There will be a lot of cross-retailer browsing and purchasing this holiday season, and people won’t buy all of their gifts from just one retailer or marketplace.

A recent RetailMeNot report says that 71% of holiday buyers plan to buy gifts at large retailers such as Target and Walmart this year. Another 50% expect to make purchases at department stores like Macy’s or Kohl’s. While half say they’ll shop at Amazon, people will be hitting many other retailers this holiday season.

Brands looking to maximize Q4 revenue need to fuel campaigns that boost visibility on key retail partners’ websites, while also enabling them to attribute SKU-level product sales. Since most products will have an advertised discount during this time period, boosting visibility through paid channels is key to maximizing sales.

Here are three trends we’ve identified based on our data and how every brand should be preparing for them this Christmas season:

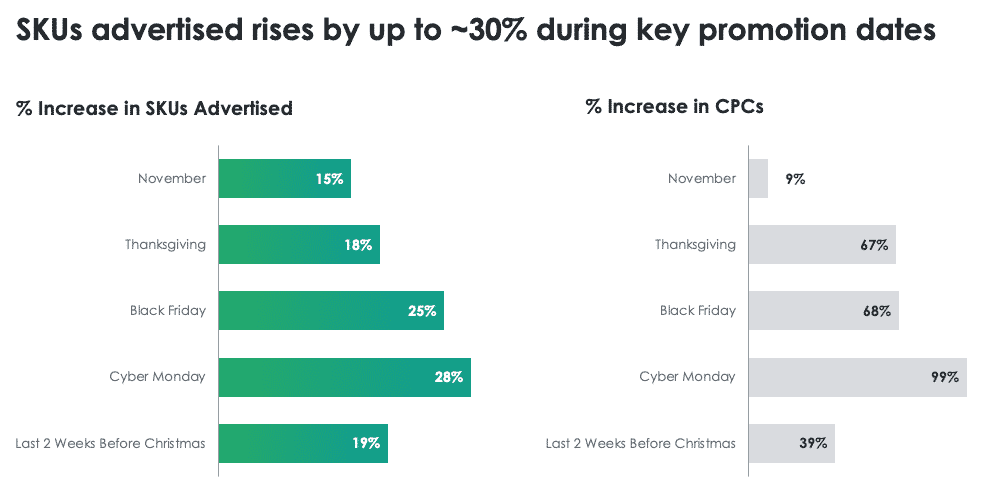

1. SKU competition skyrockets during the holidays.

Around the holidays, there are a lot of SKUs competing to be seen. Brands launch new products, and there are many more product variations and colors. Criteo Retail Media data shows that, during key promotion periods, SKUs advertised rise by up to 30%, and brands increase CPCs to stay competitive in auctions for ad space on retailer sites.

Source: Criteo North America Retailer Network data, average daily values (or daily value for key dates) vs. average daily value in July, 2018.

Many brands introduce deals in the holiday season, but it’s important to remember that visibility still matters greatly if you want buyers to take advantage of those deals.

Top-of-page presence is key to success in any category, even more so during very competitive times. The first page of search results on a retailer site drives 90% of revenue. In addition, the top 10 SKUs on that page account for 25-30% of revenue.

During the holidays, when people may at times be in a rush at the time of purchase, it’s critical to not only be on the first page of search results, but ideally in the top 10 SKUs.

2. Holiday buyer browsing starts early.

Many buyers start researching products early on. According to an MiQ study, “Even if they haven’t started shopping yet, four in 10 Americans will start making plans for their holiday shopping before November”.

Most of this consumer research will take place online, where buyers will decide which specific products they want, and where they plan to purchase them. Mobile will play a large part as well, with buyers researching and looking at reviews in real-time while in physical stores.

