A new season of gift giving is here, and with it, a new seasonal shopper.

In 2020, people around the world found new ways to find and buy gifts for loved ones and embraced digital commerce as a way to keep the spirit of the season going.

Will people keep doing more online shopping than they ever have? How early will consumers start searching for gifts, and what channels will they use to do research and buy? And what role will physical stores play?

Our 2021 Holiday Commerce Report answers these questions and more. We look at Criteo’s seasonal sales data from our 5,000 retail partners, plus our data from the first half of this year, to predict what consumer behaviors will look like in the latter part of 2021.

Below, get a preview of the five trends featured inside the report, and download your copy for even more data and trends for the 2021 peak shopping season.

Holiday Sales Trend #1: Ecommerce will stay strong globally through the new year

Data from eMarketer shows that ecommerce sales were up nearly 28% year over year in 2020.1 According to statistics from the UN Conference on Trade and Development, online sales accounted for 19% of all retail sales.2

By the 2020 peak shopping season, many stores were open with added safety measures, but consumers made their seasonal purchases online more than they ever had before. Criteo’s global sales data shows that online retail sales increased 22% year over year in early December 2020—a time when retail sales are already at their highest annual level on every channel.3

After an exceptional period of ecommerce growth, the big question is: Will consumers stick with their digital shopping habits, or will they revert to their 2019 behaviors?

