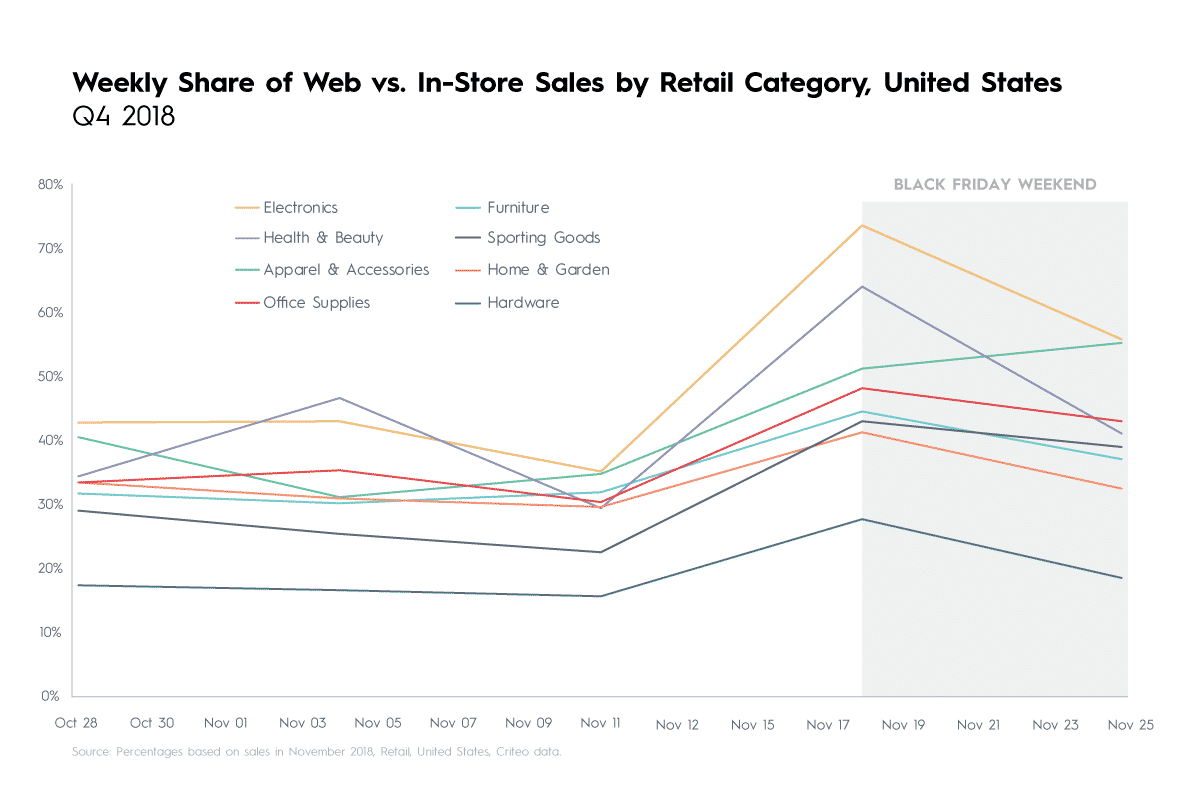

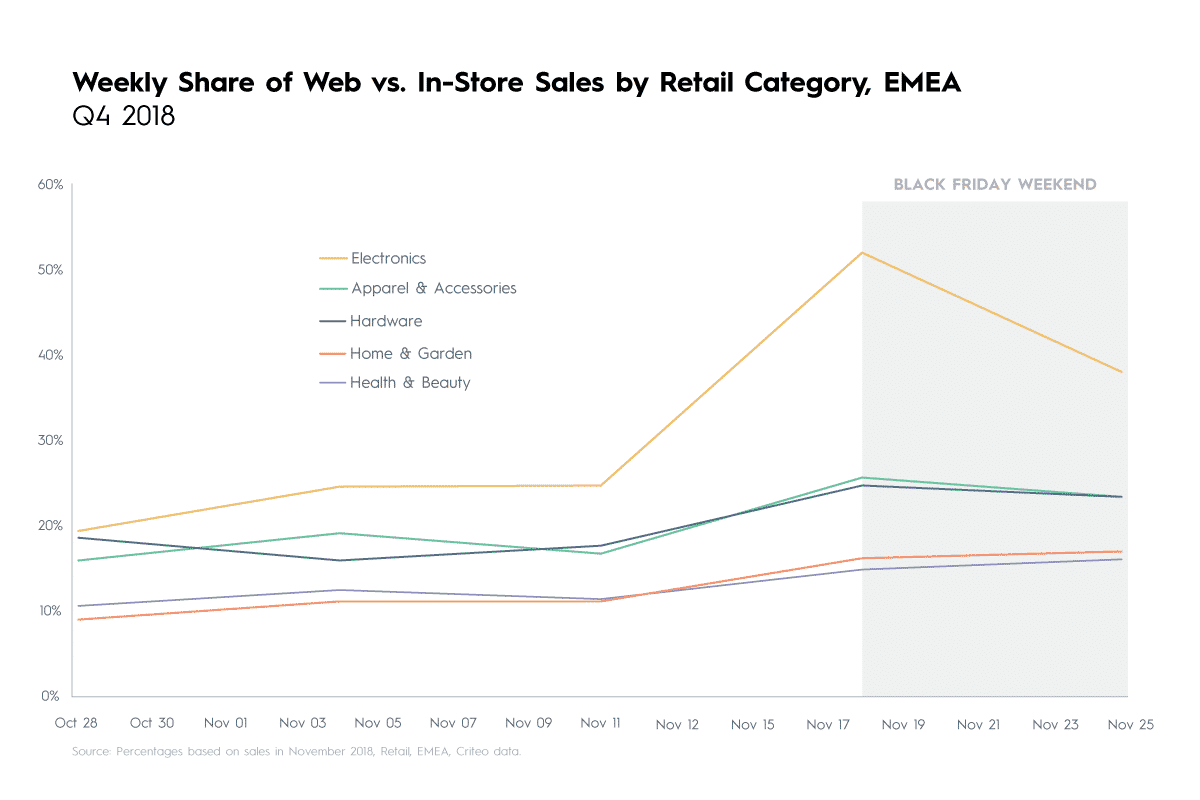

In addition to looking at overall purchase trends, we analyzed which product categories experienced the biggest shifts from in-store to online during Black Friday weekend.