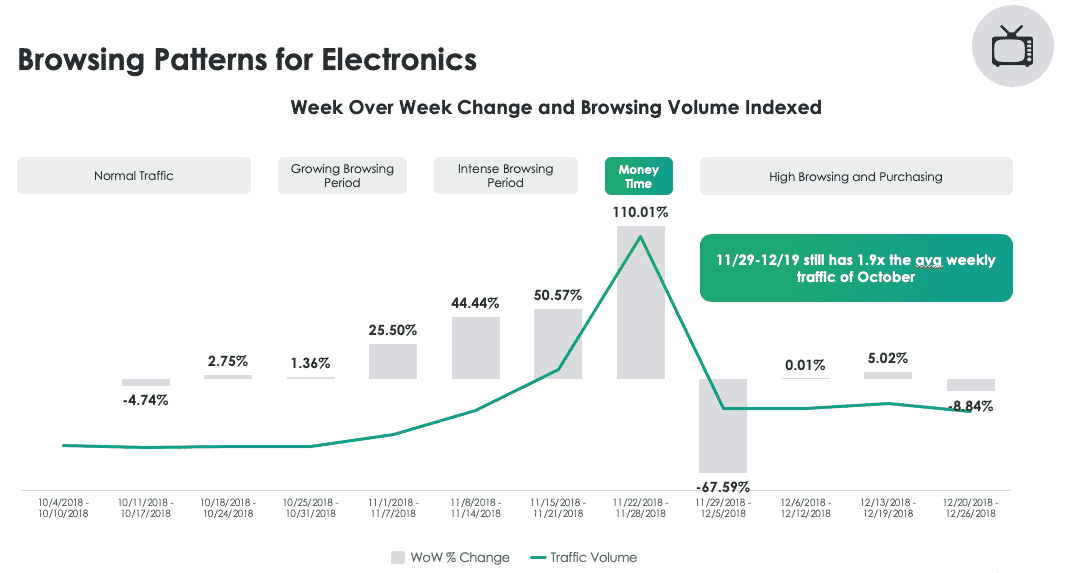

Criteo Retail Media data shows that user traffic on retailer sites begins rising in early November, or even prior, and continues to rise until Christmas. In the graph below, you can see this trend in the electronics category. In 2018, traffic to Product Detail pages began growing steeply in early November and peaked the week of Thanksgiving. While there was a week-over-week decline in traffic the week after Thanksgiving, the time period of 11/29-12/19 still had 1.9X the average weekly traffic of October.

Source: Criteo North America Retailer Network data, 2018.

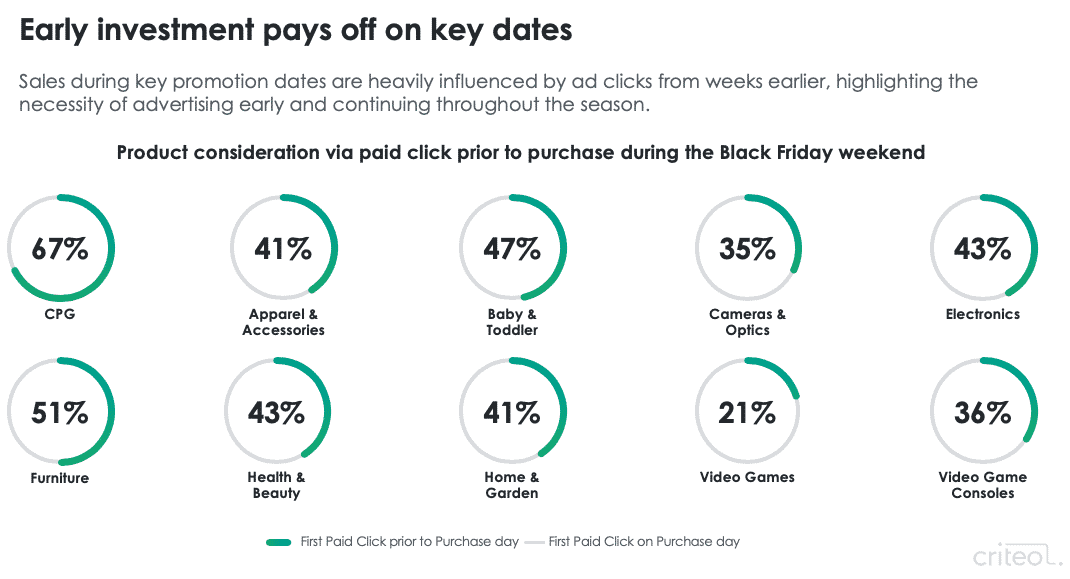

The data also shows that on average, buyers interact with a product in advance of purchase approximately 40-60% of the time.

The chart below seeks to understand if the paid channel can be effective in influencing the consideration phase well in advance of purchase. It breaks down product consideration prior to purchase during Black Friday weekend for several key verticals. Product consideration is measured by a click on a paid advertisement up to six weeks prior to purchase.

Source: Criteo North America Retailer Network data, 2018.

It’s important for brands to be present when this browsing is happening, and buyers are in the consideration phase of the buyer journey. Sales during key promotion dates are heavily influenced by ad clicks from weeks earlier, highlighting the necessity of advertising early and continuing throughout the season.