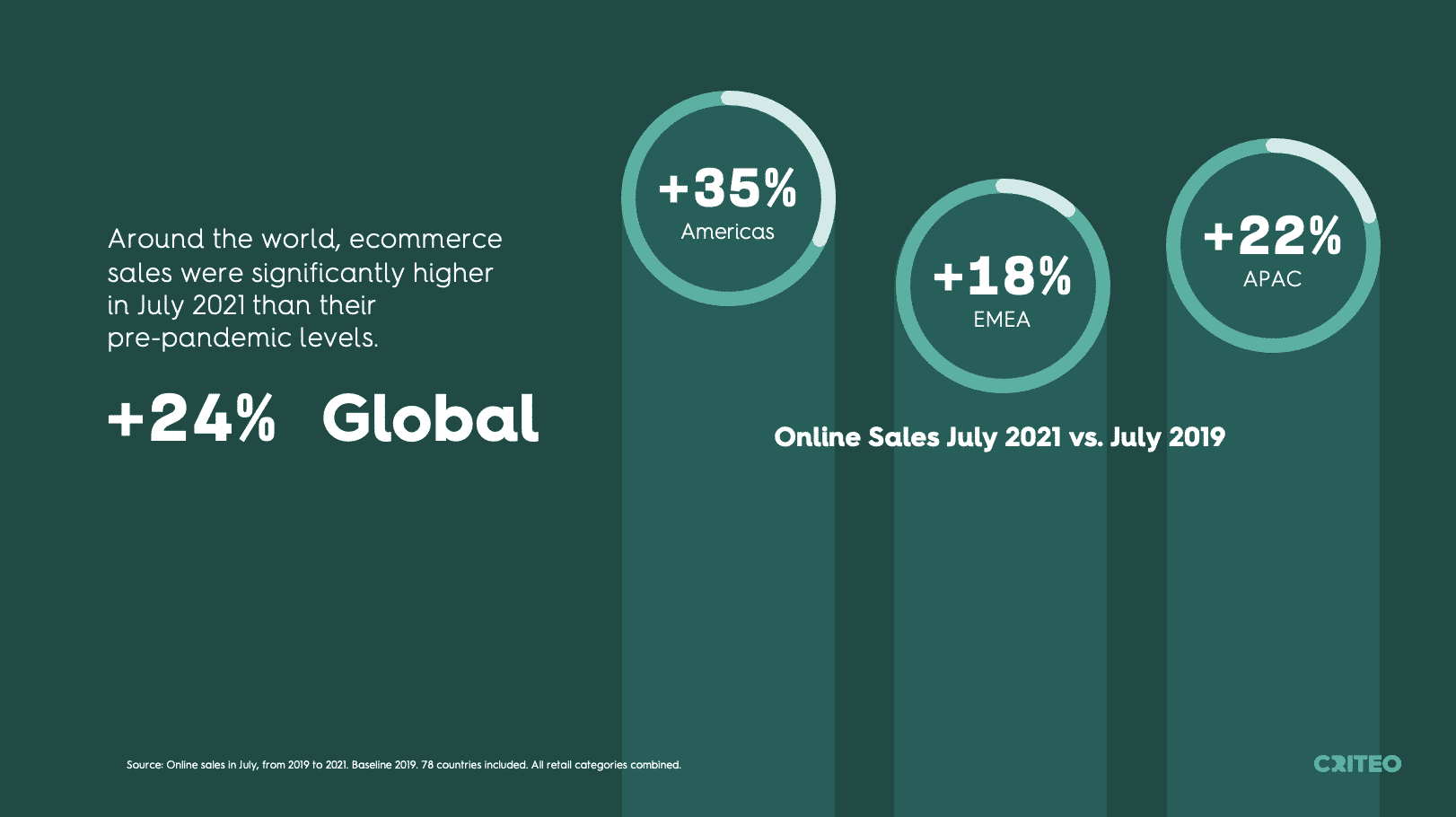

Criteo’s global retail data shows that consumers aren’t breaking their new habits. In July 2021, global ecommerce sales were 24% higher than pre-pandemic levels.

Ahead of the 2021 peak shopping season, many local economies are open, but not without setbacks. Lockdowns are returning in some countries as new COVID-19 cases rise and fall.

When and where the COVID-19 situation is stable, we anticipate that consumers will do a mix of online and in-store shopping, and their reliance on ecommerce for seasonal purchasing will be higher than it was pre-pandemic. In locations under lockdown, consumers will lean heavily on ecommerce for its safety, convenience, and 24-hour availability.

Ecommerce overall will remain steady through the end of the year, but the rate of growth of online sales in the peak season will not be a repeat of 2020.

1eMarketer, December 2, 2020.

2UN Conference on Trade and Development (UNCTAD), based on national statistics offices in Australia, Canada, China, South Korea, Singapore, UK, US.

3Criteo Global Data, 10 days between December 4-13, 2020 compared with December 6-15, 2019.

Holiday Sales Trend #2: The seasonal path to purchase will start early

From physical stores to smartphones and smart speakers, commerce is all around us. There is an abundance of ways for consumers to discover, research, and buy products and services in their daily lives.

In 2020, this “constant commerce” became even more prevalent as consumers spent more time at home plugged into all their devices. At a time of year when consumers are thinking about celebrations and gifts and retailers are offering their best deals, we anticipate “constant commerce” to be an even bigger trend. However, this doesn’t mean consumers are always making purchases; it means they’re always thinking about their next purchase.

At Criteo, we used Black Friday as a case study to understand what the path to purchase will look like in the 2021 peak shopping season.

Sales spike on Black Friday in many countries across the Americas, EMEA, and APAC. Our data shows that on average, from first touchpoint to purchase, it takes a new customer two weeks in the US—and even longer in other countries—to make their Black Friday purchase decision. For those with the longest path to purchase, it can be as much as four to nine weeks from first touchpoint to purchase, with US consumers on the shorter end and German and Japanese shoppers on the longer end.4

4Criteo Data, Apparel, US, Q4 2020, desktop and mobile combined.

Holiday Sales Trend #3: Seasonal product discovery will happen on all channels

The peak shopping season is always prime time for brand and product discovery. Consumers often break their typical shopping habits to purchase items they’ve never bought before for celebrating and gifting.

This year, discovery is likely to be in overdrive. Consumers are spending weeks considering their seasonal purchases, giving them many opportunities to find new brands and products as they do their research.

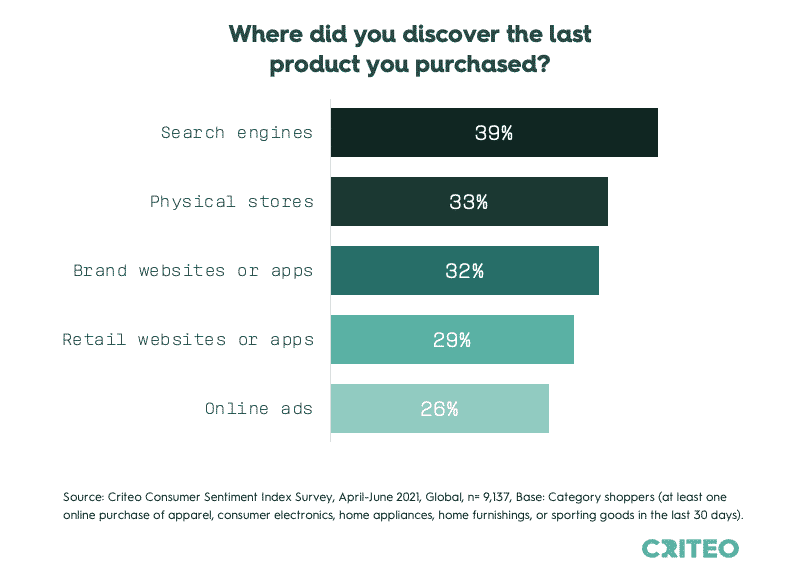

Criteo survey data shows that in 2021, discovery isn’t limited to search and social media. From April to June, we surveyed over 14,000 consumers around the world and found that people often discover the products they end up purchasing via search engines, physical stores, brand sites and apps, retail sites and apps, and online ads.

