During retail’s peak season, Black Friday, Cyber Week, and Cyber 6 have historically reigned supreme as the year’s top sales events, but in 2020, the rise of ecommerce from consumers staying home has turned these select shopping days into a whole season of online offers and promotions. And the shift towards ecommerce isn’t the only driver; our data also shows the rise of regional peak sales events helped stretch this year’s shopping season. This allowed advertisers and retailers to find success through a steady increase of sales throughout the fourth quarter, rather than with compact surges between Black Friday and Cyber Week.

Let’s examine what prompted this change.

Consumers are more comfortable buying online

The pandemic is forcing many consumers to alter their in-store shopping habits and turn to ecommerce for the things they need or want. In our “Peak to Recovery” Survey of more than 13,500 consumers worldwide, 39% of respondents purchased from online stores for the first time during the peak of COVID-19 and 85% said they’re likely to keep purchasing from the new stores they discovered. These people represent new audiences that advertisers can reach and engage with online, to foster loyalty and drive customer lifetime value.

And holiday shopping is no exception to this shift towards ecommerce. Our Holiday Season Survey of more than 23,000 global consumers shows that three out of 10 shoppers plan to buy more products online this holiday season, including toys and gaming, cultural goods, consumer electronics, apparel and accessories, luxury brands, beauty products, home goods, and holiday decorations. Whether these people are new to online shopping or returning customers, it’s crucial that advertisers and retailers continue to provide seamless advertising, searching, and buying experiences to all digital audiences.