The graph below looks at US share of sales on web versus in-store, where we see web sales slowing just before Black Friday, followed by a significant increase on Black Friday itself.

Most noticeably, Electronics and Apparel & Accessories saw heavy web activity (ie more web sales than in-store sales) on Black Friday, with online capturing the majority share of sales, at 72% (Electronics) and 63% (Apparel & Accessories).

In EMEA, Electronics saw the greatest shift from in-store to online during Black Friday weekend, jumping from an average of 22% in online share of sales all the way up to 52%.

Of course, while digital commerce increases across categories during Black Friday, some products still lend themselves to the in-store shopping experience. Home & Garden and Hardware, which include items like sofas, plants, tools, and the like, see a less noticeable rise in online sales.

The takeaway? While web may take the lion’s share of sales, that doesn’t mean that in-store necessarily does worse; Both in-store and online sales increase (though web is much more by comparison).

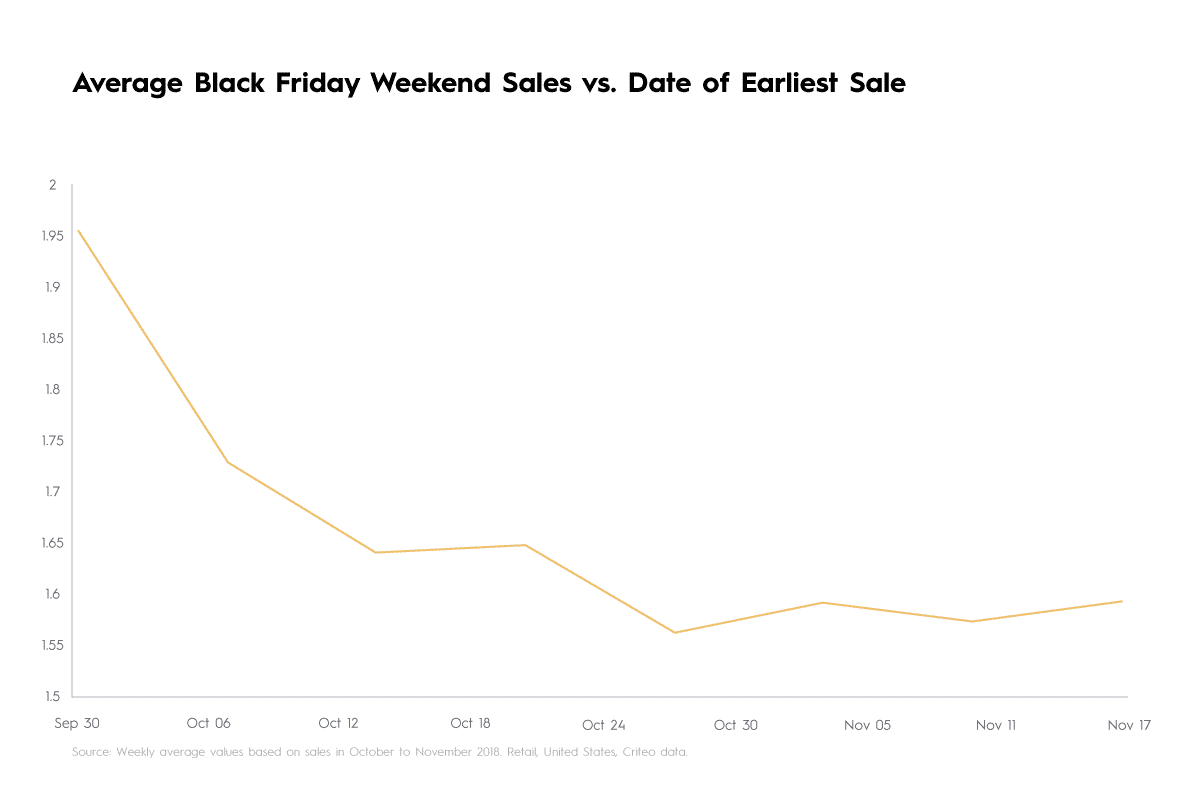

The importance of starting early

Our data showed that shoppers who bought something early on in the season are likely to spend even more later on, especially during Black Friday. Those whose first purchase on a retailer website was at least two months before Black Friday can contribute up to 23% more in sales during Black Friday weekend than a shopper whose first visit was just one day prior. Furthermore, shoppers who had already bought something in October (compared to those who only bought on Black Friday itself) had more than double the transactions on Black Friday.

‘Tis the season for omnichannel success

By understanding the holiday omnichannel journey, you can build a more efficient and effective marketing plan. Adjust the spend on channels and for certain product categories to take advantage of online and in-store peaks. Optimize product pages for the categories with the biggest online spikes. And start advertising now to attract shoppers who will happily buy from you again after the holidays.