Holiday Sales Trend #4: Stores will drive seasonal spending and excitement

The store shopping experience adds to the magic of the season. Elaborate window displays, festive in-store décor, and unique experiences—in addition to deep discounts—are what draw increased foot traffic to physical retail locations in the fourth quarter.

However, after a year when ecommerce sales were off the charts, what role will stores play in the 2021 gifting season?

In addition to being influential in the discovery phase, stores are critical at the end of the path to purchase when consumers are ready to buy.

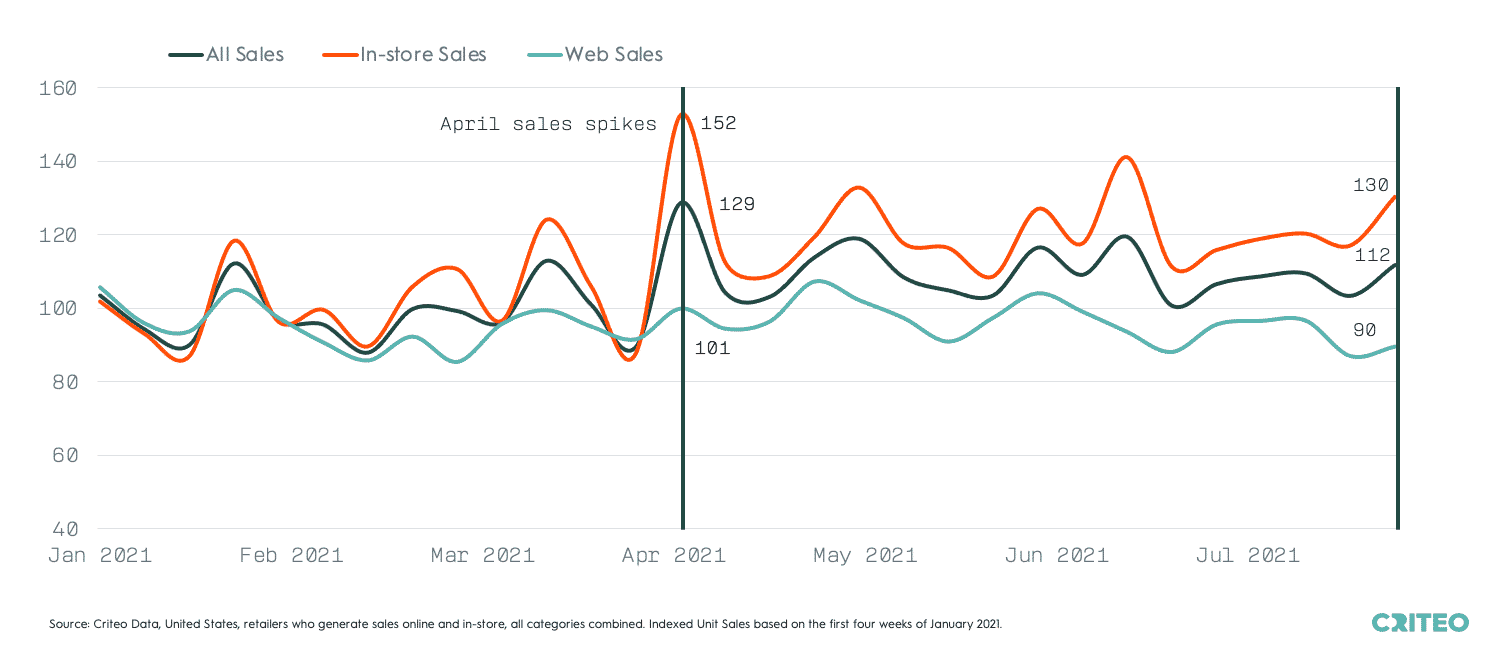

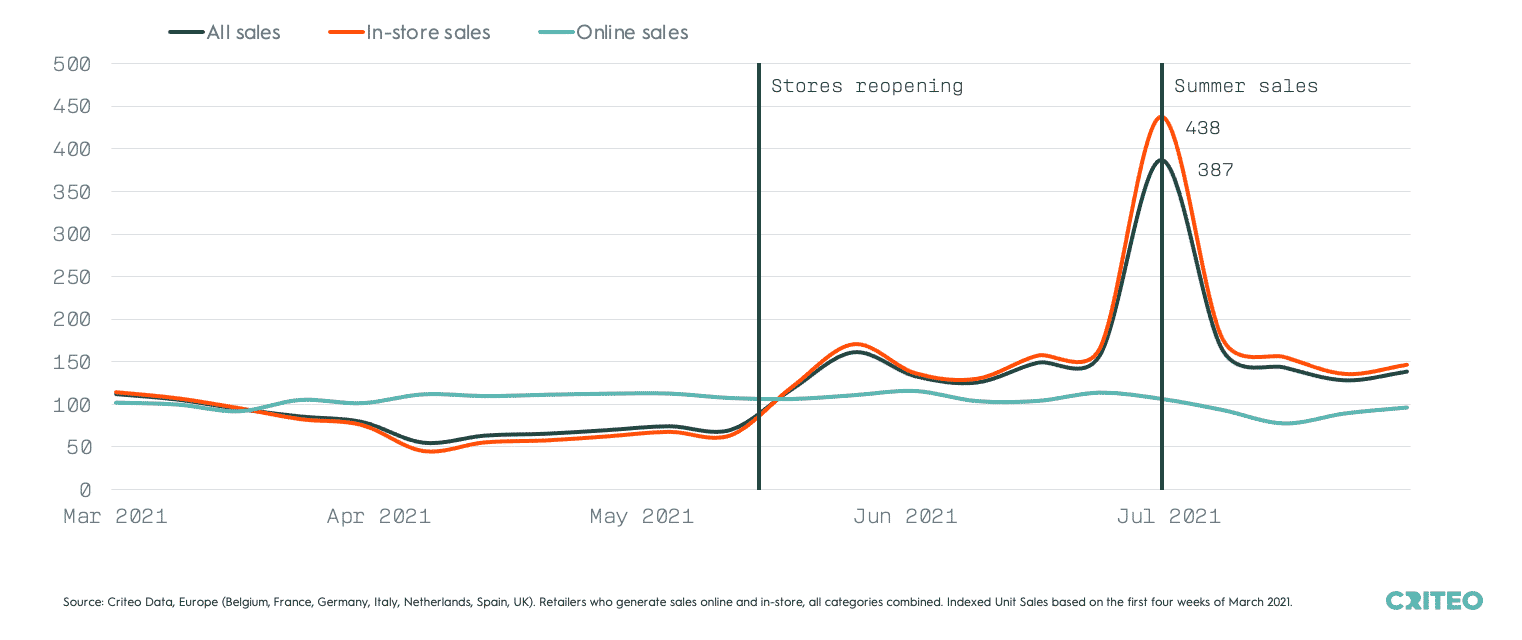

Criteo sales data from the US and Europe shows that whenever lockdowns are lifted and businesses are open, in-store sales rise quickly, driving up overall consumer spending.

When the Great Reopening kicked off earlier this year, overall sales in the US began increasing in April and a gap formed between offline and online sales. In-store sales peaked at an increase of 52% in the week ending April 11 while overall sales were up 29% and online sales were up 1% compared to the first four weeks of January.

In Europe, as soon as lockdowns ended in 2021, offline sales and sales overall began to rise. The biggest in-store sales spike occurred when several countries ran summer sales in the week ending on July 4: in-store sales increased 338% and retail sales in general grew 287% while online sales were up 7% compared to the first four weeks of March.

In places where vaccination rates are rising and businesses can stay open through the peak shopping season, physical stores offer instant gratification in a world where fast, free shipping is expected.

This is especially important when consumers need last-minute gifts and want to skip the wait altogether. In 2020, in-store sales were up 160% one week before Christmas, while online sales returned to October levels.5

5Criteo Data, United States, retailers who generate sales online and in-store, all categories combined. Indexed Sales based on the first four weeks of October 2020.

Holiday Sales Trend #5: Video will be even more influential this gifting season

As businesses vie for consumers’ attention in the peak shopping season, they’re not only competing with each other, but also with video.

We surveyed 9,000 video viewers globally to learn more about their habits and advertising preferences, and the role video will play this gifting season.

We found that video viewing across streaming services, publisher websites, social media, cable TV, and video game live streaming accelerated in 2020 as consumers looked for ways to stay entertained at home. Now, even as people increase their away-from-home activities, they still expect to spend more time watching video content in the future.