Sales events inspired people to shop long before (and after) Cyber Week

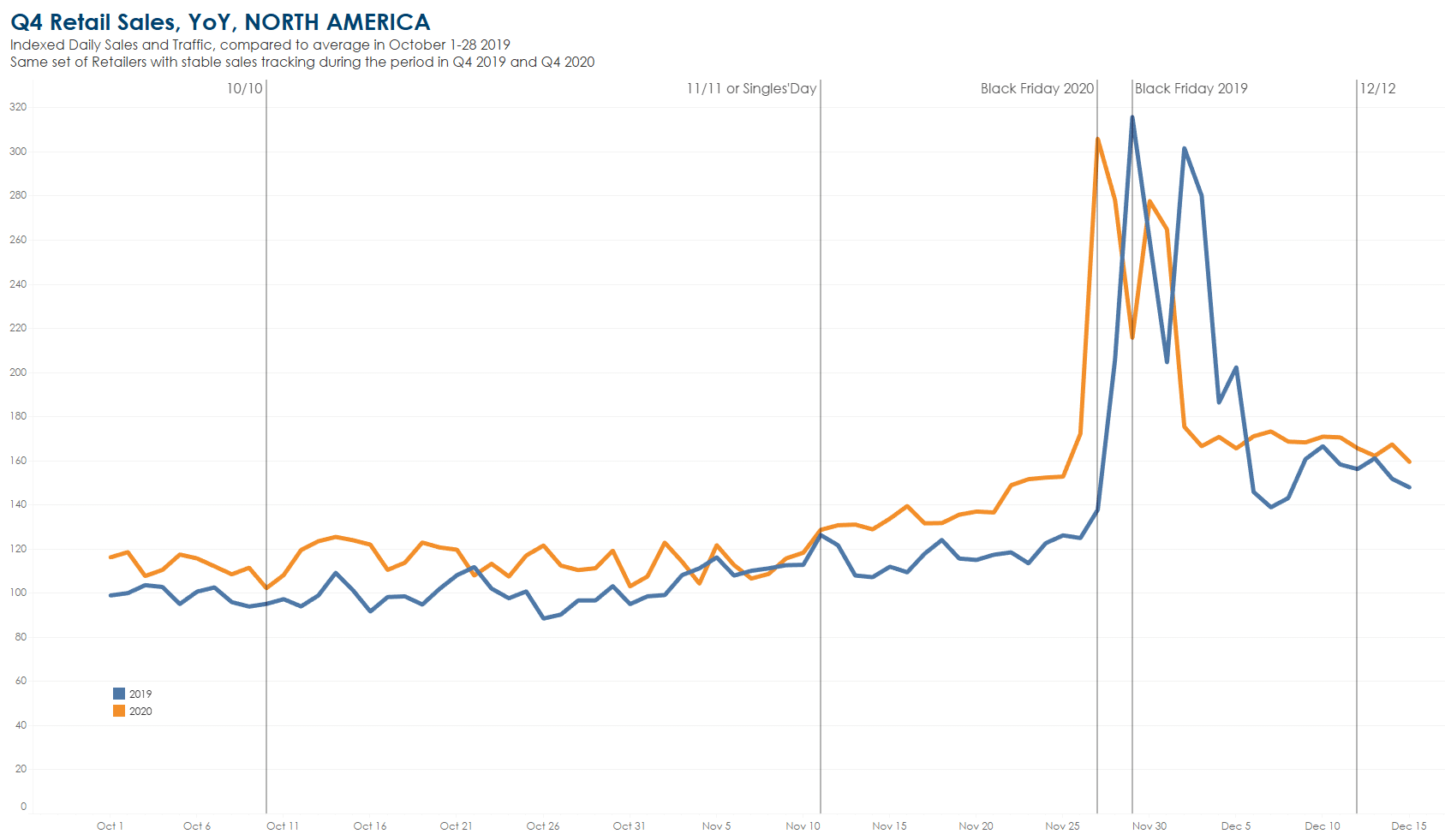

While Black Friday was long considered the holy grail of shopping events (at least in the US), our analysis across 5,500 retailers found that there wasn’t a significant year over year (YoY) sales increase on Black Friday this year. However, there was a 17% YoY increase in global sales during the first three weeks of November, which could explain why fewer shoppers purchased on Black Friday.

What prompted shoppers to start searching for gifts sooner? One possibility is that retailers held their own Black Friday events in October, which might have sparked shoppers to plan their gift list earlier than before. When we looked at US shopping data, it confirmed online sales were up 21% YoY from October 1st to December 1st, while Black Friday sales were down 5% YOY and 9% YoY on Cyber Monday. This shows consumers were willing to embrace Cyber Season, rather than reserving their shopping to Black Friday and Cyber Week.

And it doesn’t stop there: December online sales are still going strong. A recent Criteo analysis of global sales following Black Friday weekend shows online retail has already seen an acceleration in YoY trends, with a 22% increase of sales in the beginning of December (10 days between December 4-13, 2020 compared with December 6-15, 2019).

Regional peak shopping days go global

Shopping events from around the world are also drawing shoppers’ eyes towards promotional offers and discounts. Black Friday is just starting to gain popularity in the Asia-Pacific region, but sales on this day were eclipsed by the popular holiday 11/11, or Singles’ Day. This celebration of single status originally started in China, but has grown and encouraged consumers around the world, including Europe and the Americas, to treat themselves, generating $75 billion in worldwide sales this year. Furthermore, from a technology standpoint, we saw nearly one billion more site engagements, or advertiser events, on Singles’ Day than we did on Black Friday, showing the increase in web traffic on this day.

And days like 12/12 (also known as Double 12) kept the shopping season going with an outstanding performance. This year, 12/12 saw a 21% sales increase YoY globally, as well as a 47% increase in South APAC. It may have helped that 12/12 fell on a Saturday this year, as opposed to a Thursday as it did in 2019, so shoppers had more time to browse and buy. We’re excited to see a solid finish to 2020, for both our clients and our teams.

Yielding success in an uncertain year

Cyber Week and Cyber 6 have given way to Cyber Season in 2020: retailers declaring their own “Black Friday” sales events in October may have kicked things off to encourage early shopping, regional peak days went global throughout November, and December shows sales are still going strong. Advertisers have successfully adapted, even in the most challenging situations. This season saw advertiser ingenuity such as implementing a “buy online pickup in store” (BOPIS) strategy to minimize foot traffic during stay-at-home orders.

And while 2020’s longer holiday shopping season looked differently than previous years, it helped shoppers, advertisers, and retailers avoid a “Black Friday crush.” By starting their discounts as early as October and spreading them out across the entire month of November, retailers may have been able to mitigate supply issues caused by delays due to COVID-19. With more opportunities to shop discounts, consumers were able to spread out their purchases and plan their shopping for the days leading up to Black Friday. Advertisers were also able to maximize their exposure to new online audiences and build loyalty through positive ecommerce experiences.

While it was a successful retail season, it was still a new situation that required strategic thinking, agility, and fortitude from advertisers, retailers, and the industry as a whole. I’d like to take this opportunity to thank our clients for their collaboration and partnership during this crucial season, trusting us with their most important campaigns. We are excited to partner with you in 2021. Thank you and happy holidays.

Want to hear more from our leadership team? Read on for Megan Clarken’s reflections on her first year as CEO.