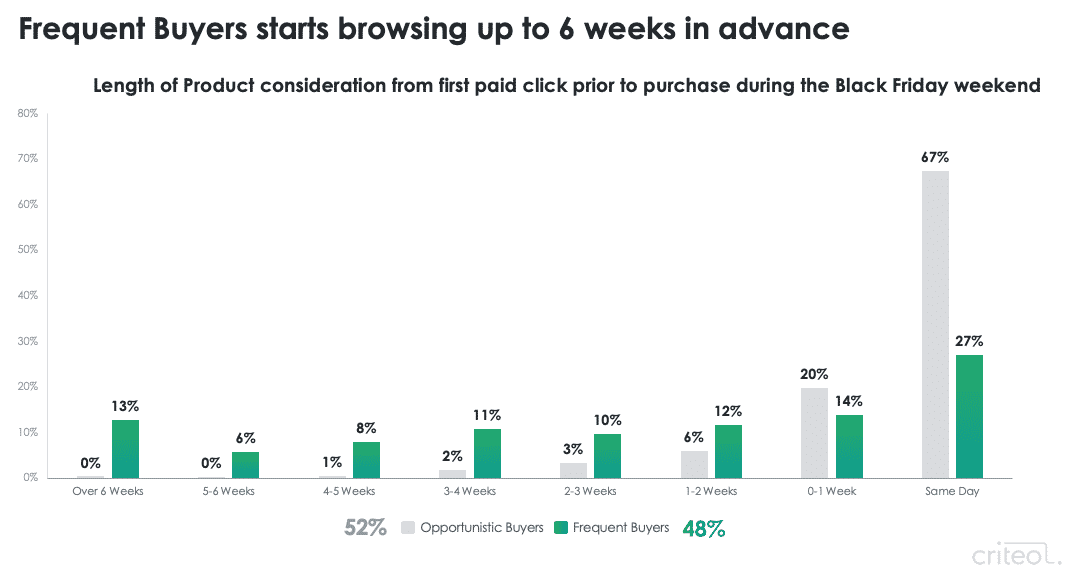

3. Frequent buyers are more likely to engage with ads before key shopping dates.

Frequent buyers, which we define as those we’ve seen purchase at a given retailer in October, are also much more likely to begin browsing early on, in November or before. From the chart below, you can see that 73% of frequent buyers interacted with an ad in advance of key purchase dates, such as Black Friday or Cyber Monday. Opportunistic buyers, defined as those who did not purchase in October, are more likely to wait to key dates to make decisions.

Source: Criteo North America Retailer Network data, 2018.

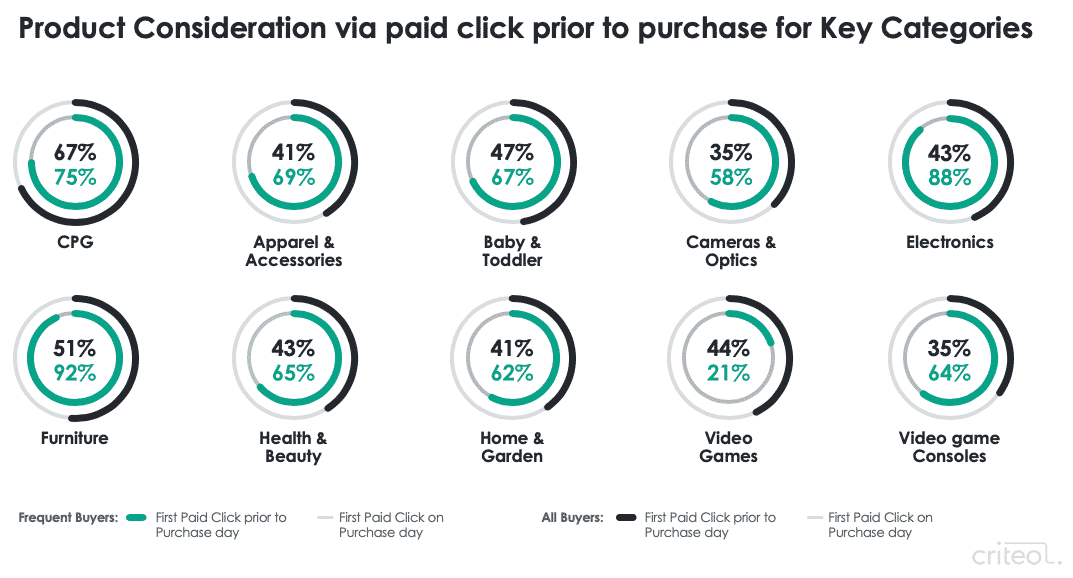

When broken down by category, the data shows that in almost all categories, frequent buyers are much more likely to interact with an ad in advance of key purchase dates.

For example, our data shows that 92% of frequent buyers of furniture clicked on an ad prior to the day they actually made a purchase, compared to 51% of all buyers. For electronics, 88% of frequent buyers clicked on an ad before the day of purchase, compared to 43% of all electronics buyers.

Source: Criteo North America Retailer Network data, 2018.

Thus, it makes sense for brands to focus campaign strategies on loyal buyers earlier. The ROAS will not be immediate, because the sales still happen on key dates, but the strategy will ultimately pay off.

Build visibility early to influence consumers prior to peak purchasing times.

During the holiday season, competition heats up, and brands need to anticipate corresponding increases in spending to maintain current share and volumes. Heavier-than-usual competition throughout peak shopping season means brands need to raise their campaign spending in order to boost visibility, particularly in retailer search results.

Browsing starts to pick up in November, so brands must start early to have a strong presence on their retail partners’ sites, in order to influence customer consideration prior to peak conversion dates. It’s also important to attract frequent buyers early in the game.