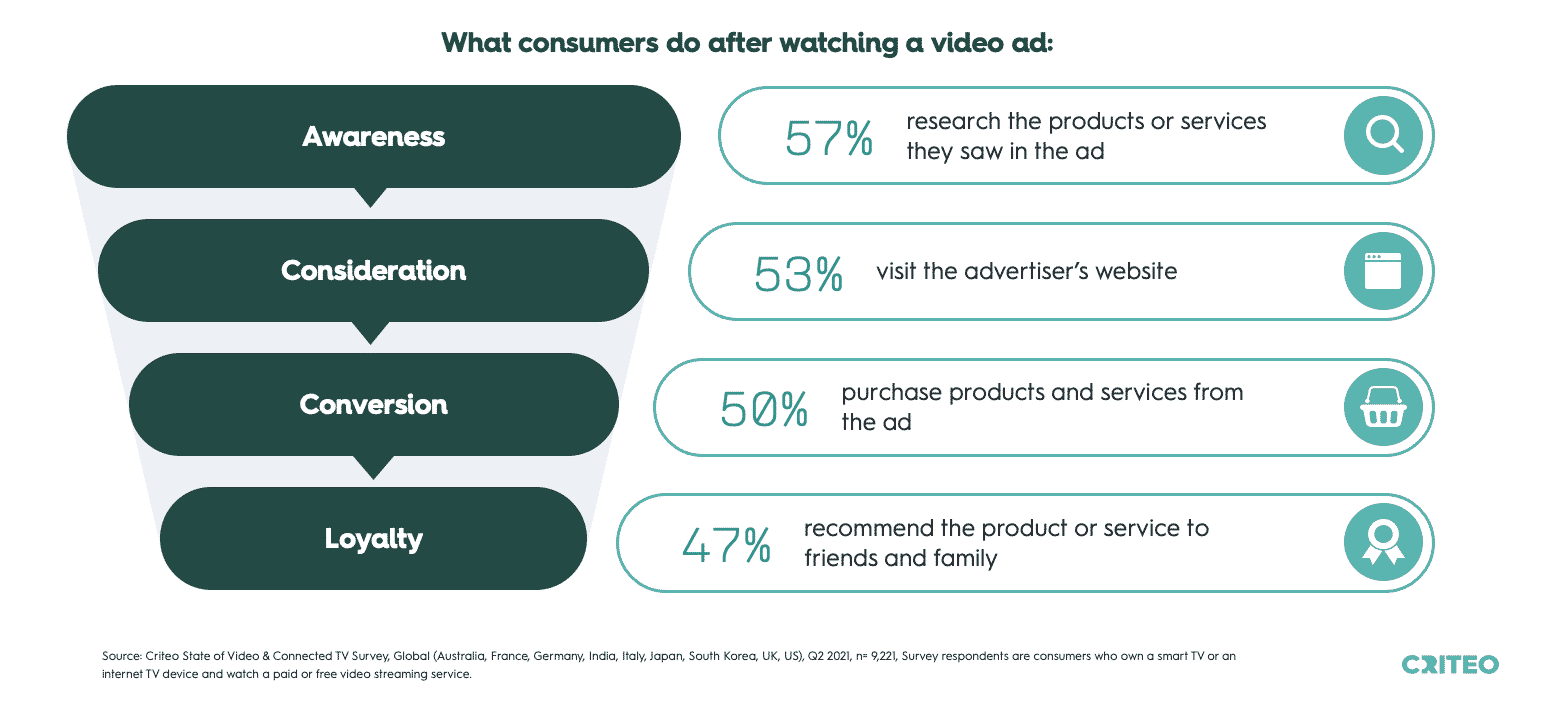

We also discovered that consumers are receptive to ads when they’re watching videos and will take actions like searching for and purchasing the products they’ve seen.

Nearly 6 in 10 survey respondents said they research the products or services they saw in an ad. More than half of them visit the advertiser’s website and go on to purchase the products or services they saw in the ad. Forty seven percent will recommend that product or service to friends and family.

This season of giving, give consumers more value

These five trends all speak to how consumers are driving big changes in global commerce. But the truth is, when consumers are making purchase decisions in 2021, they aren’t thinking about channels, touchpoints, and the path to purchase. They’re letting businesses into their lives that bring them value in the form of free content, control of their personal information, relevant and exciting ads, and a consistent omnichannel experience.

This holiday season is the chance to get the value exchange right and make a lasting impression on consumers. For more on how to achieve that balance, download The 2021 Holiday Commerce Report: